As a resident of Michigan, understanding the state's tax laws and forms is crucial to ensure compliance and avoid any potential penalties. One of the key forms for individual income tax in Michigan is the MI-2210. In this article, we will delve into the details of the MI-2210 form, its purpose, and how to complete it accurately.

What is the MI-2210 Form?

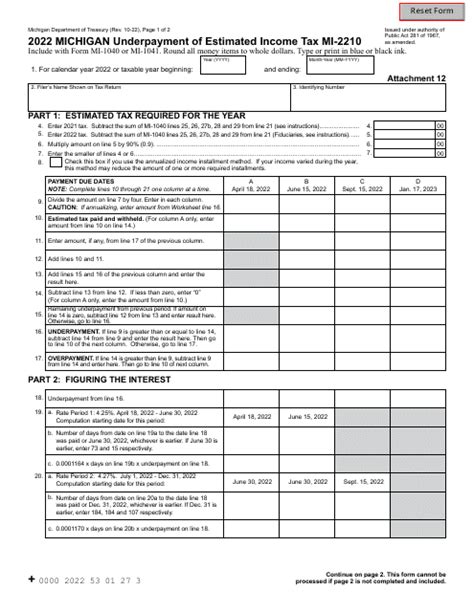

The MI-2210 form is an annual return used by individuals to report their underpayment or overpayment of Michigan income tax. The form is used to calculate the amount of tax due or the amount of refund owed to the taxpayer. It is essential to complete this form accurately to avoid any penalties or interest charges.

Who Needs to File the MI-2210 Form?

The MI-2210 form is required for individuals who meet specific criteria, including:

- Taxpayers who have underpaid their Michigan income tax by $500 or more

- Taxpayers who have overpaid their Michigan income tax by $500 or more

- Taxpayers who have a balance due on their Michigan income tax return

- Taxpayers who have a refund due on their Michigan income tax return

How to Complete the MI-2210 Form

To complete the MI-2210 form, follow these steps:

- Gather required information, including:

- Your Michigan income tax return (Form MI-1040)

- Your federal income tax return (Form 1040)

- Any supporting schedules and forms

- Calculate your underpayment or overpayment of Michigan income tax using the MI-2210 form's worksheet

- Report your underpayment or overpayment on the MI-2210 form

- Calculate any penalties or interest due

- Attach supporting schedules and forms, as required

Calculating Underpayment or Overpayment

To calculate your underpayment or overpayment, you will need to complete the MI-2210 form's worksheet. This involves calculating your total tax liability, subtracting any payments made during the year, and determining the amount of underpayment or overpayment.Penalties and Interest

If you underpaid your Michigan income tax, you may be subject to penalties and interest. The penalty is calculated as a percentage of the underpayment, and interest is charged on the underpayment amount.Common Mistakes to Avoid

When completing the MI-2210 form, avoid common mistakes, such as:

- Failing to report all income

- Incorrectly calculating underpayment or overpayment

- Failing to attach supporting schedules and forms

- Not signing and dating the form

Consequences of Not Filing the MI-2210 Form

Failing to file the MI-2210 form can result in penalties, interest, and even audit. It is essential to file the form accurately and on time to avoid any consequences.

Additional Resources

For additional information on the MI-2210 form, you can visit the Michigan Department of Treasury's website or consult with a tax professional.

Conclusion

Understanding the MI-2210 form is crucial for individuals who need to report their underpayment or overpayment of Michigan income tax. By following the steps outlined in this article, you can ensure accurate completion of the form and avoid any potential penalties or interest charges. If you have any questions or concerns, consult with a tax professional or contact the Michigan Department of Treasury.What is the purpose of the MI-2210 form?

+The MI-2210 form is used to report underpayment or overpayment of Michigan income tax.

Who needs to file the MI-2210 form?

+Individuals who have underpaid or overpaid their Michigan income tax by $500 or more, or have a balance due or refund due on their Michigan income tax return.

What are the consequences of not filing the MI-2210 form?

+Failing to file the MI-2210 form can result in penalties, interest, and even audit.