As a union or employer, filing Form LM-2 Labor Report is a crucial step in maintaining transparency and compliance with labor laws. The U.S. Department of Labor requires unions and certain employers to file this report annually, providing detailed financial information and other relevant data. In this article, we will guide you through the 5 essential steps to file Form LM-2 Labor Report, ensuring you comply with the regulations and avoid any potential penalties.

Step 1: Determine Filing Requirements

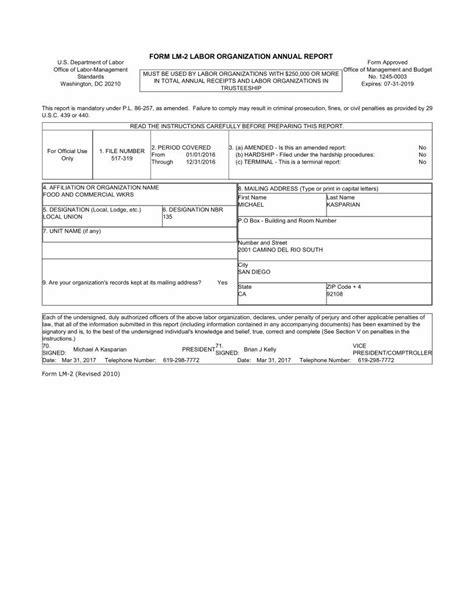

Before starting the filing process, it's essential to determine whether your union or employer is required to file Form LM-2. The U.S. Department of Labor requires unions with total annual receipts of $250,000 or more to file this report. Employers who are required to file Form LM-2 include those who have a collective bargaining agreement with a union or have made expenditures of $5,000 or more in a calendar year for the purpose of influencing employees regarding their rights to organize and bargain collectively.

Who Needs to File Form LM-2?

To determine if your organization needs to file Form LM-2, consider the following:

- Total annual receipts: Unions with total annual receipts of $250,000 or more are required to file Form LM-2.

- Collective bargaining agreements: Employers with collective bargaining agreements with unions must file Form LM-2.

- Expenditures for influencing employees: Employers who have made expenditures of $5,000 or more in a calendar year for the purpose of influencing employees regarding their rights to organize and bargain collectively must file Form LM-2.

Step 2: Gather Required Information

Once you've determined that your organization needs to file Form LM-2, gather all the required information and documents. This includes:

- Financial records: Gather financial records, including income statements, balance sheets, and general ledgers.

- Receipts and disbursements: Collect records of all receipts and disbursements, including contributions, dues, and expenditures.

- Investments and assets: Gather information on investments, assets, and liabilities.

- Officer and employee information: Collect information on officers, employees, and their compensation.

Required Documents and Information

To ensure accurate filing, gather the following documents and information:

- Financial records

- Receipts and disbursements

- Investments and assets

- Officer and employee information

- Collective bargaining agreements

- Expenditures for influencing employees

Step 3: Complete Form LM-2

With all the required information and documents in hand, complete Form LM-2. The form is divided into several sections, including:

- Section 1: Financial Information

- Section 2: Receipts and Disbursements

- Section 3: Investments and Assets

- Section 4: Officer and Employee Information

- Section 5: Collective Bargaining Agreements

- Section 6: Expenditures for Influencing Employees

Completing Form LM-2

When completing Form LM-2, ensure you:

- Provide accurate and complete information

- Follow the instructions carefully

- Use the correct reporting period

- Sign and date the form

Step 4: File Form LM-2

Once you've completed Form LM-2, file it with the U.S. Department of Labor. The filing deadline is typically March 31st of each year, but check with the Department of Labor for specific deadlines.

Filing Options

You can file Form LM-2 electronically or by mail:

- Electronic Filing: File Form LM-2 electronically through the U.S. Department of Labor's website.

- Mail Filing: Mail Form LM-2 to the U.S. Department of Labor, Office of Labor-Management Standards.

Step 5: Review and Verify

After filing Form LM-2, review and verify the information to ensure accuracy and completeness. This is an essential step to avoid any potential penalties or fines.

Review and Verification

When reviewing and verifying Form LM-2, ensure you:

- Check for accuracy and completeness

- Verify financial information

- Review officer and employee information

- Check for any discrepancies

Conclusion

Filing Form LM-2 Labor Report is a crucial step in maintaining transparency and compliance with labor laws. By following these 5 essential steps, you can ensure accurate and timely filing, avoiding any potential penalties or fines. Remember to gather required information, complete the form accurately, file on time, and review and verify the information to ensure accuracy and completeness.

Who needs to file Form LM-2?

+Unions with total annual receipts of $250,000 or more, and employers who have a collective bargaining agreement with a union or have made expenditures of $5,000 or more in a calendar year for the purpose of influencing employees regarding their rights to organize and bargain collectively.

What information is required to complete Form LM-2?

+Financial records, receipts and disbursements, investments and assets, officer and employee information, collective bargaining agreements, and expenditures for influencing employees.

How do I file Form LM-2?

+You can file Form LM-2 electronically through the U.S. Department of Labor's website or by mail to the U.S. Department of Labor, Office of Labor-Management Standards.