As the tax season approaches, many individuals are preparing to file their tax returns. One of the essential forms that needs to be filled out accurately is the ILani Tax Form, also known as the Illinois Individual Income Tax Return. Filling out this form can be a daunting task, but with the right guidance, it can be done efficiently. In this article, we will discuss five ways to fill out the ILani Tax Form correctly.

Filing taxes is a critical responsibility for all individuals who earn income in Illinois. The state requires its residents to report their income and claim deductions and credits to determine their tax liability. The ILani Tax Form is used to report income from various sources, including wages, salaries, tips, and self-employment income.

Understanding the ILani Tax Form

Before we dive into the five ways to fill out the ILani Tax Form, it's essential to understand the structure of the form. The ILani Tax Form consists of several sections, including:

- Personal information

- Income

- Deductions and exemptions

- Credits

- Tax liability

Each section requires specific information, and it's crucial to fill out the form accurately to avoid any errors or delays in processing.

1. Gather Required Documents

To fill out the ILani Tax Form correctly, you need to gather all the required documents. These documents include:

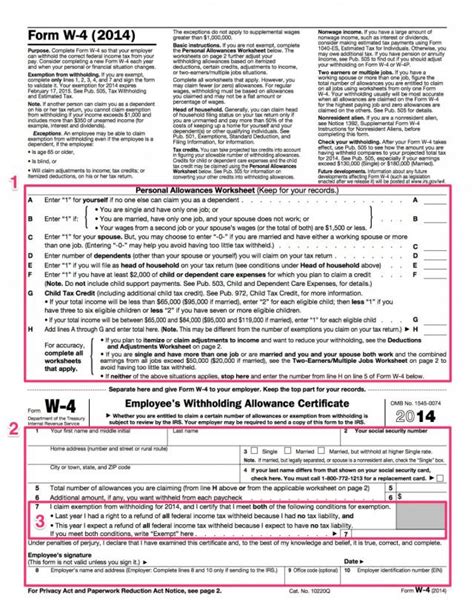

- W-2 forms from your employer(s)

- 1099 forms for freelance or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Having all the necessary documents will help you fill out the form accurately and avoid any errors.

Tips for Gathering Documents

- Make sure to collect all W-2 and 1099 forms from your employer(s) and clients.

- Check your bank and investment statements for interest and dividend income.

- Keep track of your charitable donations and medical expenses throughout the year.

- Consider using tax preparation software to help you organize your documents.

2. Determine Your Filing Status

Your filing status determines your tax rates and deductions. Illinois recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

To determine your filing status, consider the following:

- Are you married or single?

- Do you have dependents?

- Are you a widow or widower?

Tips for Determining Filing Status

- If you're married, consider filing jointly to claim the married filing jointly tax rates.

- If you have dependents, consider filing as head of household to claim the head of household tax rates.

- If you're a widow or widower, consider filing as qualifying widow(er) to claim the qualifying widow(er) tax rates.

3. Report Your Income

Reporting your income accurately is critical to filling out the ILani Tax Form correctly. You need to report income from all sources, including:

- Wages and salaries

- Tips

- Self-employment income

- Interest and dividends

- Capital gains

Use your W-2 and 1099 forms to report your income accurately.

Tips for Reporting Income

- Make sure to report all income from all sources.

- Use tax preparation software to help you calculate your income.

- Consider consulting a tax professional if you have complex income reporting.

4. Claim Deductions and Exemptions

Claiming deductions and exemptions can help reduce your tax liability. Illinois offers several deductions and exemptions, including:

- Standard deduction

- Itemized deduction

- Personal exemption

- Dependent exemption

Use your receipts and records to claim deductions and exemptions accurately.

Tips for Claiming Deductions and Exemptions

- Consider itemizing your deductions if you have significant expenses.

- Claim the personal exemption and dependent exemption if you're eligible.

- Use tax preparation software to help you calculate your deductions and exemptions.

5. Review and Submit Your Form

Once you've filled out the ILani Tax Form, review it carefully for errors. Make sure to sign and date the form before submitting it to the Illinois Department of Revenue.

Tips for Reviewing and Submitting Your Form

- Double-check your math calculations.

- Make sure to sign and date the form.

- Consider e-filing your tax return for faster processing.

By following these five ways to fill out the ILani Tax Form, you can ensure that your tax return is accurate and complete. Remember to gather required documents, determine your filing status, report your income, claim deductions and exemptions, and review and submit your form carefully.

What is the ILani Tax Form?

+The ILani Tax Form, also known as the Illinois Individual Income Tax Return, is a form used to report income and claim deductions and credits to determine tax liability.

What documents do I need to fill out the ILani Tax Form?

+You need to gather W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, and medical expense receipts.

How do I determine my filing status?

+Consider your marital status, dependents, and whether you're a widow or widower to determine your filing status.

We hope this article has helped you understand how to fill out the ILani Tax Form correctly. If you have any further questions or concerns, please don't hesitate to comment below.