As the tax season approaches, business owners and accountants are busy gathering financial data and filling out various tax forms. One of the crucial forms for corporations is Form 1125-E, also known as the Compensation of Officers. In this article, we will delve into the essential facts about Form 1125-E, its purpose, requirements, and benefits.

What is Form 1125-E?

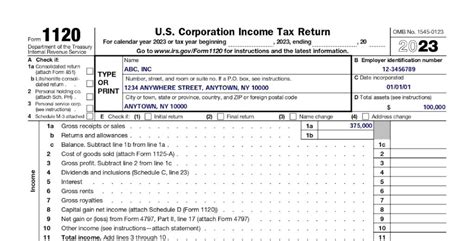

Form 1125-E is a supplemental form to the corporate income tax return (Form 1120) that requires corporations to report the compensation of certain officers. The form is used to disclose the compensation paid to officers, including salaries, bonuses, and other forms of compensation. This information is used by the Internal Revenue Service (IRS) to ensure that corporations are complying with tax laws and regulations.

Why is Form 1125-E Important?

Form 1125-E is crucial for several reasons:

- It helps the IRS to identify and prevent excessive compensation paid to officers, which can be considered taxable income to the corporation.

- It ensures that corporations are complying with the reasonable compensation rules, which require that compensation paid to officers be reasonable and not excessive.

- It provides transparency and accountability, allowing the IRS to monitor and track the compensation paid to officers.

Who Must File Form 1125-E?

Corporations that must file Form 1125-E include:

- Corporations that have total receipts of $5 million or more for the tax year.

- Corporations that have total assets of $10 million or more at the end of the tax year.

- Corporations that are required to file Form 1120, regardless of the amount of receipts or assets.

What Information is Required on Form 1125-E?

Form 1125-E requires corporations to provide the following information:

- The name and title of each officer

- The amount of compensation paid to each officer

- A description of the type of compensation paid (e.g., salary, bonus, stock options)

- The date of payment for each type of compensation

How to Complete Form 1125-E

To complete Form 1125-E, corporations should follow these steps:

- Gather all necessary information, including the names and titles of officers, compensation paid, and dates of payment.

- Complete Part I of the form, which requires the identification of the corporation and the tax year.

- Complete Part II of the form, which requires the disclosure of compensation paid to officers.

- Attach a schedule or statement that provides additional information about the compensation paid to officers.

- File the form with the IRS by the due date of the corporate income tax return.

Penalties for Failure to File Form 1125-E

Failure to file Form 1125-E can result in penalties, including:

- A penalty of $100 for each day the form is late, up to a maximum of $10,000.

- Interest on the penalty amount.

- Potential audit and examination by the IRS.

Benefits of Filing Form 1125-E

Filing Form 1125-E can provide several benefits, including:

- Compliance with tax laws and regulations.

- Avoidance of penalties and interest.

- Transparency and accountability in corporate governance.

- Potential reduction in tax liability.

Conclusion and Next Steps

In conclusion, Form 1125-E is an essential form for corporations that require transparency and accountability in corporate governance. By understanding the purpose, requirements, and benefits of filing Form 1125-E, corporations can ensure compliance with tax laws and regulations. We encourage readers to share their experiences and questions about Form 1125-E in the comments section below.

What is the due date for filing Form 1125-E?

+The due date for filing Form 1125-E is the same as the due date for the corporate income tax return (Form 1120).

Who is considered an officer for purposes of Form 1125-E?

+An officer is any individual who has the authority to make decisions on behalf of the corporation, including the CEO, CFO, and other high-ranking executives.

What is the penalty for failure to file Form 1125-E?

+The penalty for failure to file Form 1125-E is $100 for each day the form is late, up to a maximum of $10,000.