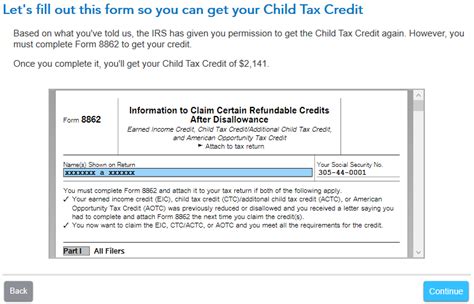

Form 8862 is a crucial document for individuals who have been denied or are at risk of being denied the Earned Income Tax Credit (EITC) due to previous errors or discrepancies in their tax returns. If you're a TurboTax user, you might be wondering how to add Form 8862 to your tax return. In this article, we'll explore five ways to do so, ensuring you receive the EITC you're eligible for.

The Importance of Form 8862

Before we dive into the methods, it's essential to understand the significance of Form 8862. The Earned Income Tax Credit is a refundable tax credit designed to benefit low-to-moderate-income working individuals and families. However, if you've made errors on your previous tax returns, you might be subject to an EITC ban or have your credit reduced. Form 8862 allows you to reapply for the EITC or request a reversal of the ban.

Method 1: Starting a New Tax Return

If you're starting a new tax return on TurboTax, you can add Form 8862 during the filing process. Here's how:

- Sign in to your TurboTax account and start a new tax return.

- Follow the prompts to enter your personal and financial information.

- When you reach the "EITC" section, select "Yes" to indicate you're eligible for the credit.

- TurboTax will then ask if you've been denied the EITC in the past or are at risk of being denied. Select "Yes" again.

- You'll be prompted to complete Form 8862. Fill in the required information, including your name, address, and Social Security number.

- Review and submit your tax return, including Form 8862.

Method 2: Amending a Previous Tax Return

If you've already filed your tax return but need to add Form 8862, you can amend your return using TurboTax.

- Sign in to your TurboTax account and select the tax return you want to amend.

- Click on "Amend a Return" and follow the prompts to enter your amended information.

- When you reach the "EITC" section, select "Yes" to indicate you're eligible for the credit.

- TurboTax will then ask if you've been denied the EITC in the past or are at risk of being denied. Select "Yes" again.

- You'll be prompted to complete Form 8862. Fill in the required information, including your name, address, and Social Security number.

- Review and submit your amended tax return, including Form 8862.

Method 3: Using TurboTax's Form 8862 Tool

TurboTax offers a Form 8862 tool that can help you complete and add the form to your tax return.

- Sign in to your TurboTax account and navigate to the "Tools" section.

- Select "Form 8862" from the list of available tools.

- Fill in the required information, including your name, address, and Social Security number.

- Review and submit the completed Form 8862.

- TurboTax will automatically add the form to your tax return.

Method 4: Uploading Form 8862 to TurboTax

If you've already completed Form 8862, you can upload it to TurboTax.

- Sign in to your TurboTax account and navigate to the "Uploads" section.

- Select "Form 8862" from the list of available forms.

- Upload your completed Form 8862.

- TurboTax will automatically add the form to your tax return.

Method 5: Contacting TurboTax Support

If you're having trouble adding Form 8862 to your tax return, you can contact TurboTax support for assistance.

- Sign in to your TurboTax account and navigate to the "Help" section.

- Select "Contact Us" and choose your preferred method of communication (phone, email, or chat).

- Explain your issue to the TurboTax support representative, and they'll guide you through the process of adding Form 8862 to your tax return.

Tips and Reminders

- Make sure to keep a copy of your completed Form 8862 for your records.

- If you're unsure about any part of the process, consider consulting a tax professional or contacting TurboTax support.

- Form 8862 is only required if you've been denied the EITC or are at risk of being denied. If you're eligible for the credit and haven't been denied, you won't need to complete this form.

By following these five methods, you can easily add Form 8862 to your TurboTax return and ensure you receive the EITC you're eligible for.

We'd love to hear about your experience with adding Form 8862 to your TurboTax return. Share your tips and insights in the comments below!

What is Form 8862, and why do I need it?

+Form 8862 is a document required for individuals who have been denied or are at risk of being denied the Earned Income Tax Credit (EITC) due to previous errors or discrepancies in their tax returns. It allows you to reapply for the EITC or request a reversal of the ban.

Can I add Form 8862 to my TurboTax return if I've already filed?

+Yes, you can amend your previous tax return using TurboTax and add Form 8862. Follow the prompts to enter your amended information, and TurboTax will guide you through the process.

What information do I need to complete Form 8862?

+You'll need to provide your name, address, and Social Security number to complete Form 8862. You may also need to provide additional information, such as your employment history and income details.