Forming a corporation in New York can be a complex process, but with the right guidance, it can be a straightforward and efficient experience. In this article, we will walk you through the step-by-step process of forming a corporation in New York, providing you with the necessary information and resources to get started.

Why Form a Corporation in New York?

Forming a corporation in New York offers numerous benefits, including:

- Limited Liability Protection: A corporation provides its owners (shareholders) with limited liability protection, shielding their personal assets from business-related risks and debts.

- Tax Benefits: Corporations can deduct business expenses, reducing taxable income and minimizing tax liabilities.

- Credibility and Legitimacy: Incorporating in New York can enhance a company's credibility and legitimacy, making it more attractive to investors, customers, and partners.

- Flexibility in Ownership and Management: Corporations can have multiple owners (shareholders) and can be managed by a board of directors, providing flexibility in ownership and management structures.

Step 1: Choose a Business Name

The first step in forming a corporation in New York is to choose a business name. The name must:

- Be Unique: The name must be distinguishable from other business names in New York.

- End with a Corporate Designator: The name must end with a corporate designator such as "Inc.," "Corp.," or "Limited."

- Not Contain Prohibited Words: The name must not contain words that are prohibited by New York law, such as "bank" or "insurance."

Business Name Requirements in New York

New York law requires that a corporation's name must:

- Be Written in English: The name must be written in English and may not contain any characters or symbols that are not part of the English alphabet.

- Not Contain Numbers: The name must not contain numbers, except for numbers that are part of a word or phrase.

- Not Contain Special Characters: The name must not contain special characters, except for the corporate designator.

Step 2: Appoint a Registered Agent

A registered agent is an individual or entity responsible for receiving and forwarding important documents and notices on behalf of the corporation. The registered agent must:

- Have a Physical Address in New York: The registered agent must have a physical address in New York, not a post office box.

- Be Available During Business Hours: The registered agent must be available during business hours to receive and forward documents and notices.

Registered Agent Requirements in New York

New York law requires that a registered agent must:

- Be an Individual or Entity: The registered agent must be an individual or entity, such as a corporation or limited liability company.

- Have a Physical Address in New York: The registered agent must have a physical address in New York, not a post office box.

- Be Available During Business Hours: The registered agent must be available during business hours to receive and forward documents and notices.

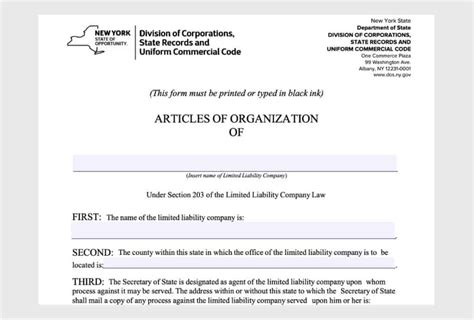

Step 3: File Articles of Incorporation

The next step is to file Articles of Incorporation with the New York Department of State. The Articles of Incorporation must:

- Contain the Corporation's Name: The Articles of Incorporation must contain the corporation's name, as well as the name and address of the registered agent.

- Specify the Purpose of the Corporation: The Articles of Incorporation must specify the purpose of the corporation, including the type of business it will conduct.

- Specify the Authorized Stock: The Articles of Incorporation must specify the authorized stock of the corporation, including the number and type of shares.

Articles of Incorporation Requirements in New York

New York law requires that the Articles of Incorporation must:

- Be Signed by the Incorporator: The Articles of Incorporation must be signed by the incorporator, who is the individual or entity responsible for forming the corporation.

- Be Filed with the Department of State: The Articles of Incorporation must be filed with the New York Department of State.

- Contain the Required Information: The Articles of Incorporation must contain the required information, including the corporation's name, purpose, and authorized stock.

Step 4: Obtain an EIN

An Employer Identification Number (EIN) is a unique number assigned to the corporation by the Internal Revenue Service (IRS). The EIN is used to:

- Identify the Corporation for Tax Purposes: The EIN is used to identify the corporation for tax purposes, including filing tax returns and paying taxes.

- Open a Business Bank Account: The EIN is required to open a business bank account, which is necessary for managing the corporation's finances.

EIN Requirements in New York

New York law requires that a corporation must:

- Obtain an EIN from the IRS: The corporation must obtain an EIN from the IRS, which can be done online or by mail.

- Use the EIN for Tax Purposes: The corporation must use the EIN for tax purposes, including filing tax returns and paying taxes.

Step 5: Obtain Business Licenses and Permits

Business licenses and permits are required to operate a business in New York. The type of licenses and permits required will depend on the type of business and its location.

Business License and Permit Requirements in New York

New York law requires that a corporation must:

- Obtain a Business License: The corporation must obtain a business license from the New York Department of State, which is required to operate a business in New York.

- Obtain Permits and Certificates: The corporation must obtain permits and certificates from various state and local agencies, depending on the type of business and its location.

Conclusion

Forming a corporation in New York requires careful planning and attention to detail. By following the steps outlined in this article, you can ensure that your corporation is formed correctly and is in compliance with New York law. Remember to choose a unique business name, appoint a registered agent, file Articles of Incorporation, obtain an EIN, and obtain business licenses and permits.

What is the purpose of a registered agent?

+A registered agent is an individual or entity responsible for receiving and forwarding important documents and notices on behalf of the corporation.

What is an EIN?

+An Employer Identification Number (EIN) is a unique number assigned to the corporation by the Internal Revenue Service (IRS) for tax purposes.

What are the requirements for obtaining a business license in New York?

+The corporation must obtain a business license from the New York Department of State, which is required to operate a business in New York.