As a policyholder, it's essential to understand the process of surrendering your Gerber Life Insurance policy. Whether you're facing financial difficulties or no longer need the coverage, knowing how to navigate the surrender process can help you make informed decisions about your policy. In this article, we'll provide a comprehensive guide on how to fill out a Gerber Life Insurance surrender form, including the required steps, documents, and potential implications.

Understanding Gerber Life Insurance Surrender

Before we dive into the step-by-step guide, it's crucial to understand what surrendering a Gerber Life Insurance policy means. Surrendering your policy involves canceling your coverage and receiving the cash value, if applicable. However, this decision should not be taken lightly, as it may result in:

- Loss of coverage: Once you surrender your policy, you'll no longer have life insurance coverage.

- Tax implications: You may be subject to taxes on the cash value, depending on your policy type and tax laws.

- Potential penalties: Some policies may have surrender charges or penalties for early cancellation.

Why Surrender a Gerber Life Insurance Policy?

There are various reasons why you might consider surrendering your Gerber Life Insurance policy. Some common reasons include:

- Financial difficulties: If you're struggling to pay premiums, surrendering your policy might be a viable option.

- Change in circumstances: If your life circumstances have changed, such as divorce, death of a beneficiary, or change in income, you might no longer need the coverage.

- Alternative coverage: If you've acquired new coverage or have alternative options, surrendering your Gerber Life Insurance policy might be necessary.

Step-By-Step Guide to Filling Out a Gerber Life Insurance Surrender Form

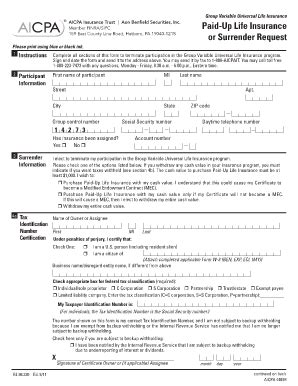

To surrender your Gerber Life Insurance policy, you'll need to fill out a surrender form. Here's a step-by-step guide to help you through the process:

Step 1: Obtain the Surrender Form

Contact Gerber Life Insurance directly to request a surrender form. You can reach them by phone, email, or through their website. Make sure to specify your policy number and type to ensure you receive the correct form.

Step 2: Review the Form and Policy Documents

Carefully review the surrender form and your policy documents to understand the terms, conditions, and potential implications of surrendering your policy.

Step 3: Fill Out the Surrender Form

Complete the surrender form, providing all required information, including:

- Policy number and type

- Policyholder's name and address

- Beneficiary information (if applicable)

- Reason for surrender (optional)

Step 4: Sign and Date the Form

Sign and date the surrender form, ensuring that all signatures match the policyholder's records.

Step 5: Attach Required Documents

Attach any required documents, such as:

- Proof of identity (driver's license, passport, etc.)

- Proof of beneficiary (death certificate, etc.)

- Policy documents (policy contract, etc.)

Step 6: Submit the Surrender Form

Submit the completed surrender form and attached documents to Gerber Life Insurance via mail, email, or fax, depending on their specified instructions.

Required Documents and Information

When filling out the surrender form, you'll need to provide the following documents and information:

- Policy number and type

- Policyholder's name and address

- Beneficiary information (if applicable)

- Reason for surrender (optional)

- Proof of identity (driver's license, passport, etc.)

- Proof of beneficiary (death certificate, etc.)

- Policy documents (policy contract, etc.)

Potential Implications of Surrendering a Gerber Life Insurance Policy

Before surrendering your Gerber Life Insurance policy, it's essential to consider the potential implications:

- Loss of coverage: Once you surrender your policy, you'll no longer have life insurance coverage.

- Tax implications: You may be subject to taxes on the cash value, depending on your policy type and tax laws.

- Potential penalties: Some policies may have surrender charges or penalties for early cancellation.

Alternatives to Surrendering a Gerber Life Insurance Policy

If you're considering surrendering your Gerber Life Insurance policy, it's worth exploring alternative options:

- Loan or withdrawal: If you need cash, you might be able to take a loan or withdrawal from your policy's cash value.

- Policy modification: You might be able to modify your policy to reduce premiums or change coverage.

- Alternative coverage: You could explore alternative life insurance options that better suit your needs.

Conclusion and Next Steps

Surrendering a Gerber Life Insurance policy can be a complex process. If you're unsure about the implications or need guidance, consider consulting with a licensed insurance professional or financial advisor.

To ensure a smooth surrender process, make sure to:

- Carefully review the surrender form and policy documents

- Provide all required information and documents

- Understand the potential implications of surrendering your policy

- Explore alternative options before making a decision

By following these steps and considering the potential implications, you'll be better equipped to make an informed decision about your Gerber Life Insurance policy.

What is the surrender process for a Gerber Life Insurance policy?

+The surrender process involves filling out a surrender form, providing required documents and information, and submitting the form to Gerber Life Insurance.

What are the potential implications of surrendering a Gerber Life Insurance policy?

+Potential implications include loss of coverage, tax implications, and potential penalties for early cancellation.

Can I modify my Gerber Life Insurance policy instead of surrendering it?

+Yes, you might be able to modify your policy to reduce premiums or change coverage. Contact Gerber Life Insurance to discuss your options.