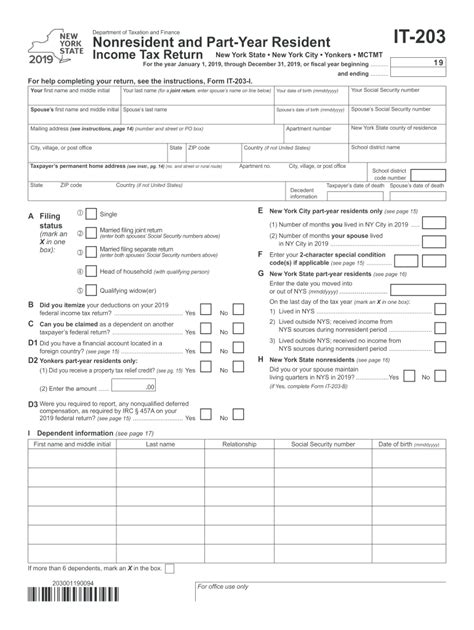

As a resident of New York State, it's essential to understand the tax filing requirements to avoid any penalties or fines. One of the key forms you may need to file is the IT-203 form, also known as the New York State Non-Resident and Part-Year Resident Income Tax Return. In this article, we'll delve into the details of the IT-203 form, its filing requirements, and provide a comprehensive guide to help you navigate the process.

What is the IT-203 form?

The IT-203 form is used by non-resident and part-year resident individuals to report their income earned in New York State. This form is used to calculate the tax liability for individuals who don't live in New York State for the entire year or have income from New York State sources.

Who needs to file the IT-203 form?

You'll need to file the IT-203 form if you meet any of the following conditions:

- You're a non-resident with income from New York State sources, such as rental income, dividends, or capital gains.

- You're a part-year resident with income from New York State sources during the period you lived in the state.

- You're a resident of New York State with income from sources outside the state.

Filing Requirements

To file the IT-203 form, you'll need to meet the following requirements:

- You must have earned income from New York State sources.

- You must have filed a federal income tax return (Form 1040).

- You must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

What income is subject to New York State tax?

The following types of income are subject to New York State tax:

- Wages and salaries earned in New York State.

- Self-employment income earned in New York State.

- Rental income from properties located in New York State.

- Dividends and interest from New York State sources.

- Capital gains from the sale of property located in New York State.

How to file the IT-203 form

To file the IT-203 form, you can use the following methods:

- E-file: You can e-file the IT-203 form through the New York State Department of Taxation and Finance website.

- Mail: You can mail the completed IT-203 form to the address listed on the form.

- Tax professional: You can hire a tax professional to prepare and file the IT-203 form on your behalf.

Deadline for filing

The deadline for filing the IT-203 form is typically April 15th of each year. However, if you're filing for an automatic six-month extension, the deadline is October 15th.

Penalties for late filing

If you fail to file the IT-203 form on time, you may be subject to penalties and interest. The penalty for late filing is typically 5% of the unpaid tax liability, plus interest on the unpaid amount.

Amending the IT-203 form

If you need to make changes to your IT-203 form, you can file an amended return using Form IT-203-X. You can e-file the amended return or mail it to the address listed on the form.

Record keeping

It's essential to keep accurate records of your income and expenses related to your New York State tax return. You should keep the following records:

- W-2 forms and 1099 forms.

- Self-employment records, including business expense records.

- Rental income records, including rent payments and expenses.

- Dividend and interest statements.

Tax credits and deductions

You may be eligible for tax credits and deductions on your IT-203 form. Some common credits and deductions include:

- Earned Income Tax Credit (EITC).

- Child Tax Credit.

- Mortgage interest deduction.

- Charitable donation deduction.

Common mistakes to avoid

When filing the IT-203 form, it's essential to avoid common mistakes that can delay processing or result in penalties. Some common mistakes to avoid include:

- Failing to sign the form.

- Failing to include all required documentation.

- Failing to report all income.

- Failing to claim all eligible credits and deductions.

Conclusion

Filing the IT-203 form can be a complex process, but with the right guidance, you can ensure you meet the filing requirements and avoid any penalties. Remember to keep accurate records, report all income, and claim all eligible credits and deductions. If you're unsure about any aspect of the IT-203 form, it's always best to consult with a tax professional.

What is the deadline for filing the IT-203 form?

+The deadline for filing the IT-203 form is typically April 15th of each year. However, if you're filing for an automatic six-month extension, the deadline is October 15th.

Who needs to file the IT-203 form?

+You'll need to file the IT-203 form if you're a non-resident with income from New York State sources, a part-year resident with income from New York State sources during the period you lived in the state, or a resident of New York State with income from sources outside the state.

What income is subject to New York State tax?

+The following types of income are subject to New York State tax: wages and salaries earned in New York State, self-employment income earned in New York State, rental income from properties located in New York State, dividends and interest from New York State sources, and capital gains from the sale of property located in New York State.