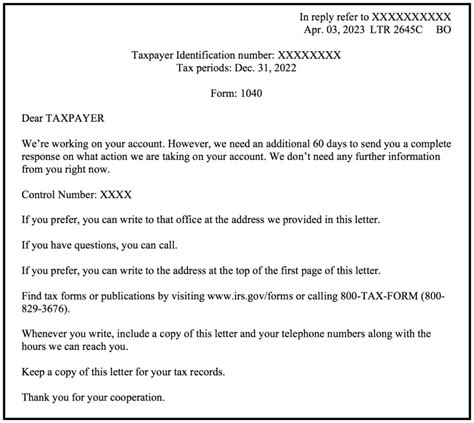

Receiving a notice from the Internal Revenue Service (IRS) can be unsettling, especially when it comes with a label like "2645C." This particular notice is part of the IRS's efforts to ensure compliance with tax laws, specifically regarding the reporting of income and the payment of taxes owed. If you've received an IRS Letter 2645C, it's essential to understand what it means and how to respond effectively. Here's a comprehensive guide to help you navigate this situation.

Understanding the IRS Letter 2645C

The IRS Letter 2645C is typically sent when the IRS believes you have unreported income or underreported taxes. This might be due to discrepancies in the income reported on your tax return compared to the income reported to the IRS by employers, banks, or other financial institutions. The IRS matches the income reported on your tax return with the information reported by these entities to ensure accuracy.

Why Did I Receive This Letter?

There are several reasons why you might receive an IRS Letter 2645C, including:

- Unreported income: You may have income that wasn't reported on your tax return.

- Underreported income: You may have reported income, but the amount is lower than what was reported to the IRS by employers or financial institutions.

- Missing or incorrect information: There might be missing or incorrect information on your tax return that needs clarification.

Responding to the IRS Letter 2645C

When responding to an IRS Letter 2645C, it's crucial to address the issue promptly and accurately. Here are five steps to help you respond effectively:

1. Review the Letter Carefully

Read the letter thoroughly to understand the specific issue and what the IRS is requesting. Look for details such as the type of income in question, the tax year involved, and any proposed adjustments to your tax liability.

2. Gather Supporting Documents

Collect all relevant documents that support your income and tax payments. This might include W-2 forms, 1099 forms, bank statements, and receipts for deductions claimed. Make sure these documents are accurate and can be used to explain or resolve the discrepancies noted by the IRS.

3. Compare Your Records with the IRS's Information

Carefully compare the income and information reported on your tax return with the information listed in the IRS Letter 2645C. If there are discrepancies, determine the cause and gather evidence to support your position.

4. Respond in Writing

When responding to the IRS, it's essential to do so in writing. Clearly explain your position regarding the income in question. If you agree with the IRS's proposed adjustments, you can indicate this in your response and arrange to pay any additional tax owed. If you disagree, provide a detailed explanation and include any supporting documentation.

5. Consider Seeking Professional Advice

Given the complexity of tax laws and the potential consequences of not responding correctly, it might be beneficial to consult with a tax professional or attorney. They can help ensure your response is accurate and effective, potentially saving you from additional penalties or interest.

After Responding to the IRS Letter 2645C

After you've responded to the IRS Letter 2645C, the IRS will review your response and make a determination regarding the proposed adjustments. If they accept your explanation, the matter will be closed. However, if they disagree or require further clarification, they may send additional correspondence or proceed with the proposed adjustments.

Additional Tips and Considerations

- Pay Any Agreed-Upon Amounts Promptly: If you agree with the IRS's proposed adjustments, ensure you pay any additional tax owed by the due date to avoid additional penalties and interest.

- Keep Records of Your Response: Make sure to keep a copy of your response to the IRS, including any supporting documentation you submitted.

- Follow Up: If you haven't received a response from the IRS after a reasonable period (usually 30 to 60 days), consider following up to ensure your response was received and processed correctly.

Receiving an IRS Letter 2645C can be stressful, but understanding what it means and how to respond effectively can significantly reduce this stress. By carefully reviewing the letter, gathering supporting documents, comparing your records with the IRS's information, responding in writing, and considering professional advice, you can navigate this situation with confidence.

We hope this comprehensive guide has provided the insights and tools needed to address your IRS Letter 2645C. If you have any specific questions or need further clarification on any of the steps, feel free to ask in the comments section below. Your input is valuable to us and helps ensure our content remains informative and relevant.

What should I do if I receive an IRS Letter 2645C?

+If you receive an IRS Letter 2645C, review it carefully to understand the issue, gather supporting documents, compare your records with the IRS's information, respond in writing, and consider seeking professional advice.

Why did I receive an IRS Letter 2645C?

+You might receive an IRS Letter 2645C if the IRS believes you have unreported income, underreported income, or if there's missing or incorrect information on your tax return.

How do I respond to an IRS Letter 2645C?

+Respond in writing, clearly explaining your position regarding the income in question. Include any supporting documentation and indicate if you agree or disagree with the proposed adjustments.