As an Ohio resident, understanding the Ohio IT-4 form is essential for managing your taxes effectively. The Ohio IT-4 form, also known as the Employee Withholding Exemption Certificate, plays a significant role in determining the amount of state income tax withheld from your paycheck. In this comprehensive guide, we will walk you through the ins and outs of the Ohio IT-4 form, its importance, and provide a step-by-step guide on how to fill it out accurately.

What is the Ohio IT-4 Form?

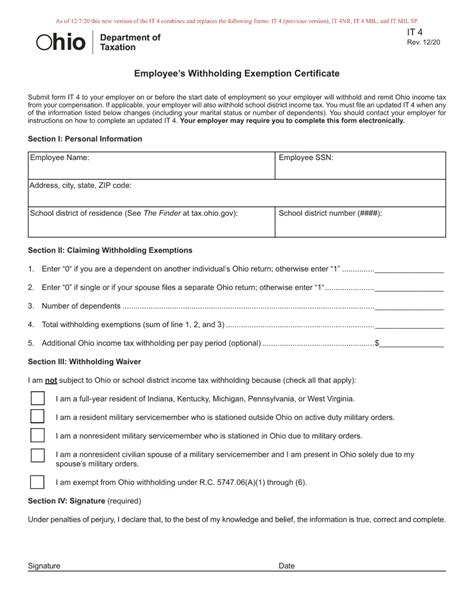

The Ohio IT-4 form is a certificate that Ohio employees must complete and submit to their employers to claim exemption from state income tax withholding or to claim a specific number of allowances. This form is used to determine the correct amount of state income tax to withhold from an employee's wages. The IT-4 form is typically required for new employees, but it may also be necessary for existing employees who experience changes in their tax status.

Why is the Ohio IT-4 Form Important?

The Ohio IT-4 form is crucial because it helps employers accurately withhold state income tax from employee wages. By completing the form, employees can ensure that the correct amount of tax is withheld, avoiding any potential underpayment or overpayment of taxes. Additionally, the IT-4 form provides the Ohio Department of Taxation with the necessary information to verify an employee's tax status and ensure compliance with state tax laws.

Who Needs to Complete the Ohio IT-4 Form?

The Ohio IT-4 form is required for all Ohio employees who want to claim exemption from state income tax withholding or claim a specific number of allowances. This includes:

- New employees who are subject to Ohio state income tax withholding

- Existing employees who experience changes in their tax status, such as getting married, having children, or buying a home

- Employees who want to claim exemption from state income tax withholding

- Employees who want to claim a specific number of allowances

How to Fill Out the Ohio IT-4 Form

Filling out the Ohio IT-4 form is a straightforward process. Here's a step-by-step guide to help you complete the form accurately:

- Employee Information: Provide your name, address, and Social Security number.

- Allowances: Claim the number of allowances you are eligible for. You can claim one allowance for yourself, your spouse, and each dependent.

- Exemption: If you are exempt from state income tax withholding, check the box and provide the reason for your exemption.

- Signature: Sign and date the form.

- Certification: Certify that the information provided is true and accurate.

Common Mistakes to Avoid When Filling Out the Ohio IT-4 Form

When filling out the Ohio IT-4 form, it's essential to avoid common mistakes that can lead to errors in state income tax withholding. Here are some mistakes to avoid:

- Inaccurate employee information: Ensure that your name, address, and Social Security number are accurate.

- Incorrect allowances: Claim the correct number of allowances to avoid underpayment or overpayment of taxes.

- Failure to sign and date the form: Sign and date the form to certify that the information provided is true and accurate.

Ohio IT-4 Form FAQs

What is the Ohio IT-4 form used for?

+The Ohio IT-4 form is used to determine the correct amount of state income tax to withhold from an employee's wages.

Who needs to complete the Ohio IT-4 form?

+The Ohio IT-4 form is required for all Ohio employees who want to claim exemption from state income tax withholding or claim a specific number of allowances.

How often do I need to complete the Ohio IT-4 form?

+You typically need to complete the Ohio IT-4 form when you start a new job or experience changes in your tax status.

We hope this comprehensive guide has provided you with a thorough understanding of the Ohio IT-4 form and its importance in managing your taxes effectively. If you have any further questions or concerns, please don't hesitate to reach out. Share your thoughts and experiences with the Ohio IT-4 form in the comments section below.