Filing taxes can be a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a relatively smooth and straightforward experience. If you're a resident of Connecticut, you'll need to file the CT 1040 form, which is the state's individual income tax return. In this article, we'll provide you with 7 tips to help you navigate the process and ensure that you file your CT 1040 form correctly.

Understanding the CT 1040 Form

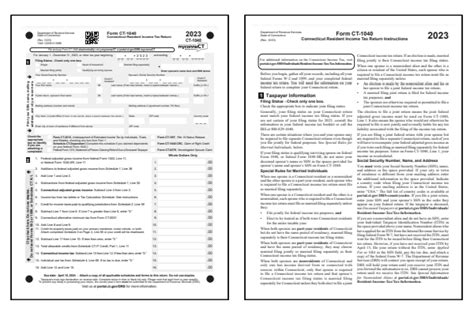

Before we dive into the tips, let's take a brief look at what the CT 1040 form is and what it's used for. The CT 1040 form is the official document used by the Connecticut Department of Revenue Services (DRS) to collect individual income tax returns. It's used to report an individual's income, deductions, and credits, and to calculate their tax liability.

Tip 1: Gather All Necessary Documents

Before you start filling out the CT 1040 form, make sure you have all the necessary documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs

- Your W-2 forms from all employers

- Your 1099 forms for freelance work or self-employment income

- Any other relevant tax documents, such as interest statements or dividend statements

Why Gathering Documents is Important

Gathering all the necessary documents will help you ensure that you report all your income and claim all the deductions and credits you're eligible for. This will also help you avoid errors and delays in processing your return.

Tip 2: Choose the Correct Filing Status

Your filing status affects the tax rates and deductions you're eligible for. Make sure you choose the correct filing status on your CT 1040 form. The options include:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Why Choosing the Correct Filing Status is Important

Choosing the correct filing status will ensure that you're eligible for the correct tax rates and deductions. This will also help you avoid errors and delays in processing your return.

Tip 3: Report All Income

Make sure you report all your income on your CT 1040 form, including:

- Wages and salaries

- Tips and gratuities

- Self-employment income

- Interest and dividends

- Capital gains and losses

Why Reporting All Income is Important

Reporting all your income will ensure that you're paying the correct amount of taxes. Failing to report income can result in penalties and fines.

Tip 4: Claim All Eligible Deductions and Credits

Make sure you claim all the deductions and credits you're eligible for, including:

- Standard deduction or itemized deductions

- Personal exemptions

- Education credits

- Child tax credit

- Earned income tax credit (EITC)

Why Claiming Deductions and Credits is Important

Claiming deductions and credits can help reduce your tax liability. Make sure you review the eligibility criteria for each deduction and credit to ensure you're eligible.

Tip 5: File Electronically

Filing your CT 1040 form electronically is faster, more accurate, and more secure than filing a paper return. You can use the Connecticut Department of Revenue Services' (DRS) online filing system or a third-party tax preparation software.

Why Filing Electronically is Important

Filing electronically will help you avoid errors and delays in processing your return. It will also provide you with faster refunds and better security.

Tip 6: Pay Any Tax Due

If you owe taxes, make sure you pay them by the deadline to avoid penalties and fines. You can pay online, by phone, or by mail.

Why Paying Tax Due is Important

Paying your taxes on time will help you avoid penalties and fines. It will also help you maintain a good tax compliance record.

Tip 7: Seek Professional Help if Needed

If you're unsure about any part of the tax filing process, consider seeking professional help from a tax professional or accountant. They can provide you with guidance and support to ensure you file your CT 1040 form correctly.

Why Seeking Professional Help is Important

Seeking professional help can ensure that you file your CT 1040 form correctly and avoid errors and delays. It can also provide you with peace of mind and help you navigate the tax filing process.

We hope these 7 tips will help you navigate the process of filing your CT 1040 form. Remember to gather all necessary documents, choose the correct filing status, report all income, claim all eligible deductions and credits, file electronically, pay any tax due, and seek professional help if needed.

Now that you've read this article, we encourage you to share your thoughts and experiences with filing your CT 1040 form. Have you encountered any challenges or successes? Share your story in the comments below!

FAQ Section:

What is the deadline for filing the CT 1040 form?

+The deadline for filing the CT 1040 form is April 15th of each year.

Can I file my CT 1040 form electronically?

+Yes, you can file your CT 1040 form electronically using the Connecticut Department of Revenue Services' (DRS) online filing system or a third-party tax preparation software.

What happens if I owe taxes and don't pay by the deadline?

+If you owe taxes and don't pay by the deadline, you may be subject to penalties and fines.