The HUD-92051 form is a crucial document in the mortgage industry, particularly for individuals seeking to purchase a home through the Federal Housing Administration (FHA) loan program. Despite its importance, many people are unfamiliar with the specifics of this form. In this article, we will delve into the world of HUD-92051, exploring its purpose, benefits, and the necessary steps to complete it accurately.

What is the HUD-92051 Form?

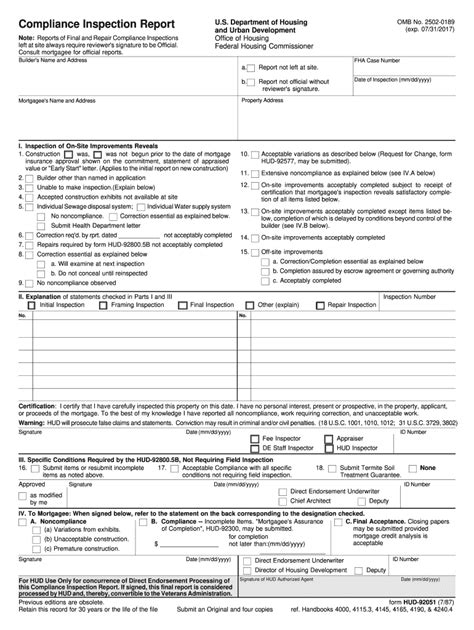

The HUD-92051 form, also known as the " Mortgage Insurance Disclosure - Notice of Right to Cancel," is a standard document used by lenders to inform borrowers about the terms and conditions of their mortgage insurance. This form is specifically designed for FHA loans, which are popular among first-time homebuyers and individuals with lower credit scores.

Why is the HUD-92051 Form Important?

The HUD-92051 form serves several purposes:

- It discloses the details of the mortgage insurance premium (MIP) to the borrower.

- It explains the borrower's right to cancel the mortgage insurance.

- It outlines the conditions under which the lender can terminate the mortgage insurance.

By signing this form, borrowers acknowledge that they have received and understood the information provided. This form is a crucial part of the mortgage process, as it ensures transparency and protects the rights of both parties involved.

Benefits of the HUD-92051 Form

The HUD-92051 form offers several benefits to borrowers:

- Increased Transparency: The form provides clear information about the mortgage insurance premium, allowing borrowers to make informed decisions about their loan.

- Protection of Borrower Rights: The form outlines the borrower's right to cancel the mortgage insurance, ensuring that they are aware of their options.

- Compliance with Regulations: The form helps lenders comply with FHA regulations, reducing the risk of non-compliance and potential penalties.

By completing the HUD-92051 form accurately, borrowers can ensure a smooth mortgage process and avoid potential issues down the line.

How to Complete the HUD-92051 Form

Completing the HUD-92051 form requires careful attention to detail. Here are the necessary steps to follow:

- Review the Form: Carefully review the form to ensure that all information is accurate and complete.

- Verify the Loan Details: Verify the loan details, including the loan amount, interest rate, and mortgage insurance premium.

- Understand the Mortgage Insurance: Understand the terms and conditions of the mortgage insurance, including the premium amount and the right to cancel.

- Sign and Date the Form: Sign and date the form, acknowledging that you have received and understood the information provided.

By following these steps, borrowers can ensure that the HUD-92051 form is completed accurately and efficiently.

Common Mistakes to Avoid

When completing the HUD-92051 form, there are several common mistakes to avoid:

- Inaccurate Loan Details: Ensure that the loan details are accurate and complete to avoid delays or issues with the mortgage process.

- Failure to Understand the Mortgage Insurance: Take the time to understand the terms and conditions of the mortgage insurance to avoid unexpected surprises.

- Incomplete or Missing Information: Ensure that all information is complete and accurate to avoid delays or issues with the mortgage process.

By avoiding these common mistakes, borrowers can ensure a smooth mortgage process and avoid potential issues down the line.

Conclusion and Next Steps

In conclusion, the HUD-92051 form is a critical document in the mortgage industry, providing transparency and protection for borrowers. By understanding the purpose, benefits, and necessary steps to complete this form accurately, borrowers can ensure a smooth mortgage process and avoid potential issues.

If you have any questions or concerns about the HUD-92051 form, we encourage you to reach out to a qualified lender or mortgage professional. They can provide personalized guidance and support to help you navigate the mortgage process with confidence.

We hope this article has been informative and helpful. If you have any comments or questions, please feel free to share them below.

What is the purpose of the HUD-92051 form?

+The HUD-92051 form is used to disclose the details of the mortgage insurance premium to the borrower and explain their right to cancel the mortgage insurance.

Why is the HUD-92051 form important?

+The HUD-92051 form is important because it provides transparency and protection for borrowers, ensuring that they understand the terms and conditions of their mortgage insurance.

How do I complete the HUD-92051 form accurately?

+To complete the HUD-92051 form accurately, review the form carefully, verify the loan details, understand the mortgage insurance, and sign and date the form.