As an employee, understanding your tax forms is crucial for ensuring you're meeting your tax obligations and taking advantage of the benefits available to you. One of the most important tax forms you'll encounter is the W-2 form, which is used to report your income and taxes withheld from your employer. In this article, we'll take a closer look at the UIUC W2 form, what it is, and how to navigate it.

As an employee of the University of Illinois at Urbana-Champaign (UIUC), you'll receive a W-2 form each year, typically by January 31st. This form will show your income and taxes withheld for the previous tax year. Understanding the information on your W-2 form is essential for filing your tax return accurately and avoiding any potential errors or penalties.

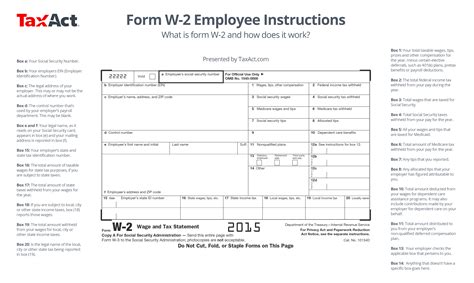

What is a W-2 Form?

A W-2 form, also known as the Wage and Tax Statement, is a tax document that employers are required to provide to their employees each year. The form shows the employee's income and taxes withheld for the previous tax year. The W-2 form is used to report the following information:

- Employee's name, address, and Social Security number

- Employer's name, address, and Employer Identification Number (EIN)

- Employee's wages, tips, and other compensation

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

- State and local taxes withheld (if applicable)

How to Read a W-2 Form

Understanding how to read a W-2 form is essential for ensuring you're taking advantage of the benefits available to you. Here's a breakdown of the different sections of the W-2 form:

- Employee's Information: This section shows your name, address, and Social Security number.

- Employer's Information: This section shows your employer's name, address, and EIN.

- Wages, Tips, and Other Compensation: This section shows your total wages, tips, and other compensation for the year.

- Federal Income Tax Withheld: This section shows the total amount of federal income tax withheld from your wages.

- Social Security Tax Withheld: This section shows the total amount of Social Security tax withheld from your wages.

- Medicare Tax Withheld: This section shows the total amount of Medicare tax withheld from your wages.

- State and Local Taxes Withheld: This section shows the total amount of state and local taxes withheld from your wages (if applicable).

UIUC W2 Form: What's Different?

The UIUC W2 form is similar to other W-2 forms, but there are a few differences. Here are some key differences to note:

- University of Illinois at Urbana-Champaign: The UIUC W2 form will show the University of Illinois at Urbana-Champaign as your employer.

- Employer Identification Number (EIN): The UIUC W2 form will show the University's EIN, which is 37-0685874.

- State and Local Taxes: The UIUC W2 form will show state and local taxes withheld, as the University is required to withhold these taxes for employees who work in Illinois.

How to Get a Copy of Your UIUC W2 Form

If you're an employee of the University of Illinois at Urbana-Champaign, you can get a copy of your W-2 form in several ways:

- Online: You can access your W-2 form online through the University's self-service portal, NESSIE.

- Mail: The University will mail a copy of your W-2 form to you by January 31st each year.

- HR Office: You can contact the University's HR office to request a copy of your W-2 form.

Frequently Asked Questions

Here are some frequently asked questions about the UIUC W2 form:

- Q: What is the deadline for receiving my W-2 form? A: The deadline for receiving your W-2 form is January 31st each year.

- Q: How do I access my W-2 form online? A: You can access your W-2 form online through the University's self-service portal, NESSIE.

- Q: What if I don't receive my W-2 form? A: If you don't receive your W-2 form, you can contact the University's HR office to request a copy.

What is the purpose of a W-2 form?

+The purpose of a W-2 form is to report an employee's income and taxes withheld from their employer.

How do I correct errors on my W-2 form?

+If you find errors on your W-2 form, you should contact your employer's HR office to request a corrected form.

Can I get a copy of my W-2 form from a previous year?

+Yes, you can contact the University's HR office to request a copy of your W-2 form from a previous year.

We hope this article has provided you with a comprehensive guide to understanding your UIUC W2 form. Remember to review your form carefully and contact the University's HR office if you have any questions or concerns.