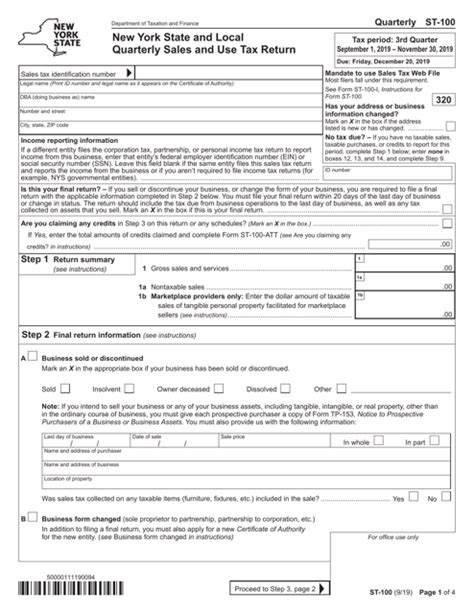

Filling out tax forms can be a daunting task, especially for those who are new to the process. The New York State Department of Taxation and Finance requires certain businesses to file Form ST-100, also known as the New York State and Local Quarterly Sales and Use Tax Return. This form is used to report and remit sales and use taxes collected by businesses in the state of New York.

If you're having trouble filling out Form ST-100, don't worry! We're here to help. Here are five ways to ensure you fill out the form correctly.

Understand the Purpose of Form ST-100

Before you start filling out the form, it's essential to understand its purpose. Form ST-100 is used to report and remit sales and use taxes collected by businesses in the state of New York. The form requires businesses to report their total sales, taxable sales, and taxes collected, as well as any additional taxes owed or overpayments made.

Gather Required Documents and Information

To fill out Form ST-100 correctly, you'll need to gather certain documents and information. This includes:

- Your business's federal tax ID number

- Your New York State tax ID number

- Your business's name and address

- Your business's sales tax certificate of authority number

- Records of all sales made during the reporting period, including taxable and non-taxable sales

- Records of all taxes collected during the reporting period

- Records of any additional taxes owed or overpayments made

Calculating Taxable Sales

To calculate your taxable sales, you'll need to determine which sales are subject to sales tax in New York State. This includes most tangible personal property, such as goods and merchandise, as well as certain services, such as hotel and motel occupancy.You'll also need to calculate any exemptions or deductions you're eligible for. For example, if you're a registered vendor and have a valid resale certificate, you may be exempt from paying sales tax on certain purchases.

Complete the Form Correctly

Once you've gathered all the required documents and information, it's time to fill out the form. Here are some tips to ensure you complete the form correctly:

- Read the instructions carefully and make sure you understand what's being asked

- Use black ink and write clearly and legibly

- Make sure to sign and date the form

- Use the correct reporting period dates

- Calculate your taxable sales and taxes collected correctly

- Report any additional taxes owed or overpayments made

Common Errors to Avoid

When filling out Form ST-100, there are several common errors to avoid. These include:- Failing to sign and date the form

- Using the wrong reporting period dates

- Failing to report all taxable sales and taxes collected

- Calculating taxable sales and taxes collected incorrectly

- Failing to report additional taxes owed or overpayments made

E-File or Mail the Form

Once you've completed the form, you can either e-file it or mail it to the New York State Department of Taxation and Finance. If you choose to e-file, you can do so through the department's website. If you choose to mail the form, make sure to use the correct address and postage.

Benefits of E-Filing

E-filing Form ST-100 has several benefits, including:- Faster processing time

- Reduced errors

- Increased security

- Ability to track the status of your return

- Ability to receive refunds faster

Seek Professional Help if Needed

If you're having trouble filling out Form ST-100 or need help with any part of the process, don't hesitate to seek professional help. You can hire a tax professional or accountant to assist you with the form and ensure it's completed correctly.

Benefits of Seeking Professional Help

Seeking professional help with Form ST-100 has several benefits, including:- Ensuring the form is completed correctly

- Reducing errors and penalties

- Increasing the chances of receiving a refund

- Providing peace of mind and reducing stress

- Allowing you to focus on running your business

We hope these five ways to fill out Form ST-100 correctly have been helpful. Remember to take your time, read the instructions carefully, and seek professional help if needed. By following these tips, you can ensure your form is completed correctly and avoid any errors or penalties.

Now it's your turn! If you have any questions or need help with Form ST-100, leave a comment below. Don't forget to share this article with your friends and colleagues who may need help with the form.

What is Form ST-100?

+Form ST-100 is the New York State and Local Quarterly Sales and Use Tax Return. It's used to report and remit sales and use taxes collected by businesses in the state of New York.

Who needs to file Form ST-100?

+Businesses that are registered for sales tax in New York State need to file Form ST-100. This includes businesses that sell tangible personal property, such as goods and merchandise, as well as certain services, such as hotel and motel occupancy.

What is the due date for Form ST-100?

+The due date for Form ST-100 is the 20th day of the month following the end of the reporting period. For example, if the reporting period is January 1 - March 31, the due date would be April 20.