Understanding the American Fidelity 403b Withdrawal Process

As a participant in the American Fidelity 403b plan, you're likely to have questions about the withdrawal process. Withdrawing from your 403b plan can be a bit complex, but understanding the process can help you make informed decisions about your retirement savings. In this article, we'll provide a comprehensive guide to the American Fidelity 403b withdrawal form and process.

Why You Might Need to Withdraw from Your 403b Plan

There are several reasons why you might need to withdraw from your 403b plan. Some common reasons include:

- Retirement: You've reached age 59 1/2 and are ready to retire.

- Separation from service: You've left your job or are no longer eligible to participate in the plan.

- Financial hardship: You're experiencing financial difficulties and need access to your retirement savings.

- Loan repayment: You've taken a loan from your 403b plan and need to repay it.

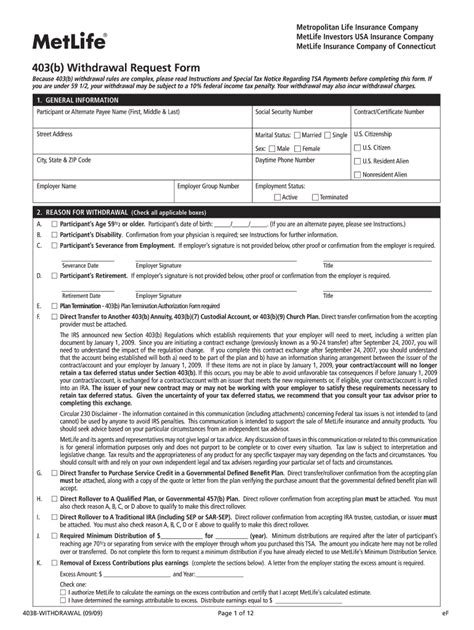

The American Fidelity 403b Withdrawal Form

The American Fidelity 403b withdrawal form is a crucial document that you'll need to complete to initiate the withdrawal process. The form will require you to provide personal and account information, as well as specify the amount you wish to withdraw.

Here are some key details you'll need to provide on the form:

- Your name and social security number or taxpayer identification number

- Your account information, including your account number and plan name

- The amount you wish to withdraw

- Your payment instructions, including the frequency and method of payment

Types of Withdrawals

There are several types of withdrawals you can make from your American Fidelity 403b plan:

- Lump sum withdrawal: You can withdraw your entire account balance in one lump sum.

- Installment payments: You can receive regular payments over a set period, such as monthly or quarterly.

- Substantially equal periodic payments (SEPP): You can receive regular payments over your life expectancy.

- Roth 403b withdrawals: If you have a Roth 403b account, you can withdraw contributions and earnings tax-free and penalty-free after age 59 1/2.

The Withdrawal Process

The withdrawal process typically involves the following steps:

- Complete the withdrawal form: Fill out the American Fidelity 403b withdrawal form and return it to American Fidelity.

- Verify your identity: American Fidelity may require you to verify your identity before processing your withdrawal.

- Review and confirm: Review your withdrawal request and confirm that the information is accurate.

- Processing: American Fidelity will process your withdrawal request and send you a check or direct deposit.

Taxes and Penalties

Withdrawals from your 403b plan may be subject to taxes and penalties. Here are some key tax implications to consider:

- Income tax: Withdrawals from your 403b plan are generally subject to income tax.

- Penalties: If you withdraw from your 403b plan before age 59 1/2, you may be subject to a 10% penalty.

- Withholding: American Fidelity may be required to withhold taxes on your withdrawal.

Conclusion

Withdrawing from your American Fidelity 403b plan can be a complex process, but understanding the withdrawal form and process can help you make informed decisions about your retirement savings. Remember to carefully review your options and consider seeking professional advice before making a withdrawal.

We hope this guide has been helpful in explaining the American Fidelity 403b withdrawal form and process. If you have any further questions or concerns, please don't hesitate to comment below.

What is the American Fidelity 403b withdrawal form?

+The American Fidelity 403b withdrawal form is a document that you need to complete to initiate the withdrawal process from your 403b plan.

What types of withdrawals can I make from my 403b plan?

+You can make lump sum withdrawals, installment payments, substantially equal periodic payments (SEPP), or Roth 403b withdrawals from your 403b plan.

Are withdrawals from my 403b plan subject to taxes and penalties?

+Yes, withdrawals from your 403b plan may be subject to income tax and penalties if you withdraw before age 59 1/2.