Railroad retirement benefits are a crucial aspect of a railroad worker's compensation package. The Railroad Retirement Board (RRB) administers these benefits, which are similar to Social Security benefits. However, railroad retirement benefits have some unique features, particularly when it comes to tax reporting. In this article, we will delve into the world of Form RRB 1099, exploring its significance, how to read it, and the tax implications of railroad retirement benefits.

What is Form RRB 1099?

Form RRB 1099, also known as the Statement of Railroad Retirement Benefits, is a tax document issued by the RRB to recipients of railroad retirement benefits. This form reports the total amount of benefits paid to the recipient in a calendar year, as well as the amount of taxes withheld. The RRB sends Form RRB 1099 to beneficiaries by January 31st of each year, reflecting the benefits paid in the previous year.

How to Read Form RRB 1099

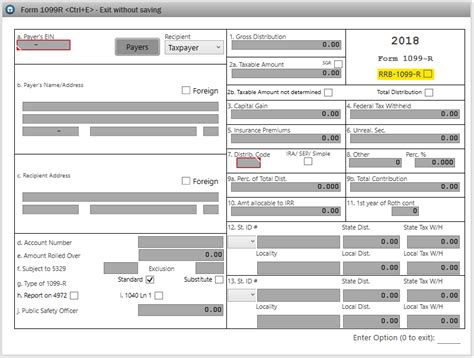

Form RRB 1099 is divided into several sections, each providing specific information about the benefits paid. Here's a breakdown of the key sections:

- Beneficiary's Name and Address: This section displays the name and address of the benefit recipient.

- Benefit Year: This section indicates the calendar year for which the benefits are being reported.

- Gross Benefits Paid: This section shows the total amount of benefits paid to the recipient in the benefit year.

- Tax Withheld: This section reports the amount of federal income tax withheld from the benefits.

- Total Benefits Paid: This section displays the total amount of benefits paid, including any tax withheld.

Tax Implications of Railroad Retirement Benefits

Railroad retirement benefits are subject to federal income tax, but the tax treatment varies depending on the recipient's income level and filing status. Here are some key tax implications to consider:

- Taxation of Benefits: Up to 85% of railroad retirement benefits may be subject to federal income tax, depending on the recipient's income level.

- Tax Withholding: The RRB withholds federal income tax from benefits paid, but recipients can elect to have additional taxes withheld or make estimated tax payments.

- Reporting Benefits on Tax Returns: Recipients must report their railroad retirement benefits on their tax returns, using Form 1040 or Form 1040A.

Taxation of Railroad Retirement Benefits for Married Couples

Married couples receiving railroad retirement benefits may be subject to different tax rules. Here are some key considerations:

- Joint Returns: Married couples filing joint returns may be subject to a higher tax rate on their benefits, depending on their combined income.

- Separate Returns: Married couples filing separate returns may be subject to a different tax rate on their benefits, depending on their individual income.

Common Questions and Concerns

Recipients of railroad retirement benefits often have questions and concerns about their benefits and tax implications. Here are some common questions and answers:

- Q: How do I report my railroad retirement benefits on my tax return? A: Recipients should report their benefits on Form 1040 or Form 1040A, using the information provided on Form RRB 1099.

- Q: Can I elect to have additional taxes withheld from my benefits? A: Yes, recipients can elect to have additional taxes withheld from their benefits by completing Form RRB W-4V.

Conclusion

Form RRB 1099 is an essential document for recipients of railroad retirement benefits, providing critical information about their benefits and tax implications. By understanding how to read Form RRB 1099 and the tax implications of their benefits, recipients can ensure accurate tax reporting and minimize potential tax liabilities.

We hope this guide has been informative and helpful in understanding Form RRB 1099 and the tax implications of railroad retirement benefits. If you have any further questions or concerns, please feel free to comment below or share this article with others who may benefit from this information.

What is the deadline for receiving Form RRB 1099?

+The RRB sends Form RRB 1099 to beneficiaries by January 31st of each year, reflecting the benefits paid in the previous year.

How do I report my railroad retirement benefits on my tax return?

+Recipients should report their benefits on Form 1040 or Form 1040A, using the information provided on Form RRB 1099.

Can I elect to have additional taxes withheld from my benefits?

+Yes, recipients can elect to have additional taxes withheld from their benefits by completing Form RRB W-4V.