Investors often come across various forms and filings when researching publicly traded companies. One such form is the SC 13G, which can be a valuable tool for investors to gain insights into a company's ownership structure and potential future developments. But what exactly is a Form SC 13G, and is it good or bad for investors?

What is a Form SC 13G?

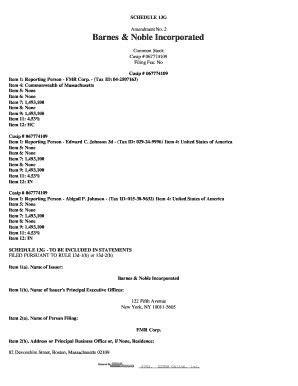

A Form SC 13G is a filing with the Securities and Exchange Commission (SEC) that discloses the ownership of a publicly traded company by a passive investor. Passive investors are those who hold 5% or more of a company's outstanding shares but do not have the intention of influencing the company's management or control. This filing is required by the SEC to ensure transparency and provide investors with information about the company's ownership structure.

Who Files a Form SC 13G?

Form SC 13G filings are typically made by institutional investors, such as:

- Pension funds

- Mutual funds

- Insurance companies

- Endowments

- Hedge funds

These investors are required to file a Form SC 13G within 10 days of acquiring or disposing of 5% or more of a company's outstanding shares.

What Information is Disclosed in a Form SC 13G?

A Form SC 13G filing discloses the following information:

- The identity of the passive investor

- The number of shares owned by the investor

- The percentage of outstanding shares owned by the investor

- The date of acquisition or disposition of the shares

- The reason for the filing (e.g., acquisition or disposition of shares)

Why is a Form SC 13G Important for Investors?

A Form SC 13G can provide valuable insights for investors in several ways:

- Ownership structure: The filing discloses the ownership structure of the company, which can help investors understand the level of institutional ownership and potential future developments.

- Institutional investor sentiment: The filing can indicate the level of interest in the company among institutional investors, which can be a positive or negative indicator of the company's prospects.

- Potential future developments: The filing can provide insight into potential future developments, such as mergers and acquisitions, that may be influenced by the passive investor.

Is a Form SC 13G Good or Bad for Investors?

A Form SC 13G is neither inherently good nor bad for investors. The filing is simply a disclosure of the ownership structure of the company, which can be used as one of many tools to inform investment decisions.

However, the filing can be seen as positive if it indicates:

- Increased institutional ownership: This can be a positive indicator of the company's prospects and potential future developments.

- Stable ownership structure: A stable ownership structure can provide reassurance to investors that the company is not subject to significant changes in ownership.

On the other hand, the filing can be seen as negative if it indicates:

- Decreased institutional ownership: This can be a negative indicator of the company's prospects and potential future developments.

- Unstable ownership structure: An unstable ownership structure can create uncertainty and potential volatility in the company's stock price.

How to Use a Form SC 13G in Investment Decisions

When using a Form SC 13G in investment decisions, consider the following:

- Use it as one of many tools: The filing should be used in conjunction with other research and analysis to inform investment decisions.

- Monitor changes in ownership: Monitor changes in ownership structure and adjust investment decisions accordingly.

- Consider the context: Consider the context of the filing, including the company's industry, financial performance, and overall market conditions.

By understanding the purpose and content of a Form SC 13G, investors can use this filing as a valuable tool to inform investment decisions and gain insights into a company's ownership structure and potential future developments.

We'd love to hear from you! Share your thoughts on the importance of Form SC 13G filings in the comments below.

What is a Form SC 13G?

+A Form SC 13G is a filing with the Securities and Exchange Commission (SEC) that discloses the ownership of a publicly traded company by a passive investor.

Who files a Form SC 13G?

+Institutional investors, such as pension funds, mutual funds, insurance companies, endowments, and hedge funds, file a Form SC 13G.

What information is disclosed in a Form SC 13G?

+A Form SC 13G discloses the identity of the passive investor, the number of shares owned, the percentage of outstanding shares owned, the date of acquisition or disposition of the shares, and the reason for the filing.