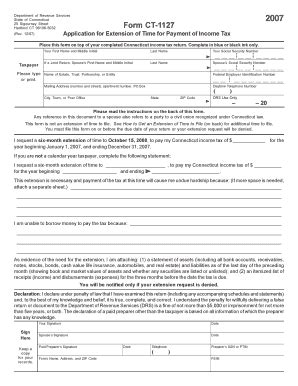

Filling out form CT 1127, also known as the Application for Refund of Connecticut Income Tax, can be a daunting task, especially for those who are not familiar with the process. However, with the right guidance, it can be done efficiently and effectively. In this article, we will walk you through five ways to fill out form CT 1127, ensuring that you get the refund you deserve.

Understanding Form CT 1127

Before we dive into the ways to fill out form CT 1127, it's essential to understand what the form is used for. Form CT 1127 is an application for a refund of Connecticut income tax. It's used by individuals and businesses to claim a refund of overpaid taxes or to request a refund of taxes paid in error.

Who Needs to Fill Out Form CT 1127?

You may need to fill out form CT 1127 if you:

- Overpaid your Connecticut income tax

- Paid taxes in error

- Are eligible for a refund of taxes paid on a joint return

- Need to claim a refund of taxes withheld from your paycheck

5 Ways to Fill Out Form CT 1127

Now that we've covered the basics, let's move on to the five ways to fill out form CT 1127.

1. Gather Required Documents

Before you start filling out form CT 1127, make sure you have all the required documents. These may include:

- Your Connecticut income tax return (Form CT-1040)

- Your W-2 forms

- Your 1099 forms

- Any other relevant tax documents

2. Fill Out the Form Online

You can fill out form CT 1127 online through the Connecticut Department of Revenue Services (DRS) website. This method is convenient and allows you to submit your application electronically.

- Go to the DRS website and click on "Refund" under the "Individuals" tab

- Select "Form CT-1127" and click on "Fill out online"

- Fill out the form and submit it electronically

3. Fill Out the Form by Hand

If you prefer to fill out the form by hand, you can download and print it from the DRS website.

- Download and print form CT-1127 from the DRS website

- Fill out the form using a black pen

- Sign and date the form

- Mail the form to the address listed on the form

4. Use Tax Preparation Software

You can also use tax preparation software to fill out form CT 1127. These programs guide you through the process and ensure that you fill out the form accurately.

- Choose a tax preparation software that supports form CT-1127

- Follow the prompts to fill out the form

- Review and submit the form electronically

5. Seek Professional Help

If you're not comfortable filling out form CT 1127 on your own, you can seek professional help from a tax professional or accountant.

- Find a tax professional or accountant who is familiar with form CT-1127

- Provide them with the required documents

- Let them fill out the form and submit it on your behalf

Additional Tips

Here are some additional tips to keep in mind when filling out form CT 1127:

- Make sure to fill out the form accurately and completely

- Use the correct form version

- Sign and date the form

- Keep a copy of the form for your records

Get Your Refund

Filling out form CT 1127 is a straightforward process that can help you get the refund you deserve. By following the five ways outlined in this article, you can ensure that you fill out the form accurately and efficiently.

Final Thoughts

In conclusion, filling out form CT 1127 is a process that requires attention to detail and accuracy. By following the five ways outlined in this article, you can ensure that you fill out the form correctly and get the refund you deserve. Remember to gather required documents, fill out the form online or by hand, use tax preparation software, seek professional help, and follow additional tips.

We hope this article has been helpful in guiding you through the process of filling out form CT 1127. If you have any questions or concerns, feel free to comment below.

What is form CT 1127 used for?

+Form CT 1127 is an application for a refund of Connecticut income tax.

Who needs to fill out form CT 1127?

+You may need to fill out form CT 1127 if you overpaid your Connecticut income tax, paid taxes in error, or are eligible for a refund of taxes paid on a joint return.

How do I fill out form CT 1127?

+You can fill out form CT 1127 online, by hand, using tax preparation software, or seeking professional help.