Are you a resident of New Jersey who has recently purchased or sold a property? If so, you may have come across the term "Form MVU-26" during the process. As a crucial document in the state's motor vehicle and property tax regulations, it's essential to understand what Form MVU-26 entails and its significance in the property transfer process. In this article, we will delve into the five essential facts about Form MVU-26 that every New Jersey resident should know.

What is Form MVU-26?

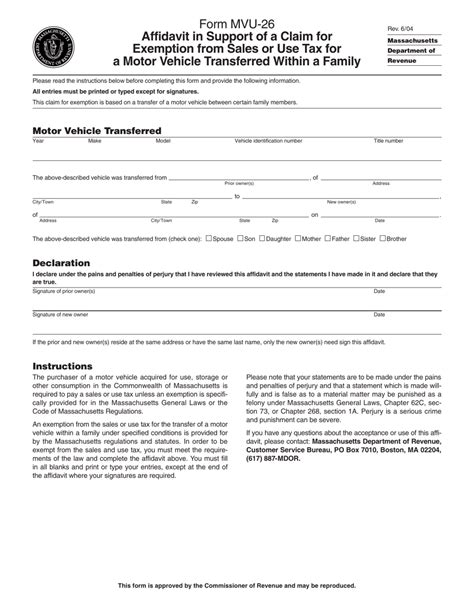

Form MVU-26 is a certification document required by the New Jersey Motor Vehicle Commission (MVC) and the New Jersey Division of Taxation. It is used to verify the details of a motor vehicle's sale or transfer, as well as the payment of sales tax on the vehicle. The form is typically completed by the seller or transferor of the vehicle and is a critical component in the property transfer process.

When is Form MVU-26 Required?

Form MVU-26 is required in various situations, including:

- When a vehicle is sold or transferred to a new owner

- When a vehicle is gifted or donated to another party

- When a vehicle is traded-in or exchanged for another vehicle

- When a vehicle is leased or rented for an extended period

In each of these scenarios, the seller or transferor of the vehicle must complete Form MVU-26 and submit it to the MVC and the Division of Taxation.

Who is Responsible for Completing Form MVU-26?

The seller or transferor of the vehicle is typically responsible for completing Form MVU-26. This individual must provide accurate and detailed information about the vehicle, including its make, model, year, and vehicle identification number (VIN). The seller or transferor must also provide information about the buyer or transferee, including their name, address, and driver's license number.

What Information is Required on Form MVU-26?

Form MVU-26 requires the following information:

- Vehicle details:

- Make

- Model

- Year

- VIN

- Seller or transferor information:

- Name

- Address

- Driver's license number

- Buyer or transferee information:

- Name

- Address

- Driver's license number

- Sales tax information:

- Sales tax rate

- Sales tax amount

- Payment method

What are the Consequences of Not Completing Form MVU-26?

Failure to complete Form MVU-26 can result in significant consequences, including:

- Delayed or rejected vehicle registration

- Fines and penalties for non-compliance

- Interest charges on unpaid sales tax

- Potential audits or investigations by the MVC and the Division of Taxation

It is essential to complete Form MVU-26 accurately and submit it to the relevant authorities to avoid these consequences.

How to Obtain Form MVU-26?

Form MVU-26 can be obtained from the MVC website or by visiting a local MVC agency. It is also available for download from the Division of Taxation website. Alternatively, vehicle dealerships and other authorized entities may provide Form MVU-26 to buyers or transferees as part of the sales or transfer process.

In conclusion, Form MVU-26 is a critical document that plays a significant role in the property transfer process in New Jersey. By understanding the essential facts about Form MVU-26, residents can ensure a smooth and compliant transaction. If you have any further questions or concerns about Form MVU-26, please do not hesitate to comment below or share this article with others who may find it informative.

What is the purpose of Form MVU-26?

+Form MVU-26 is a certification document required by the New Jersey Motor Vehicle Commission (MVC) and the New Jersey Division of Taxation. It is used to verify the details of a motor vehicle's sale or transfer, as well as the payment of sales tax on the vehicle.

Who is responsible for completing Form MVU-26?

+The seller or transferor of the vehicle is typically responsible for completing Form MVU-26.

What are the consequences of not completing Form MVU-26?

+Failure to complete Form MVU-26 can result in significant consequences, including delayed or rejected vehicle registration, fines and penalties for non-compliance, interest charges on unpaid sales tax, and potential audits or investigations by the MVC and the Division of Taxation.