As a taxpayer in New Jersey, it's essential to understand the importance of making timely and accurate estimated tax payments throughout the year. Failure to do so can result in penalties and interest, which can be a significant financial burden. In this article, we'll delve into the details of the NJ Form 2210, which is used to calculate and report underpayment of estimated tax.

What is NJ Form 2210?

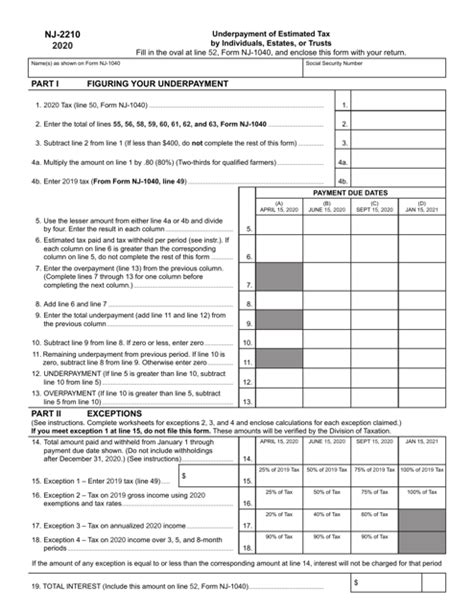

NJ Form 2210 is a tax form used by the New Jersey Division of Taxation to calculate and report underpayment of estimated tax. The form is used to determine the amount of penalty and interest owed by taxpayers who fail to make timely and accurate estimated tax payments. The form takes into account the taxpayer's total tax liability, estimated tax payments made, and any underpayment or overpayment of estimated tax.

Who Needs to File NJ Form 2210?

Taxpayers who are required to make estimated tax payments in New Jersey may need to file NJ Form 2210. This includes:

- Individuals who expect to owe more than $500 in taxes for the year

- Businesses that expect to owe more than $500 in taxes for the year

- Taxpayers who receive income that is not subject to withholding, such as self-employment income, rental income, or investment income

How to Calculate Underpayment of Estimated Tax

To calculate underpayment of estimated tax, taxpayers must first determine their total tax liability for the year. This can be done by completing a tax return, such as the NJ-1040. Next, taxpayers must calculate their estimated tax payments made throughout the year. This includes any quarterly estimated tax payments made using Form NJ-1040-ES.

The underpayment of estimated tax is calculated by subtracting the total estimated tax payments made from the total tax liability. If the result is a positive number, the taxpayer has underpaid their estimated tax and may be subject to penalty and interest.

Penalty and Interest on Underpayment of Estimated Tax

Taxpayers who underpay their estimated tax may be subject to penalty and interest. The penalty is calculated as a percentage of the underpayment, and the interest is calculated as a percentage of the underpayment plus the penalty.

The penalty for underpayment of estimated tax in New Jersey is 5% of the underpayment, plus an additional 0.5% per month or part of a month, up to a maximum of 25%. The interest rate is determined by the New Jersey Division of Taxation and is typically the prime rate plus 3%.

Avoiding Underpayment of Estimated Tax

To avoid underpayment of estimated tax, taxpayers can take several steps:

- Make timely and accurate estimated tax payments throughout the year

- Review and adjust estimated tax payments as needed to ensure accurate payments

- Consider making annualized estimated tax payments to avoid underpayment

- Keep accurate records of estimated tax payments and total tax liability

Annualized Estimated Tax Payments

Taxpayers who receive income that is not subject to withholding, such as self-employment income or investment income, may be eligible to make annualized estimated tax payments. This allows taxpayers to make a single estimated tax payment at the end of the year, rather than making quarterly payments throughout the year.

FAQs

What is the penalty for underpayment of estimated tax in New Jersey?

+The penalty for underpayment of estimated tax in New Jersey is 5% of the underpayment, plus an additional 0.5% per month or part of a month, up to a maximum of 25%.

Who is required to make estimated tax payments in New Jersey?

+Individuals who expect to owe more than $500 in taxes for the year, businesses that expect to owe more than $500 in taxes for the year, and taxpayers who receive income that is not subject to withholding are required to make estimated tax payments in New Jersey.

How can I avoid underpayment of estimated tax?

+To avoid underpayment of estimated tax, make timely and accurate estimated tax payments throughout the year, review and adjust estimated tax payments as needed, consider making annualized estimated tax payments, and keep accurate records of estimated tax payments and total tax liability.

In conclusion, understanding NJ Form 2210 and the importance of making timely and accurate estimated tax payments is crucial for taxpayers in New Jersey. By following the steps outlined in this article, taxpayers can avoid underpayment of estimated tax and minimize penalty and interest. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the New Jersey Division of Taxation.