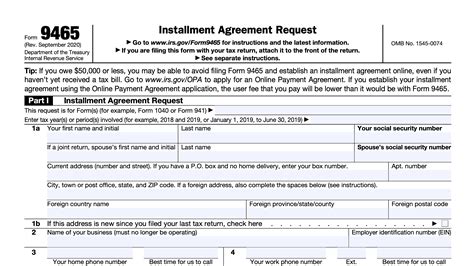

Are you struggling to pay off your tax debt to the IRS? You're not alone. Many individuals and businesses face financial difficulties that make it challenging to pay their tax bills in full. Fortunately, the IRS offers a payment plan option called an Installment Agreement, which allows you to make monthly payments towards your tax debt. To set up an Installment Agreement, you'll need to file Form 9465, also known as the Installment Agreement Request. In this article, we'll provide a step-by-step guide on how to complete Form 9465 and establish an IRS Installment Agreement.

Understanding IRS Installment Agreements

Before we dive into the instructions for Form 9465, it's essential to understand how IRS Installment Agreements work. An Installment Agreement is a payment plan that allows you to make monthly payments towards your tax debt over a set period. The IRS typically requires you to make monthly payments for a maximum of 72 months, but this can vary depending on your individual circumstances.

The benefits of an Installment Agreement include:

- Avoiding additional penalties and interest on your tax debt

- Preventing the IRS from levying your bank accounts or wages

- Having a predictable monthly payment amount

- Eventually paying off your tax debt in full

However, there are some requirements and restrictions to be aware of:

- You must owe $50,000 or less in combined tax, interest, and penalties

- You must have filed all required tax returns

- You must not have any outstanding tax returns or unfiled tax returns

- You must not be in bankruptcy

If you meet these requirements, you can proceed with filing Form 9465 to request an Installment Agreement.

Form 9465: The Installment Agreement Request

Form 9465 is a relatively straightforward form that requires you to provide some basic information about yourself, your tax debt, and your proposed payment plan. Here's a step-by-step guide to completing Form 9465:

- Line 1: Name and Address Enter your name and address as it appears on your tax return.

- Line 2: Social Security Number or Individual Taxpayer Identification Number (ITIN) Enter your Social Security Number or ITIN.

- Line 3: Employer Identification Number (EIN) If you're a business, enter your EIN.

- Line 4: Tax Year and Tax Type Enter the tax year and tax type (e.g., Form 1040, Form 1120) for which you're requesting an Installment Agreement.

- Line 5: Total Amount Due Enter the total amount you owe, including tax, interest, and penalties.

- Line 6: Proposed Monthly Payment Amount Enter the monthly payment amount you propose to pay. Make sure this amount is realistic and takes into account your income, expenses, and other financial obligations.

- Line 7: Number of Months Enter the number of months you propose to make payments. This can be up to 72 months.

- Line 8: Payment Frequency Choose how often you want to make payments: monthly, quarterly, or annually.

- Line 9: Payment Method Choose how you want to make payments: electronic funds withdrawal, check, or money order.

- Signature Sign and date the form.

How to File Form 9465

Once you've completed Form 9465, you'll need to file it with the IRS. You can do this in one of the following ways:

- Mail: Send the completed form to the IRS address listed in the instructions for Form 9465.

- Online: You can file Form 9465 online through the IRS Online Account system.

- Phone: You can also call the IRS at 1-800-829-1040 (individuals) or 1-800-829-4933 (businesses) to request an Installment Agreement.

What Happens After You File Form 9465?

After you file Form 9465, the IRS will review your request and determine whether to approve your Installment Agreement. This can take several weeks or even months. If your request is approved, you'll receive a notice from the IRS outlining the terms of your agreement, including your monthly payment amount and due date.

If your request is denied, you'll receive a notice explaining why your request was denied and what you can do to appeal the decision.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing Form 9465:

- Make sure you owe $50,000 or less in combined tax, interest, and penalties.

- Ensure you've filed all required tax returns and have no outstanding tax returns or unfiled tax returns.

- Propose a realistic monthly payment amount that takes into account your income, expenses, and other financial obligations.

- Consider hiring a tax professional to help you complete Form 9465 and negotiate with the IRS.

- Keep records of your payments and correspondence with the IRS.

Conclusion

Filing Form 9465 and establishing an IRS Installment Agreement can be a complex process, but with the right guidance, you can navigate it successfully. Remember to carefully review the instructions for Form 9465, propose a realistic monthly payment amount, and keep records of your payments and correspondence with the IRS. If you're unsure about any part of the process, consider hiring a tax professional to help you. By following these steps and tips, you can take control of your tax debt and get back on track financially.

What is an IRS Installment Agreement?

+An IRS Installment Agreement is a payment plan that allows you to make monthly payments towards your tax debt over a set period.

How do I qualify for an IRS Installment Agreement?

+To qualify for an IRS Installment Agreement, you must owe $50,000 or less in combined tax, interest, and penalties, have filed all required tax returns, and have no outstanding tax returns or unfiled tax returns.

How long does it take to process Form 9465?

+Processing Form 9465 can take several weeks or even months. If your request is approved, you'll receive a notice from the IRS outlining the terms of your agreement.