As a business owner in Texas, navigating the complexities of sales tax can be a daunting task. One crucial document that plays a significant role in this process is the Form TR-205, also known as the Texas Comptroller's Resale Certificate. In this article, we will delve into the details of Form TR-205, its purpose, and its significance in the sales tax ecosystem.

What is Form TR-205?

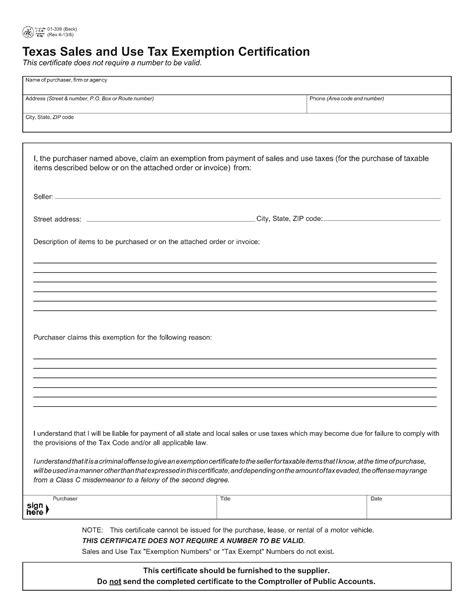

Form TR-205, also known as the Texas Resale Certificate, is a document that allows businesses to purchase goods or services from a seller without paying sales tax. The certificate serves as proof that the buyer intends to resell the items, thereby exempting the transaction from sales tax. This form is issued by the Texas Comptroller's office and is a critical component of the sales tax process in the state.

Purpose of Form TR-205

The primary purpose of Form TR-205 is to facilitate the resale of goods and services without imposing sales tax on the transaction. When a business purchases items for resale, it is not considered a final sale, and therefore, sales tax is not applicable. The resale certificate allows the seller to verify the buyer's intent to resell the items, ensuring that the transaction is exempt from sales tax.

Who Needs Form TR-205?

Any business that purchases goods or services for resale in Texas needs to obtain a Form TR-205. This includes:

- Retailers who purchase inventory for resale

- Wholesalers who purchase goods for resale to retailers

- Manufacturers who purchase raw materials for production

- Contractors who purchase materials for construction projects

How to Obtain Form TR-205

To obtain a Form TR-205, businesses can follow these steps:

- Register for a sales tax permit with the Texas Comptroller's office

- Complete the Form TR-205 application, providing required information, such as business name, address, and tax ID number

- Submit the application to the Texas Comptroller's office for approval

Benefits of Using Form TR-205

Using a Form TR-205 provides several benefits to businesses, including:

- Exemption from sales tax on resale transactions

- Reduced administrative burden, as the certificate eliminates the need for individual sales tax exemptions

- Improved cash flow, as businesses can avoid paying sales tax on resale transactions

Common Mistakes to Avoid

When using a Form TR-205, businesses should avoid the following common mistakes:

- Failing to register for a sales tax permit before obtaining a resale certificate

- Not providing accurate information on the application

- Not renewing the certificate as required

- Using an expired or invalid certificate

Penalties for Non-Compliance

Failure to comply with the requirements for Form TR-205 can result in penalties, including:

- Sales tax liability on resale transactions

- Interest and penalties on unpaid sales tax

- Revocation of the sales tax permit

Best Practices for Using Form TR-205

To ensure compliance with the requirements for Form TR-205, businesses should follow these best practices:

- Register for a sales tax permit before obtaining a resale certificate

- Keep accurate records of resale transactions and certificates

- Renew the certificate as required

- Verify the validity of the certificate before accepting it from a buyer

Conclusion: A Smooth Sales Tax Process with Form TR-205

In conclusion, Form TR-205 is a critical component of the sales tax process in Texas, allowing businesses to purchase goods and services for resale without paying sales tax. By understanding the purpose, requirements, and benefits of Form TR-205, businesses can ensure compliance and avoid penalties. Remember to follow best practices and avoid common mistakes to ensure a smooth sales tax process.

We encourage you to share your thoughts and experiences with Form TR-205 in the comments section below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the purpose of Form TR-205?

+The purpose of Form TR-205 is to facilitate the resale of goods and services without imposing sales tax on the transaction.

Who needs Form TR-205?

+Any business that purchases goods or services for resale in Texas needs to obtain a Form TR-205.

How do I obtain Form TR-205?

+To obtain a Form TR-205, businesses can register for a sales tax permit with the Texas Comptroller's office and complete the Form TR-205 application.