In today's digital age, it's no secret that our personal information is scattered across various databases and platforms. One such database is Innovis, a consumer reporting agency that collects and maintains vast amounts of consumer data. While Innovis data can be useful for businesses and lenders, it's essential to ensure that your personal information is accurate and up-to-date. If you're concerned about your data being shared or want to limit your exposure, you can opt-out of Innovis. In this article, we'll walk you through the simple steps to remove your info from Innovis.

Why Opt-Out of Innovis?

Before we dive into the opt-out process, it's essential to understand why you might want to remove your info from Innovis. Here are a few reasons:

- Data security: By opting out of Innovis, you can reduce the risk of your data being compromised in the event of a data breach.

- Credit monitoring: If you're not planning to apply for credit or loans, you might not need your data to be shared with lenders.

- Marketing solicitations: Innovis data can be used for marketing purposes. Opting out can help reduce unwanted solicitations.

What Happens When You Opt-Out of Innovis?

When you opt-out of Innovis, your data will be removed from their database, and it will no longer be shared with third-party lenders or businesses. However, it's essential to note that:

- Opting out won't affect your credit score: Your credit score is maintained by the three major credit bureaus: Equifax, Experian, and TransUnion. Innovis is a separate entity, and opting out won't impact your credit score.

- You may need to re-opt-out: Innovis may periodically update their database, which means you might need to re-opt-out to ensure your data remains removed.

The 3 Simple Steps to Remove Your Info from Innovis

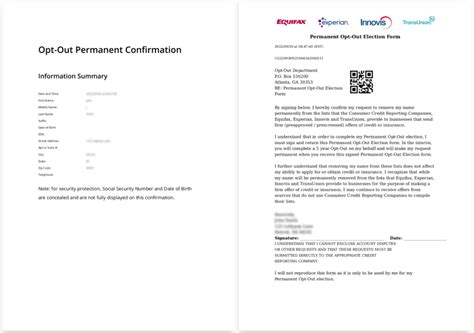

Opting out of Innovis is a straightforward process that can be completed online or by mail. Here are the steps:

Step 1: Visit the Innovis Website

To start the opt-out process, visit the Innovis website at . Click on the "Consumers" tab and select "Opt-Out" from the drop-down menu.

Step 2: Fill Out the Opt-Out Form

You'll be directed to an opt-out form that requires you to provide some personal information, including:

- Name: Your full name as it appears on your identification documents.

- Address: Your current address.

- Social Security Number: Your Social Security number or Individual Taxpayer Identification Number (ITIN).

Once you've filled out the form, review the information carefully to ensure it's accurate.

Step 3: Submit Your Opt-Out Request

After reviewing your information, submit your opt-out request. You'll receive an email confirmation from Innovis, indicating that your request has been received.

Alternative Method: Opting Out by Mail

If you prefer to opt-out by mail, you can download the Innovis opt-out form from their website. Fill out the form, sign it, and mail it to:

Innovis Consumer Assistance P.O. Box 134000 Columbus, OH 43213-3000

Make sure to include a copy of your identification documents, such as a driver's license or state ID, to verify your identity.

Conclusion

Opting out of Innovis is a simple process that can help you maintain control over your personal data. By following the three steps outlined above, you can remove your info from Innovis and reduce the risk of your data being compromised. Remember to re-opt-out periodically to ensure your data remains removed.

We hope this article has been informative and helpful. If you have any further questions or concerns, feel free to comment below.

Will opting out of Innovis affect my credit score?

+No, opting out of Innovis will not affect your credit score. Innovis is a separate entity from the three major credit bureaus (Equifax, Experian, and TransUnion), and opting out will only remove your data from the Innovis database.

Can I opt-out of Innovis by phone?

+No, Innovis does not offer a phone opt-out option. You can opt-out online or by mail using the steps outlined above.

How long does it take for Innovis to process my opt-out request?

+Innovis typically processes opt-out requests within 10-15 business days. You'll receive an email confirmation once your request has been processed.