Missouri residents who need to make a payment with their individual income tax return can use the Form MO-1040V, also known as the Missouri Income Tax Payment Voucher. This voucher allows taxpayers to submit their payment along with their tax return, making it easier to manage their tax obligations.

Understanding Form MO-1040V

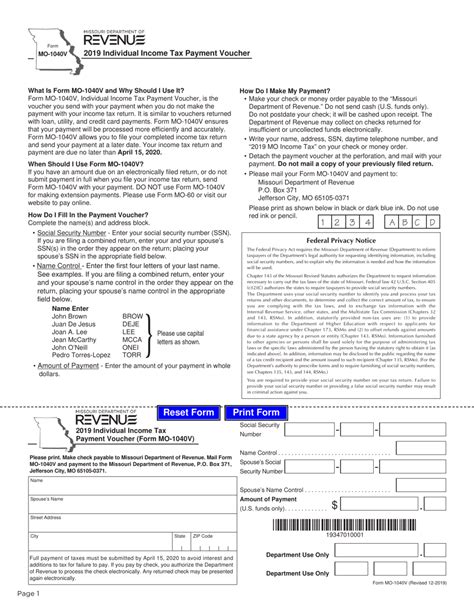

Form MO-1040V is a payment voucher that taxpayers can use to make a payment with their Missouri individual income tax return. The voucher is used to remit payment for the tax due, and it provides the necessary information to ensure that the payment is properly credited to the taxpayer's account.

Why Use Form MO-1040V?

Using Form MO-1040V can help taxpayers avoid errors and ensure that their payment is processed correctly. The voucher provides a clear and concise way to submit payment information, reducing the risk of mistakes or misapplication of payments. Additionally, using the voucher can help taxpayers keep track of their payments and ensure that they are in compliance with Missouri tax laws.

How to Complete Form MO-1040V

To complete Form MO-1040V, taxpayers will need to provide the following information:

- Their name and address

- Their social security number or individual taxpayer identification number (ITIN)

- The tax year for which they are making the payment

- The amount of payment they are submitting

- The type of payment they are making (e.g., annual, estimated, or amended return)

Taxpayers should ensure that they complete the voucher accurately and legibly, as errors or illegible handwriting can cause delays in processing their payment.

Where to File Form MO-1040V

Taxpayers should file Form MO-1040V with their Missouri individual income tax return (Form MO-1040). The voucher should be attached to the front of the return, and the payment should be made payable to the "Missouri Department of Revenue."

Making Payments with Form MO-1040V

Taxpayers can make payments with Form MO-1040V using one of the following methods:

- Check or money order: Make the payment payable to the "Missouri Department of Revenue" and attach it to the voucher.

- Electronic funds transfer: Taxpayers can use the Missouri Department of Revenue's online payment system to make a payment using their bank account or credit card.

- Credit card: Taxpayers can make a payment using their credit card through the Missouri Department of Revenue's online payment system.

Penalties and Interest

Taxpayers who fail to make a payment or make a late payment may be subject to penalties and interest. The Missouri Department of Revenue may impose a penalty of up to 5% of the unpaid tax, plus interest on the unpaid amount.

FAQs

Here are some frequently asked questions about Form MO-1040V:

- Q: What is Form MO-1040V used for? A: Form MO-1040V is used to make a payment with the Missouri individual income tax return.

- Q: Where do I file Form MO-1040V? A: File Form MO-1040V with your Missouri individual income tax return (Form MO-1040).

- Q: Can I make a payment online? A: Yes, you can make a payment using the Missouri Department of Revenue's online payment system.

What is the deadline for making a payment with Form MO-1040V?

+The deadline for making a payment with Form MO-1040V is April 15th of each year, unless you file for an extension.

Can I use Form MO-1040V to make an estimated tax payment?

+No, Form MO-1040V is used to make a payment with the individual income tax return. Estimated tax payments are made using Form MO-1040ES.

What happens if I don't make a payment with Form MO-1040V?

+If you don't make a payment with Form MO-1040V, you may be subject to penalties and interest on the unpaid amount.

We hope this article has provided you with a comprehensive understanding of Form MO-1040V and how to use it to make a payment with your Missouri individual income tax return. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.