The world of corporate filings can be complex and overwhelming, especially for those who are new to the process. One such filing that is crucial for Canadian publicly traded companies is the Ifta Form 56-102. In this article, we will delve into the world of Ifta Form 56-102, exploring its importance, benefits, and a step-by-step guide on how to file it.

Understanding Ifta Form 56-102

Ifta Form 56-102, also known as the "Insider Report," is a filing requirement for Canadian publicly traded companies under the Securities Act. The form is used to disclose insider transactions, which include purchases, sales, or other changes in the ownership of the company's securities by its insiders, such as directors, officers, and significant shareholders.

Why is Ifta Form 56-102 Important?

Ifta Form 56-102 plays a crucial role in maintaining transparency and fairness in the Canadian capital markets. By disclosing insider transactions, the form helps to:

- Prevent insider trading and ensure that insiders do not take advantage of their position to profit from non-public information

- Provide stakeholders with valuable information about the company's securities and insider activities

- Enhance investor confidence and trust in the market

Benefits of Filing Ifta Form 56-102

Filing Ifta Form 56-102 has numerous benefits for publicly traded companies, including:

- Compliance with regulatory requirements and avoidance of potential penalties and fines

- Enhanced transparency and accountability, which can lead to increased investor confidence and trust

- Better management of insider transactions and prevention of insider trading

- Improved corporate governance and reduced risk of non-compliance

A Step-by-Step Guide to Filing Ifta Form 56-102

Filing Ifta Form 56-102 can seem daunting, but breaking it down into smaller steps can make the process more manageable. Here is a step-by-step guide to help you get started:

- Determine the Filing Deadline: The filing deadline for Ifta Form 56-102 is typically 5 business days after the insider transaction.

- Gather Required Information: Collect all necessary information, including the insider's name, title, and security holdings, as well as the details of the transaction, such as the date, type, and number of securities involved.

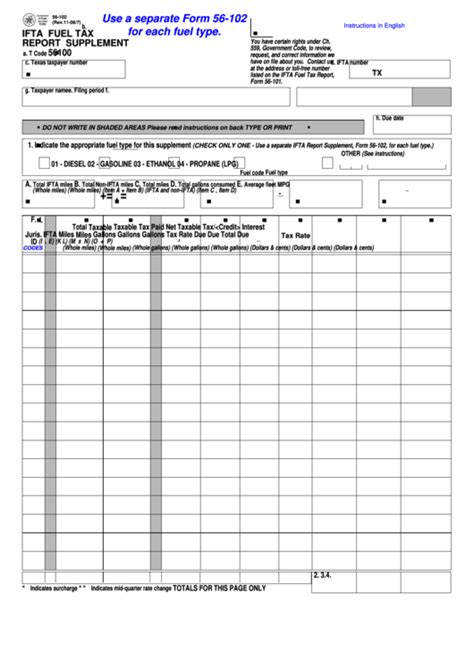

- Complete the Form: Fill out Ifta Form 56-102, ensuring that all required information is accurate and complete.

- Review and Verify: Review the form for accuracy and completeness, and verify that all required signatures are obtained.

- File the Form: Submit the completed form to the relevant regulatory bodies, such as the Canadian Securities Administrators (CSA) and the System for Electronic Document Analysis and Retrieval (SEDAR).

Common Mistakes to Avoid When Filing Ifta Form 56-102

When filing Ifta Form 56-102, it's essential to avoid common mistakes that can lead to delays, penalties, or even non-compliance. Some common mistakes to avoid include:

- Failing to file the form on time or missing the deadline

- Providing inaccurate or incomplete information

- Failing to obtain required signatures

- Not filing the form with the relevant regulatory bodies

Best Practices for Filing Ifta Form 56-102

To ensure a smooth and efficient filing process, follow these best practices:

- Establish a Filing Calendar: Create a calendar to track filing deadlines and ensure timely submission of the form.

- Designate a Filing Officer: Appoint a responsible officer to oversee the filing process and ensure that all requirements are met.

- Use a Filing Template: Utilize a filing template to ensure that all required information is captured and accurately completed.

- Review and Verify: Thoroughly review and verify the form for accuracy and completeness before submission.

Conclusion and Next Steps

Filing Ifta Form 56-102 is a critical requirement for Canadian publicly traded companies. By understanding the importance of the form, following the step-by-step guide, and avoiding common mistakes, companies can ensure compliance and maintain transparency in the market. We hope this comprehensive guide has provided you with the necessary information to navigate the filing process with confidence.

What is the purpose of Ifta Form 56-102?

+Ifta Form 56-102 is used to disclose insider transactions, including purchases, sales, or other changes in the ownership of the company's securities by its insiders.

Who is required to file Ifta Form 56-102?

+Canadian publicly traded companies are required to file Ifta Form 56-102 to disclose insider transactions.

What is the filing deadline for Ifta Form 56-102?

+The filing deadline for Ifta Form 56-102 is typically 5 business days after the insider transaction.