Understanding the Importance of E-Filing Form M-8453 for Fiduciary Income Tax Returns

As a fiduciary, managing the financial affairs of an estate or trust can be a daunting task. One crucial aspect of this responsibility is ensuring compliance with tax laws and regulations. In the United States, the Internal Revenue Service (IRS) requires fiduciaries to file Form 1041, the U.S. Income Tax Return for Estates and Trusts. To streamline this process, the IRS has introduced the option to e-file Form M-8453, the U.S. Return of Estates and Trusts, which serves as a declaration of the fiduciary's intent to file Form 1041 electronically. In this article, we will delve into the world of e-filing Form M-8453, exploring its benefits, requirements, and procedures.

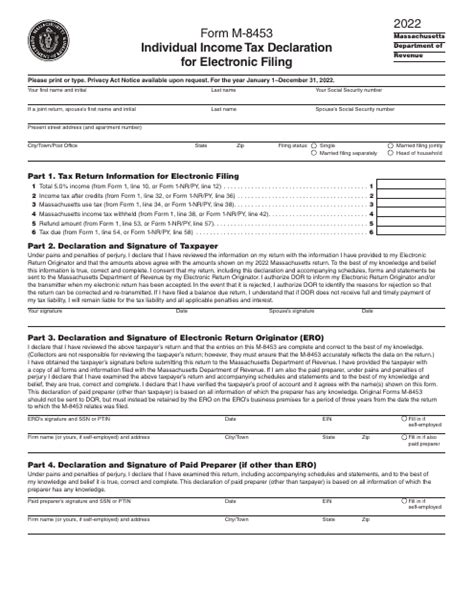

What is Form M-8453?

Form M-8453 is a relatively new development in the realm of tax compliance. Introduced by the IRS in 2020, it allows fiduciaries to electronically file their intent to file Form 1041, rather than submitting a paper declaration. This form serves as a statement of the fiduciary's intention to e-file the estate or trust's income tax return, which includes the necessary information to authenticate the filing.

Benefits of E-Filing Form M-8453

E-filing Form M-8453 offers numerous benefits to fiduciaries, including:

- Convenience: Electronic filing eliminates the need for paper submissions, reducing the risk of errors and lost documents.

- Speed: E-filing allows for faster processing times, as the IRS can quickly verify the information and accept the filing.

- Accuracy: Electronic submissions minimize the risk of transcription errors, ensuring that the information is accurate and complete.

- Security: The IRS's e-file system provides a secure environment for transmitting sensitive tax information.

- Reduced Costs: E-filing eliminates the need for paper, postage, and storage, resulting in cost savings for fiduciaries.

Who is Required to E-File Form M-8453?

The IRS requires fiduciaries to e-file Form M-8453 in certain situations:

- Large Estates and Trusts: Estates and trusts with assets exceeding $25 million are required to e-file their Form 1041 and, consequently, Form M-8453.

- ** Estates and Trusts with Complex Tax Situations**: Fiduciaries managing estates or trusts with complex tax situations, such as those involving partnerships, S corporations, or international tax issues, are encouraged to e-file Form M-8453.

Requirements for E-Filing Form M-8453

To e-file Form M-8453, fiduciaries must meet the following requirements:

- Electronic Filing Software: Fiduciaries must use approved electronic filing software, such as IRS Free File or a commercial tax preparation program.

- Authentication: Fiduciaries must provide authentication information, including their name, title, and taxpayer identification number.

- Form 1041: Fiduciaries must have a completed Form 1041, including all required schedules and attachments.

How to E-File Form M-8453

E-filing Form M-8453 involves the following steps:

- Choose an Electronic Filing Software: Select an approved electronic filing software, such as IRS Free File or a commercial tax preparation program.

- Prepare Form 1041: Complete Form 1041, including all required schedules and attachments.

- Authenticate the Filing: Provide authentication information, including your name, title, and taxpayer identification number.

- Submit the Filing: Submit the Form M-8453 and accompanying Form 1041 through the electronic filing software.

- Receive an Acknowledgement: The IRS will send an acknowledgement of receipt, indicating that the filing has been accepted or rejected.

Tips for Successful E-Filing of Form M-8453

To ensure a smooth e-filing experience, fiduciaries should:

- Verify Software Compatibility: Ensure that the electronic filing software is compatible with the IRS's e-file system.

- Test the Filing: Test the filing process before submitting the actual Form M-8453 and Form 1041.

- Keep Records: Maintain accurate records of the filing, including the acknowledgement of receipt from the IRS.

Common Errors to Avoid When E-Filing Form M-8453

Fiduciaries should be aware of the following common errors to avoid when e-filing Form M-8453:

- Inaccurate Authentication Information: Ensure that the authentication information is accurate and complete.

- Incomplete Form 1041: Verify that Form 1041 is complete, including all required schedules and attachments.

- Software Compatibility Issues: Ensure that the electronic filing software is compatible with the IRS's e-file system.

Conclusion

E-filing Form M-8453 is a crucial step in the tax compliance process for fiduciaries. By understanding the benefits, requirements, and procedures for e-filing, fiduciaries can ensure a smooth and efficient process. Remember to verify software compatibility, test the filing, and maintain accurate records to avoid common errors. By following these tips and best practices, fiduciaries can confidently e-file Form M-8453 and meet their tax obligations.

What is the purpose of Form M-8453?

+Form M-8453 is a declaration of the fiduciary's intent to file Form 1041 electronically. It serves as a statement of the fiduciary's intention to e-file the estate or trust's income tax return, which includes the necessary information to authenticate the filing.

Who is required to e-file Form M-8453?

+The IRS requires fiduciaries to e-file Form M-8453 in certain situations, including large estates and trusts with assets exceeding $25 million and estates and trusts with complex tax situations.

What are the benefits of e-filing Form M-8453?

+E-filing Form M-8453 offers numerous benefits, including convenience, speed, accuracy, security, and reduced costs.