Filing taxes can be a daunting task, especially for business owners and individuals who are not familiar with the process. In the state of Georgia, the Form 600 is a crucial document that must be filed annually by corporations, partnerships, and other business entities. The Georgia Form 600 is a complex document that requires careful preparation and attention to detail to ensure accuracy and compliance with state tax laws. In this article, we will provide five tips for filing Georgia Form 600s successfully.

Understanding the Basics of Georgia Form 600

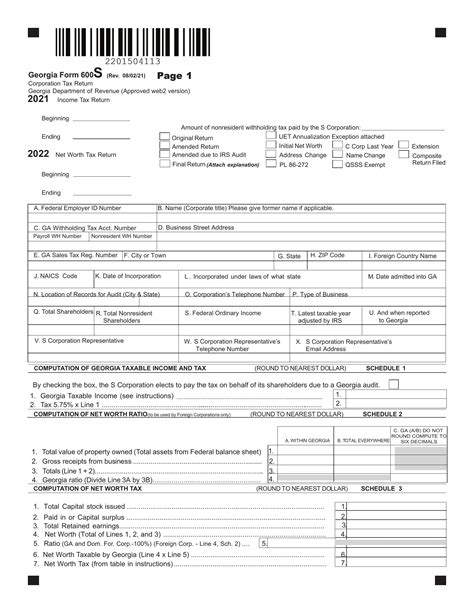

Before we dive into the tips, it's essential to understand the basics of the Georgia Form 600. The Form 600 is an annual tax return that must be filed by corporations, partnerships, and other business entities that conduct business in the state of Georgia. The form is used to report the business's income, deductions, and credits, and to calculate the amount of state income tax owed.

Tip 1: Choose the Correct Filing Status

The first tip for filing Georgia Form 600s successfully is to choose the correct filing status. The filing status will determine which sections of the form must be completed and which tax rates apply. In Georgia, businesses can file as a C-corporation, S-corporation, partnership, or limited liability company (LLC). It's essential to choose the correct filing status to avoid errors and penalties.

Choosing the Correct Filing Status:

- C-corporation: File Form 600 if the business is a C-corporation and has Georgia taxable income.

- S-corporation: File Form 600S if the business is an S-corporation and has Georgia taxable income.

- Partnership: File Form 600P if the business is a partnership and has Georgia taxable income.

- LLC: File Form 600 if the business is an LLC and has Georgia taxable income.

Tip 2: Gather All Necessary Documents

The second tip for filing Georgia Form 600s successfully is to gather all necessary documents. The Form 600 requires businesses to report their income, deductions, and credits, which can be complex and time-consuming. To ensure accuracy and compliance, it's essential to gather all necessary documents, including:

- Financial statements, such as balance sheets and income statements

- Tax returns from previous years

- Depreciation schedules

- Records of income and deductions

Common Documents Needed for Georgia Form 600:

- W-2 forms for employees

- 1099 forms for independent contractors

- K-1 forms for partnerships and S-corporations

- Records of business expenses, such as receipts and invoices

Tip 3: Calculate Income and Deductions Correctly

The third tip for filing Georgia Form 600s successfully is to calculate income and deductions correctly. The Form 600 requires businesses to report their income and deductions, which can be complex and nuanced. To ensure accuracy and compliance, it's essential to calculate income and deductions correctly, using the correct tax rates and deductions.

Common Income and Deductions for Georgia Form 600:

- Business income, such as sales and revenue

- Cost of goods sold

- Depreciation and amortization

- Business expenses, such as rent and utilities

Tip 4: Take Advantage of Tax Credits

The fourth tip for filing Georgia Form 600s successfully is to take advantage of tax credits. Georgia offers a range of tax credits that businesses can claim to reduce their tax liability. To ensure accuracy and compliance, it's essential to take advantage of tax credits, such as:

- Research and development tax credit

- Jobs tax credit

- Investment tax credit

Common Tax Credits for Georgia Form 600:

- Retraining tax credit

- Port tax credit

- Tourism development tax credit

Tip 5: File Electronically and On Time

The fifth tip for filing Georgia Form 600s successfully is to file electronically and on time. The Georgia Department of Revenue offers electronic filing options for businesses, which can simplify the filing process and reduce errors. To ensure accuracy and compliance, it's essential to file electronically and on time, using the correct filing status and tax rates.

Benefits of Electronic Filing:

- Faster processing times

- Reduced errors

- Improved accuracy

- Increased security

Wrapping Up

Filing Georgia Form 600s can be a complex and time-consuming process, but with the right tips and strategies, businesses can ensure accuracy and compliance. By choosing the correct filing status, gathering all necessary documents, calculating income and deductions correctly, taking advantage of tax credits, and filing electronically and on time, businesses can simplify the filing process and reduce errors.

We Want to Hear from You!

Have you filed Georgia Form 600s in the past? What tips and strategies do you use to ensure accuracy and compliance? Share your experiences and insights in the comments below!

What is the deadline for filing Georgia Form 600?

+The deadline for filing Georgia Form 600 is March 15th for corporations and April 15th for partnerships and S-corporations.

Can I file Georgia Form 600 electronically?

+Yes, the Georgia Department of Revenue offers electronic filing options for businesses.

What is the penalty for late filing of Georgia Form 600?

+The penalty for late filing of Georgia Form 600 is 5% of the unpaid tax per month, up to a maximum of 25%.