The Internal Revenue Service (IRS) requires various forms to be filed by individuals and businesses to report specific types of income, deductions, and credits. One such form is Form 4563, also known as the Exclusion of Income for Bona Fide Residents of American Samoa. In this comprehensive guide, we will delve into the details of Form 4563, including its purpose, eligibility criteria, and filing requirements.

What is Form 4563?

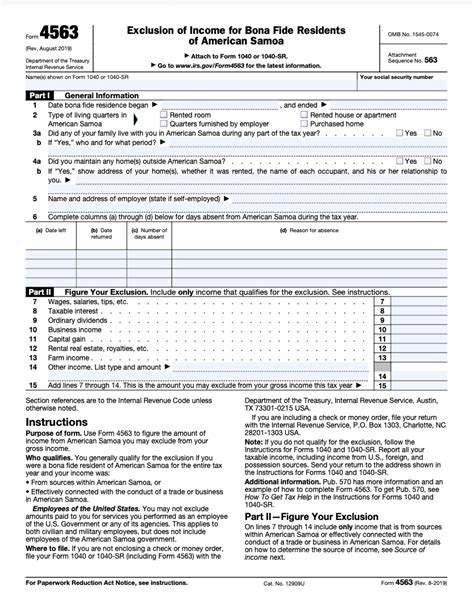

Form 4563 is an IRS form that allows bona fide residents of American Samoa to exclude certain types of income from their taxable income. The form is used to report the exclusion of income from sources within American Samoa, which is a United States territory located in the Pacific Ocean.

Purpose of Form 4563

The primary purpose of Form 4563 is to enable bona fide residents of American Samoa to exclude income that is earned from sources within the territory. This income may include wages, salaries, and other types of compensation earned by individuals who live and work in American Samoa. By excluding this income from their taxable income, residents of American Samoa can reduce their tax liability and enjoy a lower effective tax rate.

Eligibility Criteria for Form 4563

To be eligible to file Form 4563, an individual must meet the following criteria:

- Be a bona fide resident of American Samoa for the entire tax year.

- Have income earned from sources within American Samoa.

- File a federal income tax return (Form 1040) for the tax year.

Definition of Bona Fide Resident

A bona fide resident is an individual who has established a home in American Samoa and has no home or abode outside of the territory. To be considered a bona fide resident, an individual must meet one of the following tests:

- The physical presence test: The individual must be present in American Samoa for at least 183 days during the tax year.

- The tax home test: The individual's tax home must be in American Samoa, and they must have no tax home outside of the territory.

- The closer connection test: The individual must have a closer connection to American Samoa than to any other country or territory.

Filing Requirements for Form 4563

Form 4563 must be filed with the IRS by the due date of the individual's federal income tax return (Form 1040). The form can be filed electronically or by mail, and it must be signed and dated by the individual.

What to Include with Form 4563

When filing Form 4563, the following information must be included:

- The individual's name, address, and Social Security number.

- A description of the income earned from sources within American Samoa.

- The amount of income excluded from taxable income.

- A certification that the individual meets the eligibility criteria for Form 4563.

Benefits of Filing Form 4563

Filing Form 4563 can provide several benefits to bona fide residents of American Samoa, including:

- Reduced tax liability: By excluding income earned from sources within American Samoa, individuals can reduce their taxable income and lower their tax liability.

- Increased refund: By reducing their tax liability, individuals may be eligible for a larger refund when they file their federal income tax return.

- Simplified tax compliance: Filing Form 4563 can simplify the tax compliance process for individuals who earn income from sources within American Samoa.

Potential Drawbacks of Filing Form 4563

While filing Form 4563 can provide several benefits, there are also potential drawbacks to consider:

- Complex eligibility criteria: The eligibility criteria for Form 4563 can be complex, and individuals may need to seek professional advice to ensure they meet the requirements.

- Limited income exclusion: The income exclusion available on Form 4563 may be limited, and individuals may not be able to exclude all of their income earned from sources within American Samoa.

- Audit risk: Filing Form 4563 may increase the risk of an audit, as the IRS may scrutinize the individual's eligibility for the income exclusion.

Common Mistakes to Avoid When Filing Form 4563

When filing Form 4563, there are several common mistakes to avoid:

- Failing to meet the eligibility criteria: Individuals must ensure they meet the eligibility criteria for Form 4563, including being a bona fide resident of American Samoa and having income earned from sources within the territory.

- Incorrect income reporting: Individuals must accurately report their income earned from sources within American Samoa, including wages, salaries, and other types of compensation.

- Failure to file Form 4563: Individuals who are eligible to file Form 4563 must ensure they file the form by the due date of their federal income tax return.

Consequences of Failing to File Form 4563

Failing to file Form 4563 can result in several consequences, including:

- Loss of income exclusion: Individuals who fail to file Form 4563 may lose the income exclusion available on the form, resulting in a higher tax liability.

- Penalties and interest: The IRS may impose penalties and interest on individuals who fail to file Form 4563 or report income incorrectly.

- Audit risk: Failing to file Form 4563 may increase the risk of an audit, as the IRS may scrutinize the individual's eligibility for the income exclusion.

Conclusion

In conclusion, Form 4563 is an important IRS form that allows bona fide residents of American Samoa to exclude certain types of income from their taxable income. To be eligible to file Form 4563, individuals must meet specific criteria, including being a bona fide resident of American Samoa and having income earned from sources within the territory. By filing Form 4563, individuals can reduce their tax liability and enjoy a lower effective tax rate. However, there are potential drawbacks to consider, including complex eligibility criteria and limited income exclusion.

Final Thoughts

When filing Form 4563, it is essential to ensure accuracy and completeness to avoid common mistakes and consequences. Individuals should seek professional advice if they are unsure about their eligibility or the filing requirements. By following the guidelines and tips outlined in this article, individuals can navigate the Form 4563 filing process with confidence and maximize their tax benefits.

Who is eligible to file Form 4563?

+Bona fide residents of American Samoa who have income earned from sources within the territory are eligible to file Form 4563.

What is the purpose of Form 4563?

+The purpose of Form 4563 is to allow bona fide residents of American Samoa to exclude certain types of income from their taxable income.

What are the benefits of filing Form 4563?

+Filing Form 4563 can provide several benefits, including reduced tax liability, increased refund, and simplified tax compliance.