As we age, our healthcare needs become more complex, and navigating the world of Medicare can be overwhelming. Medicare Supplement Insurance, also known as Medigap, is a type of insurance that helps fill the gaps in original Medicare, covering out-of-pocket costs such as deductibles, copays, and coinsurance. AARP, one of the largest and most trusted organizations for seniors, offers a range of Medicare Supplement Insurance plans to help individuals and families make sense of their healthcare expenses.

Choosing the right Medicare Supplement Insurance plan can be a daunting task, with numerous options available and varying levels of coverage. This guide aims to walk you through the process of applying for AARP Medicare Supplement Insurance plans, highlighting the benefits, costs, and key considerations to keep in mind.

Understanding AARP Medicare Supplement Insurance Plans

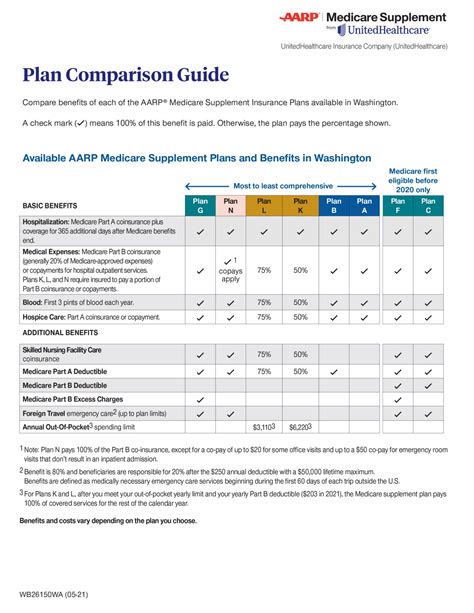

AARP Medicare Supplement Insurance plans are designed to work alongside original Medicare, providing additional coverage for out-of-pocket expenses. These plans are standardized, meaning that each plan type (labeled A-N) offers the same basic benefits, regardless of the insurance company offering it. AARP offers a range of plans, including A, B, C, D, F, G, K, L, M, and N.

Key Benefits of AARP Medicare Supplement Insurance Plans

- Covers out-of-pocket expenses not covered by original Medicare

- Standardized plans, ensuring consistent benefits

- Comprehensive coverage for hospital and medical expenses

- Ability to see any doctor or hospital that accepts Medicare patients

- Optional riders for additional coverage, such as vision and dental

Eligibility and Application Process

To be eligible for AARP Medicare Supplement Insurance plans, you must:

- Be enrolled in Medicare Parts A and B

- Be at least 65 years old (or under 65 with a disability)

- Reside in the United States

The application process typically involves the following steps:

- Determine your eligibility and choose a plan that suits your needs.

- Gather required documents, such as your Medicare card and proof of age.

- Apply online, by phone, or through an AARP representative.

- Review and sign the application, ensuring accuracy and completeness.

- Pay the initial premium payment, if applicable.

Things to Consider Before Applying

- Understand the plan's benefits, costs, and any limitations

- Review the plan's network and provider availability

- Consider additional riders for extra coverage

- Compare rates and benefits with other insurance companies

AARP Medicare Supplement Insurance Plan Costs and Premiums

The costs and premiums of AARP Medicare Supplement Insurance plans vary depending on the plan type, age, location, and other factors. On average, premiums range from $100 to $300 per month.

Factors Affecting Premiums

- Age: Premiums tend to increase with age

- Location: Premiums vary depending on the state and region

- Plan type: Different plans offer varying levels of coverage and premiums

- Tobacco use: Tobacco users may face higher premiums

AARP Medicare Supplement Insurance Plan Reviews and Ratings

AARP Medicare Supplement Insurance plans have received positive reviews and ratings from customers and experts alike.

- AARP Medicare Supplement Insurance plans have a 4.5-star rating on the AARP website

- AM Best rates AARP's financial strength as A- (Excellent)

- The Better Business Bureau accredits AARP with an A+ rating

What Customers Say

- "AARP Medicare Supplement Insurance plans have been a lifesaver for me, covering expenses that I couldn't afford otherwise."

- "I was impressed by the comprehensive coverage and affordable premiums."

- "The application process was straightforward, and the customer service was excellent."

Next Steps and Additional Resources

If you're considering AARP Medicare Supplement Insurance plans, here are some next steps and additional resources to explore:

- Visit the AARP website to compare plans and apply online

- Contact an AARP representative for personalized guidance

- Review the Medicare website for additional information on Medicare Supplement Insurance

- Consult with a licensed insurance agent or broker for expert advice

We hope this guide has provided you with a comprehensive understanding of AARP Medicare Supplement Insurance plans and the application process. Remember to carefully review the plan's benefits, costs, and limitations before making a decision.

What is the difference between Medicare Supplement Insurance and Medicare Advantage?

+Medicare Supplement Insurance plans work alongside original Medicare, covering out-of-pocket expenses, while Medicare Advantage plans replace original Medicare, offering an alternative way to receive Medicare benefits.

Can I switch from one AARP Medicare Supplement Insurance plan to another?

+Yes, you can switch from one AARP Medicare Supplement Insurance plan to another, but you may face underwriting and potential rate increases. It's essential to review the new plan's benefits and costs before making a change.

Do AARP Medicare Supplement Insurance plans cover prescription medications?

+No, AARP Medicare Supplement Insurance plans do not cover prescription medications. You may need to purchase a separate Medicare Part D plan for prescription medication coverage.