Tax season can be a daunting time for many individuals and businesses, especially when it comes to navigating complex tax forms. One such form is Form 1045, Application for Tentative Refund, which allows taxpayers to claim a refund for overpaid taxes or apply for a quick refund of overpaid taxes. In this article, we will guide you through the process of completing Form 1045 successfully.

Understanding Form 1045

Form 1045 is used by taxpayers to claim a refund for overpaid taxes or to apply for a quick refund of overpaid taxes. This form can be used for individual and business taxes, including income taxes, employment taxes, and estate and trust taxes. The form is typically used when a taxpayer has overpaid their taxes and wants to claim a refund or apply for a quick refund.

Step 1: Determine Eligibility

Before starting the process of completing Form 1045, it's essential to determine if you're eligible to claim a refund or apply for a quick refund. To be eligible, you must have overpaid your taxes, and the overpayment must be due to one of the following reasons:

- Overpayment of estimated taxes

- Overpayment of withholding taxes

- Overpayment of employment taxes

- Overpayment of estate and trust taxes

Step 2: Gather Required Documents

To complete Form 1045, you'll need to gather the required documents, including:

- Your tax return for the year in which you overpaid taxes

- Proof of overpayment, such as a cancelled check or a letter from the IRS

- Your social security number or employer identification number (EIN)

- Your address and phone number

Step 3: Complete Form 1045

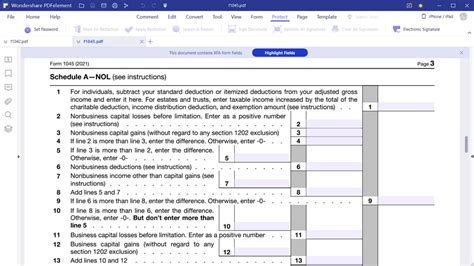

Form 1045 consists of several sections, including:

- Section 1: Taxpayer Information

- Section 2: Overpayment Information

- Section 3: Refund Information

To complete the form, follow these steps:

- Section 1: Enter your name, social security number or EIN, and address.

- Section 2: Enter the type of tax for which you're claiming a refund or applying for a quick refund.

- Section 3: Enter the amount of overpayment and the refund amount you're claiming.

Step 4: Calculate the Refund Amount

To calculate the refund amount, you'll need to determine the amount of overpayment and the applicable interest rate. You can use the IRS's refund calculator to determine the refund amount.

Step 5: Attach Supporting Documents

You'll need to attach supporting documents to Form 1045, including:

- Proof of overpayment

- Proof of identity

- Proof of address

Step 6: Submit Form 1045

Once you've completed Form 1045 and attached the required supporting documents, you can submit the form to the IRS. You can submit the form electronically or by mail.

Step 7: Follow Up

After submitting Form 1045, it's essential to follow up with the IRS to ensure that your refund is processed correctly. You can check the status of your refund on the IRS's website or by contacting the IRS directly.

Additional Tips

- Make sure to complete Form 1045 accurately and thoroughly to avoid delays or rejection.

- Keep a copy of Form 1045 and supporting documents for your records.

- If you're unsure about any aspect of the process, consider consulting a tax professional.

By following these 7 steps, you can complete Form 1045 successfully and claim a refund or apply for a quick refund of overpaid taxes.

Call to Action

We hope this article has been helpful in guiding you through the process of completing Form 1045. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.

FAQ Section

What is Form 1045 used for?

+Form 1045 is used to claim a refund for overpaid taxes or to apply for a quick refund of overpaid taxes.

What are the requirements for claiming a refund or applying for a quick refund?

+To be eligible, you must have overpaid your taxes, and the overpayment must be due to one of the following reasons: overpayment of estimated taxes, overpayment of withholding taxes, overpayment of employment taxes, or overpayment of estate and trust taxes.

How long does it take to process Form 1045?

+The processing time for Form 1045 varies depending on the complexity of the case and the workload of the IRS. However, most refunds are processed within 6-8 weeks.