As a resident of Georgia, it's essential to understand the intricacies of the state's tax system. One crucial form that plays a significant role in this process is the GA Form 500ES. This article will delve into the world of estimated tax payments, shedding light on the GA Form 500ES and its significance in the Peach State's tax landscape.

In Georgia, individuals and businesses are required to make estimated tax payments throughout the year if they expect to owe more than $1,000 in taxes. The GA Form 500ES is a critical component of this process, serving as the primary document for reporting and paying estimated taxes. Whether you're a seasoned tax pro or a newcomer to the world of Georgia taxation, understanding the GA Form 500ES is vital for avoiding penalties and ensuring compliance with state tax regulations.

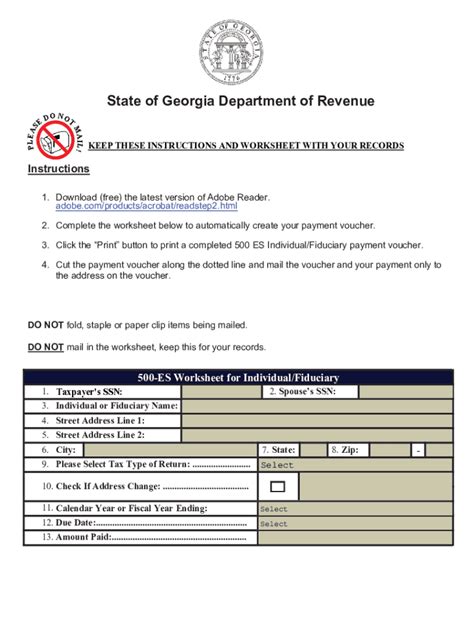

What is the GA Form 500ES?

The GA Form 500ES is a quarterly estimated tax payment voucher used by individuals and businesses to report and pay estimated taxes to the state of Georgia. The form is typically filed on a quarterly basis, with due dates falling on April 15th, June 15th, September 15th, and January 15th of the following year. This form is used to remit estimated tax payments for the current tax year and is a crucial component of the state's tax collection process.

Who Needs to File the GA Form 500ES?

Individuals and businesses that expect to owe more than $1,000 in taxes for the year are required to make estimated tax payments using the GA Form 500ES. This includes:

- Self-employed individuals

- Small business owners

- Corporations

- Partnerships

- S corporations

Failure to file the GA Form 500ES and make timely estimated tax payments can result in penalties and interest on the unpaid amount.

How to Calculate Estimated Tax Payments

Calculating estimated tax payments can be a complex process, but it's essential to get it right to avoid penalties and interest. Here are the steps to follow:

- Determine your tax liability: Estimate your total tax liability for the year, including income tax, self-employment tax, and any other taxes you may owe.

- Calculate your estimated tax payments: Divide your total tax liability by 4 to determine your quarterly estimated tax payment amount.

- Consider any changes in income or tax laws: Adjust your estimated tax payments throughout the year if your income or tax laws change.

It's essential to note that the IRS and the state of Georgia offer safe harbor rules to help taxpayers avoid penalties. If you pay either 90% of your current year's tax liability or 100% of your prior year's tax liability (110% if your adjusted gross income is over $150,000), you can avoid penalties and interest.

Penalties for Underpayment of Estimated Taxes

Failure to make timely estimated tax payments or underpaying estimated taxes can result in penalties and interest on the unpaid amount. The penalty is calculated using the following formula:

- 3.25% of the unpaid amount for each quarter or part of a quarter

Interest is also charged on the unpaid amount, with rates varying depending on the quarter and year.

Electronic Filing Options for the GA Form 500ES

The state of Georgia offers electronic filing options for the GA Form 500ES, making it easier and more convenient to file and pay estimated taxes. You can file and pay online through the Georgia Tax Center or use approved tax software to submit your estimated tax payments.

Benefits of Electronic Filing

Electronic filing offers several benefits, including:

- Convenience: File and pay from the comfort of your own home or office.

- Accuracy: Reduce errors and ensure accuracy with electronic filing.

- Speed: Get confirmation of your filing and payment instantly.

- Security: Protect your sensitive information with secure online filing.

Conclusion

The GA Form 500ES is a critical component of the state's tax collection process, and understanding its intricacies is essential for avoiding penalties and ensuring compliance with Georgia tax regulations. By following the steps outlined in this article, you can ensure accurate and timely estimated tax payments, avoiding penalties and interest on the unpaid amount.

We hope this article has provided you with a comprehensive understanding of the GA Form 500ES and its significance in the Peach State's tax landscape. If you have any further questions or concerns, please don't hesitate to reach out.

FAQ Section:

Who needs to file the GA Form 500ES?

+Individuals and businesses that expect to owe more than $1,000 in taxes for the year are required to file the GA Form 500ES.

How do I calculate estimated tax payments?

+Determine your tax liability, calculate your estimated tax payments by dividing your total tax liability by 4, and consider any changes in income or tax laws.

What are the penalties for underpayment of estimated taxes?

+The penalty is 3.25% of the unpaid amount for each quarter or part of a quarter, plus interest on the unpaid amount.