The IRS Form 8809 is a crucial document for businesses and individuals who need extra time to file their information returns. As the filing deadline approaches, many filers find themselves facing an unexpected delay or backlog, making it essential to request an automatic extension of time. In this article, we will delve into the world of IRS Form 8809, exploring its purpose, benefits, and the step-by-step process of requesting an automatic extension.

What is IRS Form 8809?

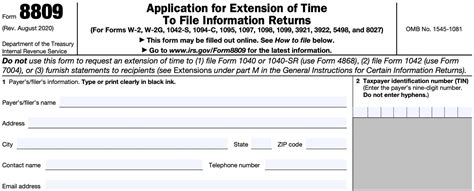

IRS Form 8809 is a request for an automatic extension of time to file information returns, such as Form 1099, Form W-2, and other related forms. This form is used by businesses, employers, and other filers to request a 30-day extension to file their information returns. The extension is automatic, meaning that the IRS will grant the extension without requiring a detailed explanation for the delay.

Benefits of Filing IRS Form 8809

Filing IRS Form 8809 offers several benefits, including:

- Avoiding penalties and fines for late filing

- Providing extra time to resolve any issues or discrepancies in the filing process

- Reducing stress and pressure associated with meeting the original deadline

- Allowing filers to take advantage of the automatic extension, which is generally easier to obtain than a discretionary extension

Who Can File IRS Form 8809?

Any business or individual who needs to file information returns can request an automatic extension using IRS Form 8809. This includes:

- Employers who need to file Form W-2 for their employees

- Businesses that need to file Form 1099 for independent contractors and vendors

- Filers who need to report income, such as rent, royalties, or interest

- Other entities that are required to file information returns with the IRS

Step-by-Step Process for Requesting an Automatic Extension

To request an automatic extension of time to file information returns, follow these steps:

- Determine the filing deadline: Identify the original filing deadline for your information returns.

- Gather required information: Collect the necessary information, including your business name, address, and Employer Identification Number (EIN).

- Complete Form 8809: Fill out IRS Form 8809, ensuring that you provide all required information.

- Submit the form: File Form 8809 with the IRS by the original filing deadline. You can submit the form online, by phone, or by mail.

- Receive the extension: The IRS will automatically grant the extension, providing you with an additional 30 days to file your information returns.

Common Mistakes to Avoid When Filing IRS Form 8809

When requesting an automatic extension, it's essential to avoid common mistakes that can lead to delays or rejection of your request. Some common mistakes to avoid include:

- Failing to provide required information or signatures

- Submitting the form after the original filing deadline

- Requesting an extension for the wrong tax year or form type

- Not keeping a copy of the submitted form for your records

Consequences of Not Filing IRS Form 8809

Failing to file IRS Form 8809 or missing the deadline can result in penalties and fines. Some consequences of not filing Form 8809 include:

- Late filing penalties: The IRS may impose penalties for late filing, which can range from $50 to $260 per return.

- Interest on penalties: In addition to penalties, the IRS may charge interest on the amount owed.

- Disruption of business operations: Failing to file information returns can disrupt business operations and lead to delays in receiving payments or tax refunds.

Best Practices for Filing IRS Form 8809

To ensure a smooth and successful filing process, follow these best practices:

- File Form 8809 electronically to reduce errors and processing time.

- Keep accurate records of your submission, including the date and time of filing.

- Verify the status of your extension request using the IRS website or by contacting the IRS directly.

- Plan ahead and request the extension well in advance of the original filing deadline.

Conclusion

IRS Form 8809 is a valuable tool for businesses and individuals who need extra time to file their information returns. By understanding the purpose, benefits, and step-by-step process of requesting an automatic extension, filers can avoid penalties and fines, reduce stress, and ensure a smooth filing process. Remember to follow best practices and avoid common mistakes to ensure a successful filing experience.

We hope this article has provided you with a comprehensive understanding of IRS Form 8809. If you have any questions or concerns, please don't hesitate to comment below. Share this article with others who may benefit from this information, and stay informed about the latest tax filing requirements and deadlines.

What is the purpose of IRS Form 8809?

+IRS Form 8809 is a request for an automatic extension of time to file information returns, such as Form 1099, Form W-2, and other related forms.

Who can file IRS Form 8809?

+Any business or individual who needs to file information returns can request an automatic extension using IRS Form 8809.

What are the consequences of not filing IRS Form 8809?

+Failing to file IRS Form 8809 or missing the deadline can result in penalties and fines, including late filing penalties and interest on penalties.