If you're a household employer, you're required to pay employment taxes on the wages you pay to your household employees. This is where Form 1040 Schedule H comes in. In this article, we'll break down what Form 1040 Schedule H is, who needs to file it, and how to complete it.

What is Form 1040 Schedule H?

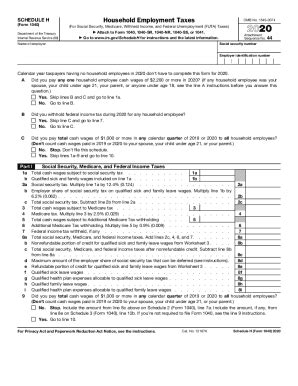

Form 1040 Schedule H is a tax form used to report household employment taxes. It's used to calculate the amount of employment taxes owed on wages paid to household employees, such as nannies, housekeepers, and yard workers. The form is filed annually with the Internal Revenue Service (IRS) and is due by the tax filing deadline, which is typically April 15th.

Who Needs to File Form 1040 Schedule H?

You'll need to file Form 1040 Schedule H if you paid wages to a household employee and the wages were subject to employment taxes. This includes:

- Wages paid to a nanny or babysitter

- Wages paid to a housekeeper or maid

- Wages paid to a yard worker or gardener

- Wages paid to a cook or chef

- Wages paid to a personal caregiver or attendant

What are Household Employment Taxes?

Household employment taxes are taxes paid on wages earned by household employees. These taxes include:

- Social Security tax: 6.2% of wages paid

- Medicare tax: 1.45% of wages paid

- Federal Unemployment Tax Act (FUTA) tax: 6% of wages paid (if the employee earns more than $1,000 in a calendar quarter)

As a household employer, you're responsible for paying these taxes on behalf of your employees. You'll also need to pay the employer portion of these taxes, which includes:

- Social Security tax: 6.2% of wages paid

- Medicare tax: 1.45% of wages paid

How to Complete Form 1040 Schedule H

To complete Form 1040 Schedule H, you'll need to follow these steps:

- Gather the necessary information:

- Employee's name and Social Security number

- Employee's wages paid

- Date of payment

- Type of employment (e.g. nanny, housekeeper, etc.)

- Calculate the employment taxes:

- Social Security tax: 6.2% of wages paid

- Medicare tax: 1.45% of wages paid

- FUTA tax: 6% of wages paid (if applicable)

- Complete Form 1040 Schedule H:

- Part I: Report the employee's wages and employment taxes

- Part II: Calculate the employer portion of employment taxes

- Part III: Calculate the total employment taxes owed

- File Form 1040 Schedule H with the IRS:

- Attach the completed form to your Form 1040

- File by the tax filing deadline (typically April 15th)

Example of Form 1040 Schedule H

Let's say you paid your nanny $10,000 in wages for the year. You'll need to calculate the employment taxes owed on those wages.

- Social Security tax: 6.2% of $10,000 = $620

- Medicare tax: 1.45% of $10,000 = $145

- FUTA tax: 6% of $10,000 = $600 (if applicable)

You'll also need to pay the employer portion of these taxes, which includes:

- Social Security tax: 6.2% of $10,000 = $620

- Medicare tax: 1.45% of $10,000 = $145

You'll report these taxes on Form 1040 Schedule H and attach it to your Form 1040.

Tips for Filing Form 1040 Schedule H

- Keep accurate records of employee wages and employment taxes

- Use a payroll service or accountant to help with tax calculations

- File Form 1040 Schedule H on time to avoid penalties

- Consider using tax software to help with tax preparation

By following these tips and understanding the requirements for Form 1040 Schedule H, you can ensure you're in compliance with employment tax laws and avoid any potential penalties.

Don't forget to share your thoughts and experiences with filing Form 1040 Schedule H in the comments below!

Who is considered a household employee?

+A household employee is anyone who works in your home and is paid wages, including nannies, housekeepers, yard workers, and personal caregivers.

What is the deadline for filing Form 1040 Schedule H?

+The deadline for filing Form 1040 Schedule H is the tax filing deadline, which is typically April 15th.

Can I file Form 1040 Schedule H electronically?

+Yes, you can file Form 1040 Schedule H electronically using tax software or by hiring a tax professional.