Filing tax forms can be a daunting task, especially for individuals who are new to the process. In West Virginia, residents are required to file Form IT-140, which is the state's individual income tax return form. To make the process smoother and less stressful, we've put together five valuable tips for filing Form IT-140 WV.

Understanding Form IT-140 WV

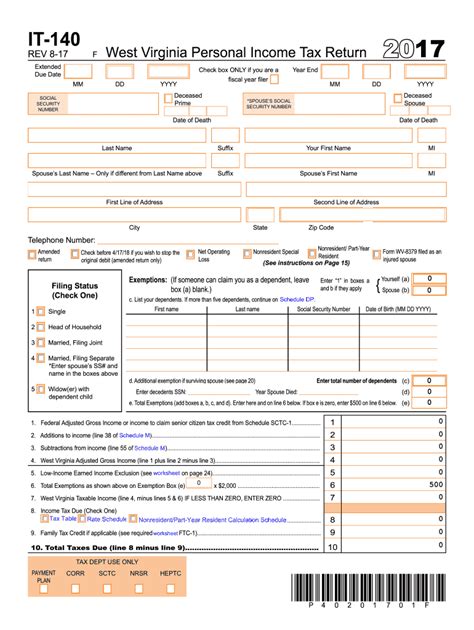

Before we dive into the tips, it's essential to understand what Form IT-140 WV is and what it's used for. Form IT-140 is the state's individual income tax return form, which is used to report an individual's income and calculate their state income tax liability. The form is typically filed annually, and the deadline for filing is usually April 15th.

Who Needs to File Form IT-140 WV?

Not everyone in West Virginia needs to file Form IT-140. However, you must file the form if you meet any of the following conditions:

- You are a resident of West Virginia and have a federal taxable income.

- You are a non-resident of West Virginia and have income from West Virginia sources.

- You are a part-year resident of West Virginia and have income from West Virginia sources.

Tip 1: Gather All Necessary Documents

Before you start filling out Form IT-140, make sure you have all the necessary documents. These may include:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for any freelance or contract work

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

Having all these documents ready will make it easier to fill out the form and reduce the likelihood of errors.

What to Do If You're Missing Documents

If you're missing any documents, don't panic. You can:

- Contact your employer or financial institution to request a duplicate copy.

- Use the IRS's Get Transcript tool to obtain a copy of your federal income tax return.

- Contact the West Virginia State Tax Department for assistance.

Tip 2: Choose the Right Filing Status

Your filing status affects your tax liability, so it's essential to choose the correct one. West Virginia recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that best describes your situation. If you're unsure, you can consult the instructions for Form IT-140 or contact the West Virginia State Tax Department for guidance.

How Filing Status Affects Your Tax Liability

Your filing status affects your tax liability in several ways. For example:

- Married couples who file jointly may qualify for a lower tax rate.

- Head of household filers may qualify for a higher standard deduction.

- Qualifying widow(er) filers may qualify for a lower tax rate.

Tip 3: Take Advantage of Tax Credits and Deductions

West Virginia offers several tax credits and deductions that can reduce your tax liability. Some of the most common ones include:

- The Earned Income Tax Credit (EITC)

- The Child Tax Credit

- The Education Expenses Deduction

- The Charitable Donations Deduction

Make sure you take advantage of these credits and deductions if you're eligible.

How to Claim Tax Credits and Deductions

To claim tax credits and deductions, you'll need to complete the relevant sections of Form IT-140. You may also need to attach supporting documentation, such as receipts or invoices.

Tip 4: File Electronically or by Mail

You can file Form IT-140 electronically or by mail. Filing electronically is generally faster and more convenient, but you can also file by mail if you prefer.

How to File Electronically

To file electronically, you'll need to:

- Create an account on the West Virginia State Tax Department's website.

- Fill out Form IT-140 online.

- Submit the form and pay any tax due.

How to File by Mail

To file by mail, you'll need to:

- Fill out Form IT-140 and attach any supporting documentation.

- Sign and date the form.

- Mail the form to the West Virginia State Tax Department.

Tip 5: Check for Errors and Omissions

Finally, make sure you check your return for errors and omissions before submitting it. This will help you avoid delays and potential penalties.

Common Errors to Watch Out For

Some common errors to watch out for include:

- Math errors

- Incorrect filing status

- Missing or incomplete documentation

- Failure to sign and date the form

By following these five tips, you can make the process of filing Form IT-140 WV easier and less stressful. Remember to gather all necessary documents, choose the right filing status, take advantage of tax credits and deductions, file electronically or by mail, and check for errors and omissions.

What is the deadline for filing Form IT-140 WV?

+The deadline for filing Form IT-140 WV is usually April 15th.

Do I need to file Form IT-140 WV if I don't owe any taxes?

+Yes, you may still need to file Form IT-140 WV even if you don't owe any taxes. You can check the instructions for Form IT-140 to see if you're required to file.

How do I contact the West Virginia State Tax Department for assistance?

+You can contact the West Virginia State Tax Department by phone, email, or mail. You can find their contact information on their website.