In the state of Washington, a Durable Power of Attorney (DPOA) is a crucial document that grants someone the authority to manage your financial affairs and make important decisions on your behalf in case you become incapacitated or unable to make decisions for yourself. The DPOA is an essential tool for estate planning, allowing you to designate a trusted individual, known as an attorney-in-fact or agent, to act in your best interests. In this article, we will delve into the specifics of the Washington State Durable Power of Attorney, its importance, and how to obtain a free printable form.

Understanding the Washington State Durable Power of Attorney

A Durable Power of Attorney in Washington State is a type of advance directive that enables you to appoint an agent to manage your financial affairs, such as paying bills, selling property, and handling investments, if you become unable to do so yourself. This document is essential for anyone who wants to ensure that their financial matters are handled according to their wishes, even if they become incapacitated.

Types of Powers of Attorney in Washington State

There are two main types of Powers of Attorney (POAs) in Washington State:

- General Power of Attorney: This type of POA grants the agent broad authority to manage your financial affairs, including real estate, investments, and other assets.

- Limited Power of Attorney: This type of POA grants the agent limited authority to manage specific aspects of your financial affairs, such as selling a particular piece of property or managing a specific investment.

Benefits of a Washington State Durable Power of Attorney

Having a Durable Power of Attorney in place can provide numerous benefits, including:

- Peace of mind: Knowing that someone you trust is authorized to manage your financial affairs if you become incapacitated can give you peace of mind.

- Protection of assets: A DPOA can help protect your assets from mismanagement or exploitation by ensuring that your agent is authorized to act in your best interests.

- Avoidance of guardianship: Without a DPOA, a court may appoint a guardian to manage your financial affairs if you become incapacitated. This can be a costly and time-consuming process.

How to Create a Washington State Durable Power of Attorney

To create a valid DPOA in Washington State, you must:

- Choose an agent: Select a trusted individual to serve as your agent.

- Determine the scope of authority: Decide what powers you want to grant your agent, such as managing real estate, investments, or other assets.

- Execute the document: Sign the DPOA document in the presence of a notary public.

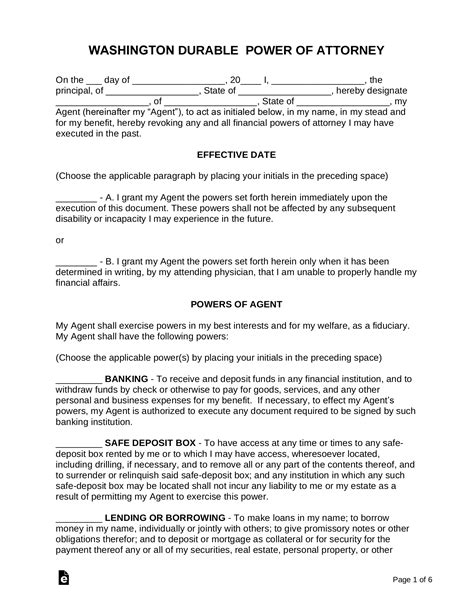

Free Printable Form

You can obtain a free printable Washington State Durable Power of Attorney form from various online sources, such as:

- The Washington State Bar Association website

- The American Bar Association website

- Online forms and templates websites

When using a free printable form, it's essential to ensure that the document meets the requirements of Washington State law and is executed properly.

Washington State Durable Power of Attorney Requirements

To create a valid DPOA in Washington State, the document must:

- Be in writing: The DPOA must be a written document.

- Be signed by the principal: You must sign the DPOA document.

- Be notarized: The DPOA must be notarized by a notary public.

- Contain the required language: The DPOA must contain specific language, including the agent's authority and the principal's intentions.

Conclusion

A Washington State Durable Power of Attorney is a crucial document that grants someone the authority to manage your financial affairs and make important decisions on your behalf if you become incapacitated. By understanding the benefits and requirements of a DPOA, you can ensure that your financial matters are handled according to your wishes. Remember to use a free printable form that meets the requirements of Washington State law and is executed properly.

We encourage you to share your thoughts and experiences with creating a Durable Power of Attorney in Washington State. Have you ever used a free printable form? What benefits or challenges have you encountered? Share your comments below!

What is the difference between a General Power of Attorney and a Limited Power of Attorney?

+A General Power of Attorney grants the agent broad authority to manage your financial affairs, while a Limited Power of Attorney grants the agent limited authority to manage specific aspects of your financial affairs.

Can I revoke a Durable Power of Attorney?

+Yes, you can revoke a Durable Power of Attorney by signing a revocation document and notifying your agent and any relevant parties.

Do I need to use a lawyer to create a Durable Power of Attorney?

+No, you do not need to use a lawyer to create a Durable Power of Attorney. However, it's recommended that you consult with a lawyer to ensure that your document meets the requirements of Washington State law.