Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. In Oklahoma, residents are required to file their state income taxes using Form 511, also known as the Oklahoma Resident Income Tax Return. In this article, we will delve into the essential filing requirements for Oklahoma Form 511, ensuring that you are well-prepared to submit your taxes accurately and efficiently.

Understanding the Purpose of Oklahoma Form 511

Before diving into the filing requirements, it's essential to understand the purpose of Oklahoma Form 511. This form is used to report an individual's Oklahoma taxable income, calculate their tax liability, and claim any applicable credits or deductions. The form is also used to report any income earned from Oklahoma sources, such as employment, self-employment, or investments.

Who Needs to File Oklahoma Form 511?

Not everyone is required to file Oklahoma Form 511. Generally, individuals who meet the following criteria are required to file:

- Residents of Oklahoma with a federal gross income exceeding $12,950 (single) or $25,900 (joint)

- Residents with Oklahoma-source income exceeding $1,000

- Individuals who claim Oklahoma credits or deductions

- Those who have made estimated tax payments or have had taxes withheld from their income

Filing Requirements for Oklahoma Form 511

Now that we've covered the basics, let's dive into the essential filing requirements for Oklahoma Form 511.

1. Gathering Required Documents

Before starting the filing process, it's crucial to gather all necessary documents, including:

- Federal income tax return (Form 1040)

- W-2 forms from all employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

2. Determining Your Filing Status

Your filing status plays a significant role in determining your tax liability. Oklahoma recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that best reflects your situation, and ensure you have the necessary documentation to support your claim.

3. Calculating Your Taxable Income

To calculate your taxable income, you'll need to report all income earned from Oklahoma sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rental income

Subtract any applicable deductions and exemptions to arrive at your taxable income.

4. Claiming Credits and Deductions

Oklahoma offers various credits and deductions to reduce your tax liability. Some of the most common include:

- Standard deduction

- Itemized deductions

- Earned income tax credit

- Child tax credit

- Education credits

Claim any applicable credits and deductions to minimize your tax bill.

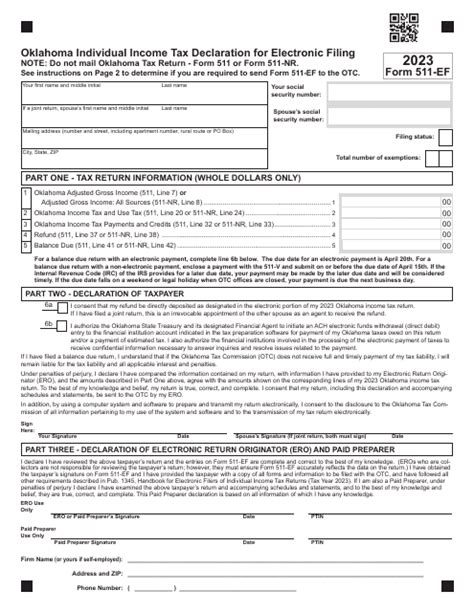

5. Submitting Your Return

Once you've completed your return, you can submit it electronically or by mail. Oklahoma offers an e-file option, which is faster and more secure than traditional mail. If you choose to mail your return, ensure you use the correct address and include all necessary supporting documentation.

Additional Tips and Reminders

To ensure a smooth filing process, keep the following tips and reminders in mind:

- File on time: The Oklahoma tax filing deadline is April 15th for individual returns.

- Use the correct form: Ensure you're using the correct version of Oklahoma Form 511 for the tax year you're filing.

- Double-check your math: Verify your calculations to avoid errors and potential delays.

- Seek professional help: If you're unsure about any aspect of the filing process, consider consulting a tax professional.

Conclusion

Filing Oklahoma Form 511 requires attention to detail and a thorough understanding of the state's tax laws. By following the essential filing requirements outlined in this article, you'll be well on your way to submitting an accurate and complete return. Remember to stay organized, seek professional help when needed, and take advantage of available credits and deductions to minimize your tax liability.

What is the deadline for filing Oklahoma Form 511?

+The Oklahoma tax filing deadline is April 15th for individual returns.

Can I e-file my Oklahoma Form 511?

+Yes, Oklahoma offers an e-file option for Form 511.

What is the standard deduction for Oklahoma Form 511?

+The standard deduction for Oklahoma Form 511 varies based on filing status. Consult the Oklahoma Tax Commission for the most up-to-date information.