The Mississippi withholding form is a crucial document for employers in the state of Mississippi, as it enables them to report and pay the state income taxes withheld from their employees' wages. In this article, we will provide a step-by-step guide on how to complete and file the Mississippi withholding form, ensuring that employers comply with the state's tax regulations.

The Importance of Withholding Forms

Withholding forms are essential for employers, as they help them report and remit the taxes withheld from their employees' wages. The Mississippi withholding form is specifically designed for employers in the state of Mississippi, and it must be completed accurately to avoid any penalties or fines. By understanding the process of completing and filing the Mississippi withholding form, employers can ensure that they are in compliance with the state's tax regulations.

Understanding the Mississippi Withholding Form

The Mississippi withholding form is a quarterly return that must be filed by employers to report the state income taxes withheld from their employees' wages. The form requires employers to provide information about the taxes withheld, as well as the number of employees and the total wages paid.

Step-By-Step Filing Guide

Step 1: Gather Required Information

Before starting the filing process, employers must gather the required information, including:

- Employee identification numbers (EINs)

- Employee names and addresses

- Total wages paid

- Total taxes withheld

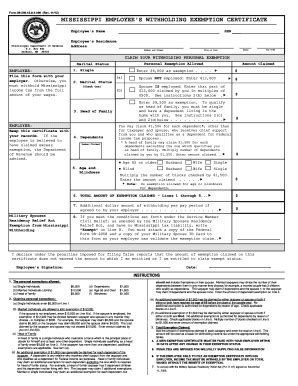

Step 2: Complete Form 89-140

Employers must complete Form 89-140, which is the Mississippi withholding tax return. The form requires employers to provide the following information:

- Employer identification number (EIN)

- Employer name and address

- Total wages paid

- Total taxes withheld

- Number of employees

Step 3: Calculate Withholding Taxes

Employers must calculate the withholding taxes based on the total wages paid and the number of employees. The withholding tax rate in Mississippi is 5% of the total wages paid.

Step 4: Complete Schedule 1

Employers must complete Schedule 1, which is the withholding tax schedule. The schedule requires employers to provide the following information:

- Total wages paid

- Total taxes withheld

- Number of employees

Step 5: File the Return

Employers must file the return electronically or by mail. The due date for filing the return is the last day of the month following the end of the quarter.

Quarterly Filing Schedule

The quarterly filing schedule for the Mississippi withholding form is as follows:

- January 31st for the quarter ending December 31st

- April 30th for the quarter ending March 31st

- July 31st for the quarter ending June 30th

- October 31st for the quarter ending September 30th

Penalties and Fines

Employers who fail to file the Mississippi withholding form or pay the withholding taxes on time may be subject to penalties and fines. The penalties and fines are as follows:

- 5% of the unpaid tax for each month or part of a month that the return is late

- 1% of the unpaid tax for each month or part of a month that the payment is late

FAQ Section

What is the Mississippi withholding form?

+The Mississippi withholding form is a quarterly return that must be filed by employers to report the state income taxes withheld from their employees' wages.

What is the due date for filing the Mississippi withholding form?

+The due date for filing the Mississippi withholding form is the last day of the month following the end of the quarter.

What are the penalties and fines for failing to file the Mississippi withholding form?

+Employers who fail to file the Mississippi withholding form or pay the withholding taxes on time may be subject to penalties and fines, including 5% of the unpaid tax for each month or part of a month that the return is late and 1% of the unpaid tax for each month or part of a month that the payment is late.

Conclusion

In conclusion, the Mississippi withholding form is a crucial document for employers in the state of Mississippi. By following the step-by-step filing guide and understanding the quarterly filing schedule, employers can ensure that they are in compliance with the state's tax regulations. It is essential for employers to gather the required information, complete the form accurately, and file the return on time to avoid any penalties or fines. By doing so, employers can ensure that they are meeting their tax obligations and avoiding any potential issues.

We encourage you to share this article with your colleagues and friends who may be interested in learning more about the Mississippi withholding form. If you have any questions or comments, please feel free to leave them in the section below.