The Form 1120 is a critical document for corporations in the United States, as it serves as the annual income tax return for C corporations. Completing this form accurately and efficiently is crucial for ensuring compliance with tax laws and avoiding potential penalties. In this article, we will delve into the Form 1120 instructions, providing a comprehensive, step-by-step guide to help corporations navigate this complex process.

Understanding the Form 1120

Before diving into the instructions, it's essential to understand the purpose and scope of the Form 1120. This form is used by C corporations to report their income, gains, losses, deductions, and credits. The information provided on the Form 1120 is used to calculate the corporation's tax liability, which is typically due on the 15th day of the fourth month after the end of the corporation's tax year.

Step 1: Gathering Required Information

To complete the Form 1120, corporations will need to gather a range of financial information, including:

- Income statements and balance sheets

- Depreciation and amortization schedules

- Capital gains and losses

- Dividend income

- Interest income

- Charitable contributions

- Business expenses

Step 2: Completing the Form 1120

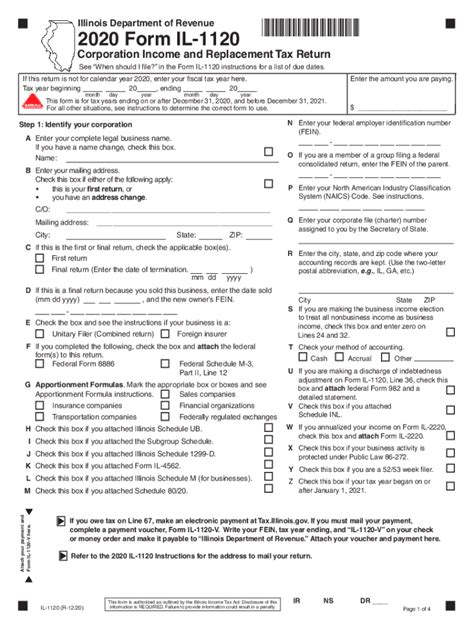

The Form 1120 consists of multiple sections, each addressing a specific aspect of the corporation's tax situation. The following is a step-by-step guide to completing the form:

Section 1: Corporation Information

- Provide the corporation's name, address, and Employer Identification Number (EIN)

- Indicate the type of corporation (e.g., C corporation, S corporation, etc.)

- Specify the accounting method used (e.g., cash, accrual, etc.)

Section 2: Income

- Report total income from all sources, including sales, services, and investments

- List income from specific sources, such as dividends, interest, and capital gains

Section 3: Cost of Goods Sold

- Calculate the cost of goods sold, including direct costs and indirect costs

- Report the cost of goods sold as a deduction on the form

Section 4: Operating Expenses

- List operating expenses, including salaries, rent, and utilities

- Report operating expenses as deductions on the form

Section 5: Depreciation and Amortization

- Calculate depreciation and amortization expenses using the appropriate methods (e.g., straight-line, accelerated, etc.)

- Report depreciation and amortization expenses as deductions on the form

Section 6: Tax Credits

- Identify and claim tax credits, such as the research and development credit

- Report tax credits as reductions to the corporation's tax liability

Section 7: Alternative Minimum Tax

- Calculate the alternative minimum tax (AMT) using the AMT worksheet

- Report the AMT as a separate tax liability on the form

Section 8: Tax Payments and Credits

- Report tax payments made during the year, including estimated tax payments

- Claim tax credits, such as the earned income tax credit

Section 9: Signature

- The corporation's authorized representative must sign the form

- Include the date and title of the representative

Additional Requirements

In addition to completing the Form 1120, corporations may be required to submit additional forms and schedules, such as:

- Schedule C: Capital gains and losses

- Schedule D: Dividend income

- Schedule E: Supplemental income and loss

- Form 4562: Depreciation and amortization

Common Mistakes to Avoid

When completing the Form 1120, corporations should be aware of common mistakes that can lead to delays or penalties, including:

- Inaccurate or incomplete information

- Failure to report all income

- Incorrect calculation of tax credits and deductions

- Failure to sign the form

Conclusion and Next Steps

Completing the Form 1120 is a complex process that requires careful attention to detail and a thorough understanding of tax laws and regulations. By following this step-by-step guide, corporations can ensure accuracy and efficiency in their tax preparation. Once the form is complete, corporations should review and verify the information, make any necessary corrections, and submit the form to the IRS by the required deadline.

We invite you to share your experiences and tips for completing the Form 1120 in the comments below. If you have any questions or concerns, please don't hesitate to reach out to our team of tax experts.

What is the deadline for filing the Form 1120?

+The deadline for filing the Form 1120 is the 15th day of the fourth month after the end of the corporation's tax year.

Can I file the Form 1120 electronically?

+Yes, the IRS allows corporations to file the Form 1120 electronically through the Electronic Federal Tax Payment System (EFTPS).

What is the penalty for late filing of the Form 1120?

+The penalty for late filing of the Form 1120 is 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.