The Importance of Filing Form 990 Online

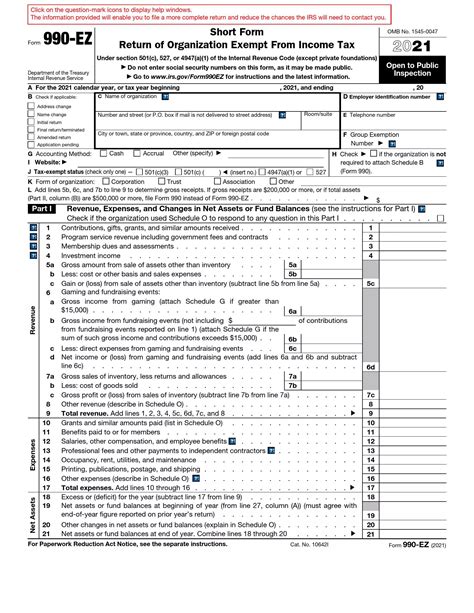

As a nonprofit organization, filing Form 990 with the Internal Revenue Service (IRS) is a crucial step in maintaining your tax-exempt status. The form, also known as the Return of Organization Exempt from Income Tax, is used to report your organization's financial activities and provide transparency to the public. With the increasing complexity of tax laws and regulations, filing Form 990 online can be a daunting task, but it doesn't have to be.

In this article, we will guide you through the process of filing Form 990 online easily and accurately. We will cover the benefits of e-filing, the requirements for Form 990, and provide step-by-step instructions on how to file your return online.

Benefits of Filing Form 990 Online

Filing Form 990 online offers several benefits, including:

- Convenience: E-filing allows you to file your return from the comfort of your own home or office, 24/7.

- Accuracy: Online filing reduces the risk of errors and omissions, as the software will automatically check for completeness and accuracy.

- Speed: E-filing is faster than paper filing, with most returns processed within 24 hours.

- Security: Online filing is more secure than paper filing, as your return is transmitted directly to the IRS.

Requirements for Form 990

Before you begin the filing process, make sure you have the following information and documents ready:

- Your organization's Employer Identification Number (EIN)

- Financial statements, including balance sheets and income statements

- List of officers, directors, and key employees

- Information on grants and contributions

- Information on fundraising activities

Filing Form 990 Online: Step-by-Step Instructions

Filing Form 990 online is a straightforward process that can be completed in a few steps:

- Choose a Filing Software: Select a reputable online filing software that is approved by the IRS. Some popular options include TurboTax, H&R Block, and TaxAct.

- Gather Required Documents: Collect all the necessary documents and information, including financial statements, lists of officers and directors, and information on grants and contributions.

- Create an Account: Create an account with the filing software, providing your organization's EIN and other required information.

- Complete the Return: Complete the Form 990 return online, using the software to guide you through the process.

- Review and Submit: Review your return for accuracy and completeness, and submit it to the IRS.

Tips for Filing Form 990 Online

To ensure a smooth and accurate filing process, follow these tips:

- Use a Reputable Software: Choose a filing software that is approved by the IRS and has a good reputation.

- Take Your Time: Don't rush through the filing process. Take your time to ensure accuracy and completeness.

- Seek Help: If you need help, don't hesitate to contact the filing software's customer support or an IRS representative.

Common Errors to Avoid

When filing Form 990 online, avoid the following common errors:

- Inaccurate or Incomplete Information: Make sure all information is accurate and complete, including financial statements and lists of officers and directors.

- Missing Signatures: Ensure that all required signatures are included, including the signature of the authorized representative.

- Incorrect Filing Status: Ensure that you are filing the correct return, including the correct filing status (e.g., 501(c)(3), 501(c)(4), etc.).

Conclusion

Filing Form 990 online is a convenient and accurate way to report your nonprofit organization's financial activities to the IRS. By following the step-by-step instructions and tips outlined in this article, you can ensure a smooth and successful filing process. Remember to choose a reputable filing software, take your time, and seek help if needed. With e-filing, you can maintain your organization's tax-exempt status and provide transparency to the public.

What's Next?

Now that you have filed your Form 990 online, it's time to focus on other important aspects of your nonprofit organization. Consider the following:

- Review and Update Your Bylaws: Ensure that your bylaws are up-to-date and compliant with state and federal regulations.

- Develop a Fundraising Plan: Create a comprehensive fundraising plan to support your organization's mission and goals.

- Build a Strong Board of Directors: Recruit and retain a diverse and skilled board of directors to provide governance and oversight.

By taking these steps, you can ensure the long-term success and sustainability of your nonprofit organization.

What is the deadline for filing Form 990?

+The deadline for filing Form 990 is the 15th day of the 5th month after the close of your organization's tax year.

Can I file Form 990 electronically?

+Yes, you can file Form 990 electronically using IRS-approved software.

What are the penalties for late filing of Form 990?

+The penalty for late filing of Form 990 is $20 per day, up to a maximum of $10,000.