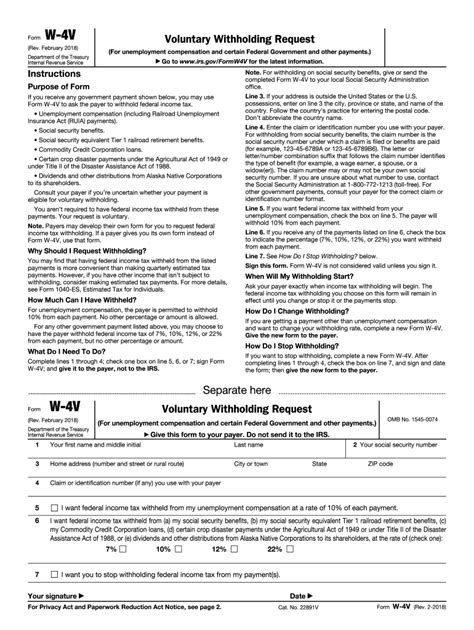

As a taxpayer, it's essential to understand the importance of filing the W-4V form, also known as the Voluntary Withholding Request, with the Internal Revenue Service (IRS). This form allows you to request voluntary withholding on certain government payments, such as Social Security benefits, unemployment compensation, and certain other government payments. In this article, we will guide you through the process of mailing your W-4V form to the IRS, including the correct address and instructions.

Why File a W-4V Form?

Before we dive into the instructions for mailing your W-4V form, let's quickly discuss why filing this form is important. By filing a W-4V form, you can request that the IRS withhold a portion of your government payments, which can help you avoid a large tax bill when you file your tax return. This is particularly useful for individuals who receive Social Security benefits, unemployment compensation, or other government payments that are subject to taxation.

IRS Address for Mailing W-4V Form

To mail your W-4V form to the IRS, you will need to send it to the following address:

Internal Revenue Service 1111 Constitution Ave NW Washington, DC 20224

Instructions for Filing W-4V Form

Now that you have the correct address, let's move on to the instructions for filing your W-4V form.

Step 1: Download and Complete the W-4V Form

To start, you will need to download the W-4V form from the IRS website or obtain a copy from your local IRS office. Once you have the form, carefully read the instructions and complete it according to the guidelines. Make sure to sign and date the form.

Step 2: Gather Required Documents

Before mailing your W-4V form, you will need to gather any required documents, such as your Social Security number or Individual Taxpayer Identification Number (ITIN). You may also need to provide proof of identity and address.

Step 3: Mail the W-4V Form

Once you have completed the W-4V form and gathered the required documents, you can mail it to the IRS address listed above. Make sure to use a secure mailing method, such as certified mail or a trackable shipping service, to ensure that your form is received by the IRS.

Tips and Reminders

Here are a few tips and reminders to keep in mind when mailing your W-4V form:

- Make sure to use the correct IRS address to avoid delays or lost forms.

- Use a secure mailing method to ensure that your form is received by the IRS.

- Keep a copy of your W-4V form and any supporting documents for your records.

- If you have any questions or concerns, you can contact the IRS or seek the advice of a tax professional.

Common Questions and Answers

Here are some common questions and answers related to mailing your W-4V form:

Q: What is the deadline for filing a W-4V form?

A: There is no specific deadline for filing a W-4V form, but it's recommended that you file the form as soon as possible to avoid delays in processing your request.

Q: Can I file a W-4V form electronically?

A: No, the IRS does not currently offer electronic filing for W-4V forms. You will need to mail the form to the IRS address listed above.

Q: How long does it take for the IRS to process a W-4V form?

A: The processing time for W-4V forms can vary depending on the volume of requests received by the IRS. It's recommended that you allow at least 4-6 weeks for processing.

Conclusion

Mailing your W-4V form to the IRS is an important step in requesting voluntary withholding on certain government payments. By following the instructions outlined in this article, you can ensure that your form is received and processed by the IRS in a timely manner. Remember to use the correct IRS address, gather required documents, and keep a copy of your form and supporting documents for your records. If you have any questions or concerns, don't hesitate to contact the IRS or seek the advice of a tax professional.

What is the purpose of filing a W-4V form?

+The purpose of filing a W-4V form is to request voluntary withholding on certain government payments, such as Social Security benefits, unemployment compensation, and certain other government payments.

Where do I mail my W-4V form?

+You should mail your W-4V form to the following address: Internal Revenue Service, 1111 Constitution Ave NW, Washington, DC 20224.

Can I file a W-4V form electronically?

+No, the IRS does not currently offer electronic filing for W-4V forms. You will need to mail the form to the IRS address listed above.