K-1 forms, specifically the EPD K-1, are an essential part of the tax reporting process for partnerships and S corporations. These forms provide crucial information to the IRS and to partners or shareholders, outlining their share of income, deductions, and credits. Understanding the EPD K-1 form is vital for accurate tax reporting and compliance. Here are five essential facts about the EPD K-1 form that you need to know.

What is the EPD K-1 Form?

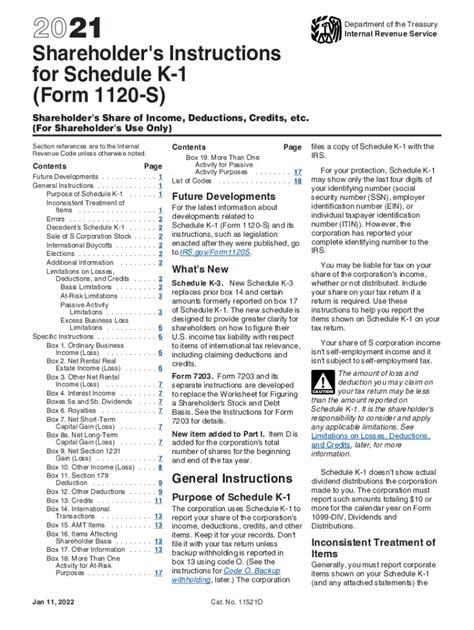

The EPD K-1 form, also known as the Schedule K-1, is a tax document used by partnerships and S corporations to report the income, deductions, and credits of the business to each partner or shareholder. The form is a critical component of the partnership's or S corporation's tax return, which is submitted to the Internal Revenue Service (IRS). The information provided on the K-1 form is used by partners or shareholders to complete their individual tax returns.

Purpose of the EPD K-1 Form

The primary purpose of the EPD K-1 form is to report the share of income, deductions, and credits of each partner or shareholder in a partnership or S corporation. This information is essential for accurate tax reporting and ensures that each partner or shareholder reports their correct share of income on their individual tax return. The K-1 form also provides information on the partner's or shareholder's basis in the partnership or S corporation, which is critical for determining gain or loss on the sale of partnership or S corporation interests.

How to Complete the EPD K-1 Form

Completing the EPD K-1 form requires careful attention to detail and a thorough understanding of the partnership's or S corporation's financial information. Here are the general steps to complete the K-1 form:

- Gather necessary information: The partnership or S corporation must gather all necessary financial information, including income, deductions, and credits.

- Determine partner's or shareholder's share: The partnership or S corporation must determine each partner's or shareholder's share of income, deductions, and credits.

- Complete the K-1 form: The partnership or S corporation must complete the K-1 form, reporting the partner's or shareholder's share of income, deductions, and credits.

Common Errors to Avoid on the EPD K-1 Form

Common errors to avoid on the EPD K-1 form include:

- Incorrect partner's or shareholder's information: Ensure that the partner's or shareholder's name, address, and tax identification number are accurate.

- Incorrect calculation of partner's or shareholder's share: Ensure that the partner's or shareholder's share of income, deductions, and credits is accurately calculated.

- Failure to report all income: Ensure that all income, including interest, dividends, and capital gains, is reported on the K-1 form.

Deadline for Filing the EPD K-1 Form

The deadline for filing the EPD K-1 form is typically March 15th of each year, which is the same deadline for filing the partnership's or S corporation's tax return. However, the deadline may vary depending on the specific circumstances of the partnership or S corporation.

Penalties for Late Filing of the EPD K-1 Form

Penalties for late filing of the EPD K-1 form can be severe, including:

- Late filing penalty: A penalty of up to $195 per month, up to a maximum of $975, may be imposed for late filing of the K-1 form.

- Interest on unpaid taxes: Interest may be charged on any unpaid taxes resulting from late filing of the K-1 form.

Conclusion

In conclusion, the EPD K-1 form is a critical component of the tax reporting process for partnerships and S corporations. Understanding the purpose, completion requirements, and deadlines for filing the K-1 form is essential for accurate tax reporting and compliance. By avoiding common errors and meeting the filing deadline, partnerships and S corporations can minimize the risk of penalties and ensure that their partners or shareholders receive accurate information for their individual tax returns.

We hope this article has provided you with a comprehensive understanding of the EPD K-1 form. If you have any questions or comments, please feel free to share them below.

What is the purpose of the EPD K-1 form?

+The purpose of the EPD K-1 form is to report the share of income, deductions, and credits of each partner or shareholder in a partnership or S corporation.

What is the deadline for filing the EPD K-1 form?

+The deadline for filing the EPD K-1 form is typically March 15th of each year, which is the same deadline for filing the partnership's or S corporation's tax return.

What are the penalties for late filing of the EPD K-1 form?

+Penalties for late filing of the EPD K-1 form can include a late filing penalty of up to $195 per month, up to a maximum of $975, and interest on unpaid taxes.