The state of Illinois has implemented various measures to alleviate the burden of property taxes on its residents. One such initiative is the Property Tax Relief program, which allows eligible homeowners to claim a reduction in their property taxes. To facilitate this process, the Illinois Department of Revenue (IDOR) has introduced the IL-1040-PTD Form, also known as the Property Tax Deduction Form. In this article, we will delve into the intricacies of the IL-1040-PTD Form and provide a comprehensive guide on how to navigate the Illinois Property Tax Relief program.

Understanding the IL-1040-PTD Form

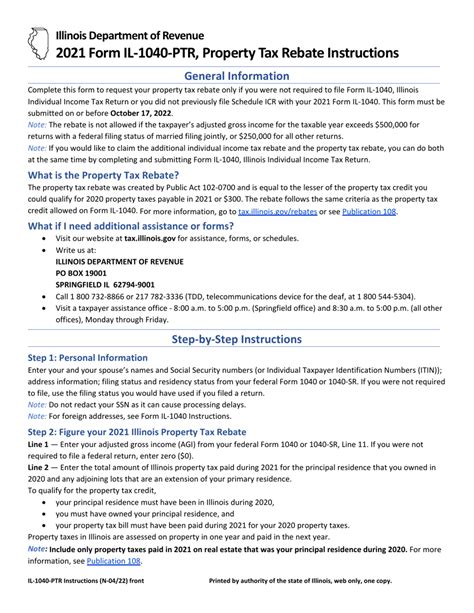

The IL-1040-PTD Form is a crucial document for Illinois residents seeking to claim a property tax deduction. This form is used to report property taxes paid on a primary residence and to calculate the eligible deduction amount. The form consists of several sections, which require taxpayers to provide detailed information about their property taxes, income, and other relevant details.

Eligibility Criteria for Property Tax Relief

To be eligible for the Property Tax Relief program, taxpayers must meet specific criteria:

- The property must be the taxpayer's primary residence.

- The taxpayer must have paid property taxes on the primary residence.

- The taxpayer's adjusted gross income (AGI) must not exceed a certain threshold, which is adjusted annually for inflation.

How to Complete the IL-1040-PTD Form

To complete the IL-1040-PTD Form, taxpayers will need to gather the following information:

- Property tax bill or statement showing the amount of taxes paid.

- Federal tax return (Form 1040) to report AGI.

- Illinois state tax return (Form IL-1040) to report state income tax liability.

Here's a step-by-step guide to completing the form:

- Section 1: Property Tax Information - Report the amount of property taxes paid on the primary residence.

- Section 2: Income Information - Report AGI from the federal tax return (Form 1040).

- Section 3: Deduction Calculation - Calculate the eligible deduction amount based on the property tax amount and AGI.

Benefits of Claiming Property Tax Relief

Claiming property tax relief can provide significant benefits to eligible taxpayers:

- Reduced property tax liability

- Increased refund or reduced tax liability on state income tax return

- Potential increase in state tax credit

Common Mistakes to Avoid

When completing the IL-1040-PTD Form, taxpayers should avoid the following common mistakes:

- Failing to report accurate property tax information

- Incorrectly calculating the deduction amount

- Failing to attach required documentation

Additional Resources

For more information on the IL-1040-PTD Form and the Property Tax Relief program, taxpayers can visit the Illinois Department of Revenue (IDOR) website or consult with a tax professional.

Conclusion

The IL-1040-PTD Form is a crucial document for Illinois residents seeking to claim a property tax deduction. By understanding the eligibility criteria, completing the form accurately, and avoiding common mistakes, taxpayers can take advantage of the Property Tax Relief program and reduce their property tax liability.

We hope this guide has provided valuable insights into the IL-1040-PTD Form and the Property Tax Relief program. If you have any further questions or concerns, please don't hesitate to comment below.

What is the deadline for filing the IL-1040-PTD Form?

+The deadline for filing the IL-1040-PTD Form is typically April 15th, but it's best to check with the Illinois Department of Revenue (IDOR) for specific deadlines and requirements.

Can I claim property tax relief if I'm a renter?

+No, the Property Tax Relief program is only available to homeowners who pay property taxes on their primary residence.

How do I calculate the eligible deduction amount?

+The eligible deduction amount is calculated based on the property tax amount and AGI. Refer to the IL-1040-PTD Form instructions for detailed calculation instructions.