As a fleet owner or manager, you're likely no stranger to the complexities of fuel tax reporting. The International Fuel Tax Agreement (IFTA) requires you to file quarterly reports detailing the fuel consumption and mileage of your vehicles. However, navigating the IFTA fuel tax form can be a daunting task, especially for those new to the process. In this article, we'll break down the IFTA fuel tax form, simplifying your reporting process and helping you avoid costly errors.

The IFTA fuel tax form is a critical component of the reporting process, as it provides the necessary information for states to calculate fuel tax revenues. The form requires you to report on the fuel consumed by your vehicles, as well as the miles driven in each participating jurisdiction. This information is used to determine the amount of fuel tax owed to each state.

Understanding the IFTA Fuel Tax Form

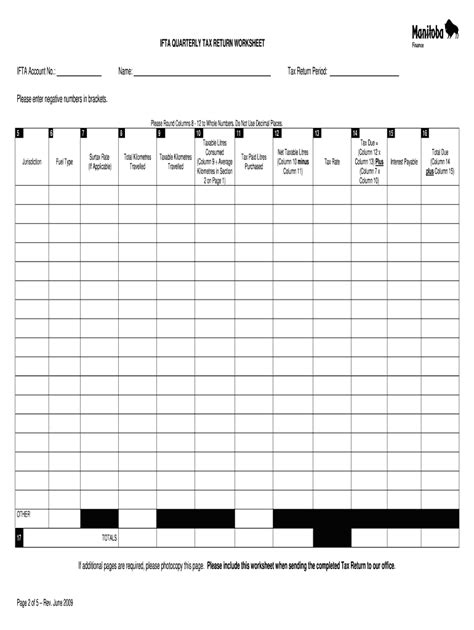

The IFTA fuel tax form is divided into several sections, each requiring specific information about your fleet's fuel consumption and mileage. Here's a breakdown of the key sections:

Section 1: Fleet Information

In this section, you'll need to provide general information about your fleet, including:

- Your IFTA account number

- Your company name and address

- The reporting period (quarterly)

Section 2: Vehicle Information

Here, you'll list each vehicle in your fleet, including:

- Vehicle identification number (VIN)

- Vehicle type (e.g., truck, trailer, etc.)

- License plate number

- Gross vehicle weight rating (GVWR)

Section 3: Fuel Consumption

In this section, you'll report on the fuel consumed by each vehicle, including:

- Fuel type (e.g., gasoline, diesel, etc.)

- Total gallons consumed

- Total miles driven

Section 4: Mileage by Jurisdiction

Here, you'll report on the miles driven in each participating jurisdiction, including:

- Jurisdiction name

- Total miles driven

- Fuel consumed in each jurisdiction

Tips for Simplifying the IFTA Fuel Tax Form

While the IFTA fuel tax form may seem complex, there are several steps you can take to simplify the reporting process:

- Keep accurate records: Maintaining accurate records of your fleet's fuel consumption and mileage is crucial for completing the IFTA fuel tax form. Consider using a fuel tax software to streamline your record-keeping.

- Use a template: Create a template for your IFTA fuel tax form to ensure you're including all necessary information.

- Double-check your calculations: Verify your calculations for fuel consumption and mileage to avoid errors.

IFTA Fuel Tax Form Filing Options

Once you've completed the IFTA fuel tax form, you'll need to file it with your base jurisdiction. There are several filing options available:

- Paper filing: You can file your IFTA fuel tax form by mail, but this method can be time-consuming and prone to errors.

- Electronic filing: Many states offer electronic filing options, which can streamline the process and reduce errors.

- Third-party filing: Consider hiring a third-party provider to handle your IFTA fuel tax filing, especially if you're new to the process.

Common Mistakes to Avoid

When completing the IFTA fuel tax form, it's essential to avoid common mistakes that can lead to costly errors and penalties:

- Incorrect calculations: Verify your calculations for fuel consumption and mileage to avoid errors.

- Missing information: Ensure you're including all necessary information, such as vehicle identification numbers and license plate numbers.

- Late filing: File your IFTA fuel tax form on time to avoid late fees and penalties.

Conclusion

The IFTA fuel tax form may seem complex, but by breaking it down into manageable sections and following tips for simplifying the reporting process, you can ensure accuracy and avoid costly errors. Remember to keep accurate records, use a template, and double-check your calculations to ensure a smooth filing process.

Take Action:

- Review your IFTA fuel tax form to ensure accuracy

- Consider using a fuel tax software to streamline your record-keeping

- File your IFTA fuel tax form on time to avoid late fees and penalties

What is the IFTA fuel tax form?

+The IFTA fuel tax form is a quarterly report detailing the fuel consumption and mileage of your vehicles.

How do I file my IFTA fuel tax form?

+You can file your IFTA fuel tax form by mail, electronically, or through a third-party provider.

What are the consequences of late filing?

+Late filing can result in late fees and penalties, so it's essential to file your IFTA fuel tax form on time.