Receiving an unexpected tax bill can be a stressful experience, especially if you're not the one responsible for the debt. In situations where one spouse has incurred tax debt due to their actions, the other spouse may be eligible to claim innocent spouse relief. To initiate this process, you'll need to complete Form 8857, also known as the Request for Innocent Spouse Relief. However, filling out this form correctly can be a daunting task, and any mistakes can lead to delays or even rejection. In this article, we'll guide you through the 7 steps to complete the injured spouse form correctly, ensuring you receive the relief you deserve.

Understanding the Importance of Form 8857

Before we dive into the steps, it's essential to understand the purpose of Form 8857. This form is used to request innocent spouse relief from the IRS, which can alleviate you from paying taxes, interest, or penalties owed by your spouse. To qualify, you must demonstrate that you had no knowledge of the debt and didn't benefit from the transactions that led to the tax liability.

Step 1: Determine Your Eligibility

Before starting the form, ensure you meet the eligibility criteria for innocent spouse relief. You must:

- Be married or have been married to the spouse who incurred the tax debt

- Have filed a joint tax return for the year in question

- Not have known about the debt or the transactions that led to it

- Not have benefited from the transactions

- Not have been a party to the transactions that led to the debt

If you meet these requirements, proceed to the next step.

Step 2: Gather Required Documents

To complete Form 8857 accurately, you'll need to gather specific documents, including:

- A copy of your joint tax return for the year in question

- Proof of your income and expenses for the year in question

- Documentation of your spouse's income and expenses for the year in question

- Records of any payments made towards the tax debt

- A copy of your divorce or separation agreement (if applicable)

Having these documents ready will make the process smoother and reduce the likelihood of errors.

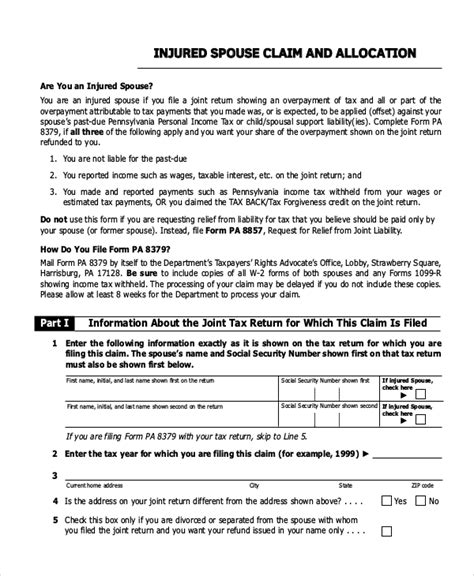

Step 3: Fill Out Part I of Form 8857

Part I of Form 8857 requires you to provide personal and tax-related information. Ensure you accurately fill out the following sections:

- Your name and Social Security number

- Your spouse's name and Social Security number

- The tax year(s) for which you're requesting relief

- The type of tax relief you're seeking (innocent spouse, separation of liability, or equitable relief)

Be meticulous when filling out this section, as any errors can lead to delays or rejection.

Step 4: Complete Part II of Form 8857

Part II of Form 8857 requires you to provide detailed information about the tax debt and your involvement. Ensure you accurately fill out the following sections:

- A description of the tax debt and how it was incurred

- Your knowledge of the debt and the transactions that led to it

- Your involvement in the transactions (if any)

- Any benefits you may have received from the transactions

Be honest and transparent when completing this section, as the IRS will carefully review your responses.

Step 5: Attach Supporting Documentation

Attach all supporting documentation to Form 8857, including the documents gathered in Step 2. Ensure you clearly label each document and attach them in the order specified in the form instructions.

Step 6: Review and Sign Form 8857

Carefully review Form 8857 to ensure accuracy and completeness. Sign the form in the designated area, and make sure to include your date of birth and Social Security number.

Step 7: Submit Form 8857

Submit Form 8857 to the IRS address listed in the form instructions. Ensure you keep a copy of the form and supporting documentation for your records.

By following these 7 steps, you'll be able to complete Form 8857 correctly and increase your chances of receiving innocent spouse relief. Remember to be patient and persistent, as the IRS may request additional information or clarification during the review process.

If you have any questions or concerns about the process, don't hesitate to reach out to a tax professional or the IRS directly. Share your experiences or ask for advice in the comments section below.

What is the purpose of Form 8857?

+Form 8857 is used to request innocent spouse relief from the IRS, which can alleviate you from paying taxes, interest, or penalties owed by your spouse.

What are the eligibility criteria for innocent spouse relief?

+You must be married or have been married to the spouse who incurred the tax debt, have filed a joint tax return for the year in question, and not have known about the debt or the transactions that led to it.

What documents do I need to gather to complete Form 8857?

+You'll need to gather documents such as your joint tax return, proof of income and expenses, and records of payments made towards the tax debt.