Filing taxes can be a daunting task, especially when it comes to navigating the intricacies of state-specific forms. For Hawaii residents, the G-45 form is a crucial part of the tax filing process. In this article, we'll break down the G-45 form and provide a comprehensive guide on how to fill it out accurately and efficiently.

Understanding the G-45 Form

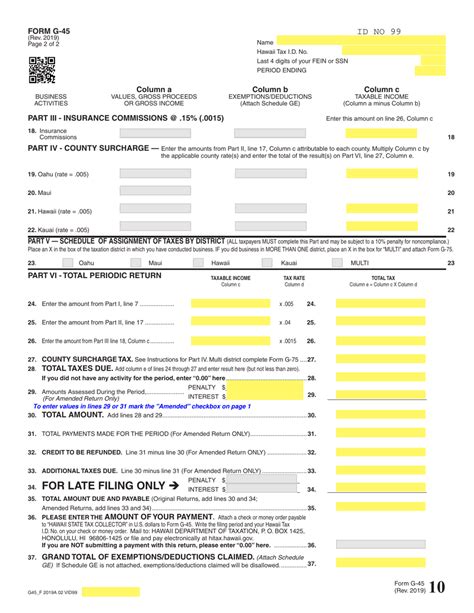

The G-45 form, also known as the "Hawaii Income Tax Return," is a vital document that Hawaii residents must submit to the state government to report their income and claim any applicable deductions and credits. The form is used to calculate the taxpayer's state income tax liability, which is then used to determine the amount of taxes owed or refunded.

Who Needs to File the G-45 Form?

Not everyone is required to file the G-45 form. Generally, you need to file this form if you:

- Are a resident of Hawaii and have a taxable income

- Are a non-resident of Hawaii and have income sourced from Hawaii

- Have a tax liability or want to claim a refund

5 Ways to Fill Out the G-45 Form

Filling out the G-45 form can seem overwhelming, but breaking it down into smaller sections makes it more manageable. Here are five ways to fill out the G-45 form accurately:

**Step 1: Gather Required Documents**

Before starting to fill out the G-45 form, make sure you have all the necessary documents and information. This includes:

- Your federal income tax return (Form 1040)

- W-2 forms from all employers

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Charitable donation receipts

**Important Tax Documents**

- Hawaii state income tax booklet (available on the Hawaii Department of Taxation website)

- Federal income tax return (Form 1040)

- W-2 forms

- 1099 forms

- Interest statements

- Charitable donation receipts

**Step 2: Fill Out the Header Section**

The header section of the G-45 form requires basic information about you and your tax filing status. Make sure to fill out the following:

- Your name and address

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Filing status (single, married, head of household, etc.)

- Number of dependents

**Filing Status Options**

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

**Step 3: Report Income**

The next section of the G-45 form requires you to report your income from various sources. Make sure to fill out the following:

- Wages, salaries, and tips

- Interest income

- Dividend income

- Capital gains and losses

- Self-employment income

**Types of Income**

- Wages, salaries, and tips

- Interest income

- Dividend income

- Capital gains and losses

- Self-employment income

- Rental income

- Royalty income

**Step 4: Claim Deductions and Credits**

This section of the G-45 form allows you to claim deductions and credits that can reduce your tax liability. Make sure to fill out the following:

- Standard deduction or itemized deductions

- Personal exemption

- Child care credit

- Education credits

- Charitable contributions

**Common Deductions and Credits**

- Standard deduction

- Itemized deductions

- Personal exemption

- Child care credit

- Education credits

- Charitable contributions

- Mortgage interest deduction

**Step 5: Calculate Tax Liability and Request Refund**

The final section of the G-45 form requires you to calculate your tax liability and request a refund if applicable. Make sure to fill out the following:

- Calculate your total tax liability

- Claim any applicable credits

- Request a refund or make a payment

**Refund Options**

- Direct deposit

- Check

- Apply to next year's tax bill

By following these five steps, you can accurately fill out the G-45 form and ensure you're taking advantage of all the deductions and credits available to you.

Get Help with Your G-45 Form

If you're unsure about any part of the G-45 form, consider consulting a tax professional or contacting the Hawaii Department of Taxation for assistance.

FAQs

What is the G-45 form?

+The G-45 form is the Hawaii Income Tax Return, which is used to report income and claim deductions and credits.

Who needs to file the G-45 form?

+Residents of Hawaii with taxable income, non-residents with income sourced from Hawaii, and those with a tax liability or seeking a refund need to file the G-45 form.

What documents do I need to fill out the G-45 form?

+You'll need your federal income tax return, W-2 forms, 1099 forms, interest statements, and charitable donation receipts.

Share Your Thoughts

Have you filled out the G-45 form before? Share your experiences and tips in the comments below!