As an In-Home Supportive Services (IHSS) caregiver, receiving your W-2 form can be a daunting experience, especially if you're not familiar with the intricacies of tax forms. The IHSS W-2 form is a crucial document that reports your income and taxes withheld from your IHSS earnings. In this article, we'll break down the key components of the IHSS W-2 form, making it easier for you to understand and navigate.

What is an IHSS W-2 Form?

The IHSS W-2 form is an annual tax document that the California Department of Social Services (CDSS) issues to IHSS caregivers, reporting their earnings and taxes withheld for the previous tax year. The form is used to report income and taxes withheld from IHSS wages, which includes federal income tax, state income tax, and Social Security tax.

Why is the IHSS W-2 Form Important?

The IHSS W-2 form is essential for several reasons:

- It reports your IHSS earnings, which is necessary for filing your tax return.

- It shows the amount of taxes withheld from your IHSS wages, which you'll need to report on your tax return.

- It provides information required for claiming credits and deductions on your tax return.

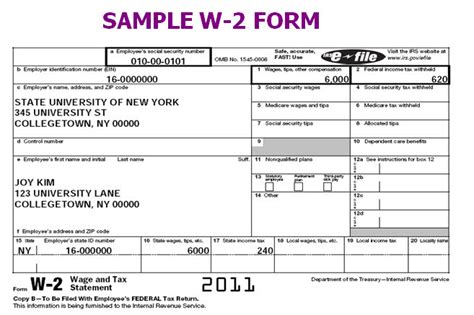

Understanding the Components of the IHSS W-2 Form

The IHSS W-2 form consists of several boxes and sections, which can be overwhelming at first glance. Let's break down the key components:

- Box 1: Wages, Tips, and Other Compensation: This box reports your total IHSS earnings for the previous tax year.

- Box 2: Federal Income Tax Withheld: This box shows the amount of federal income tax withheld from your IHSS wages.

- Box 4: Social Security Tax Withheld: This box reports the amount of Social Security tax withheld from your IHSS wages.

- Box 5: Medicare Tax Withheld: This box shows the amount of Medicare tax withheld from your IHSS wages.

- Box 14: State Income Tax Withheld: This box reports the amount of state income tax withheld from your IHSS wages.

Frequently Asked Questions about the IHSS W-2 Form

Here are some frequently asked questions about the IHSS W-2 form:

- Q: When will I receive my IHSS W-2 form?

- A: The CDSS typically issues IHSS W-2 forms by January 31st of each year.

- Q: What if I don't receive my IHSS W-2 form?

- A: Contact the CDSS or your local county IHSS office to request a replacement W-2 form.

- Q: Can I access my IHSS W-2 form online?

- A: Yes, you can access your IHSS W-2 form online through the CDSS website.

Conclusion

Understanding your IHSS W-2 form is crucial for filing your tax return accurately. By familiarizing yourself with the components of the IHSS W-2 form, you'll be better equipped to navigate the tax filing process. If you have any questions or concerns about your IHSS W-2 form, don't hesitate to reach out to the CDSS or your local county IHSS office for assistance.

We hope this article has helped you understand your IHSS W-2 form better. Share your experiences or ask questions in the comments section below!

What is the deadline for receiving my IHSS W-2 form?

+The CDSS typically issues IHSS W-2 forms by January 31st of each year.

Can I access my IHSS W-2 form online?

+Yes, you can access your IHSS W-2 form online through the CDSS website.

What if I don't receive my IHSS W-2 form?

+Contact the CDSS or your local county IHSS office to request a replacement W-2 form.