Transferring property in California can be a complex process, especially when it involves trust transfers. A California trust transfer deed is a crucial document used to transfer real property from a trust to a beneficiary or a new owner. In this article, we will explore five ways to complete a California trust transfer deed, ensuring a smooth and successful transfer of property.

Understanding the California Trust Transfer Deed

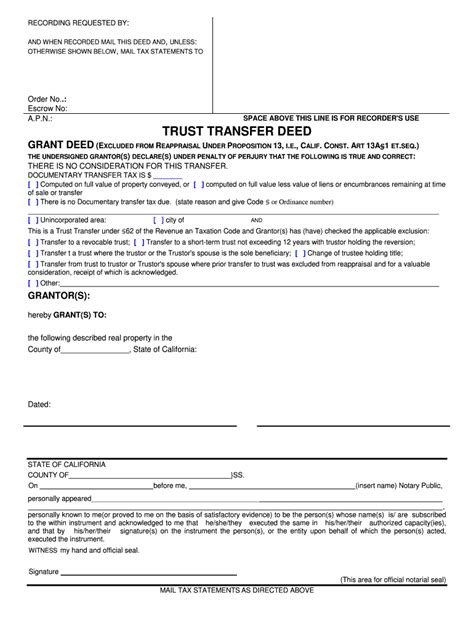

A California trust transfer deed is a document that transfers ownership of real property from a trust to a beneficiary or a new owner. This deed is typically used when a trust is being dissolved, or the trust's assets are being distributed to the beneficiaries. The deed must be properly executed and recorded to ensure a valid transfer of ownership.

Types of California Trust Transfer Deeds

There are several types of California trust transfer deeds, including:

- Trust Transfer Deed: This deed transfers ownership of real property from a trust to a beneficiary or a new owner.

- Quitclaim Deed: This deed transfers the grantor's interest in the property to the grantee, but does not guarantee the grantor's ownership.

- Warranty Deed: This deed guarantees the grantor's ownership of the property and transfers it to the grantee.

Method 1: Completing a Trust Transfer Deed with a Trustee

When completing a trust transfer deed with a trustee, the trustee must sign the deed in their capacity as trustee. The trustee's signature must be notarized, and the deed must be recorded with the county recorder's office. The trustee may also need to provide additional documentation, such as a certification of trust, to verify their authority to transfer the property.

Steps to Complete a Trust Transfer Deed with a Trustee:

- Prepare the trust transfer deed: The trustee must prepare the trust transfer deed, including the property description, the trust's name, and the beneficiary's or new owner's name.

- Sign the deed: The trustee must sign the deed in their capacity as trustee.

- Notarize the deed: The trustee's signature must be notarized.

- Record the deed: The deed must be recorded with the county recorder's office.

Method 2: Completing a Trust Transfer Deed without a Trustee

When completing a trust transfer deed without a trustee, the beneficiary or new owner must sign the deed. The deed must still be recorded with the county recorder's office, and the beneficiary or new owner may need to provide additional documentation to verify their ownership.

Steps to Complete a Trust Transfer Deed without a Trustee:

- Prepare the trust transfer deed: The beneficiary or new owner must prepare the trust transfer deed, including the property description, the trust's name, and their name.

- Sign the deed: The beneficiary or new owner must sign the deed.

- Record the deed: The deed must be recorded with the county recorder's office.

- Provide additional documentation: The beneficiary or new owner may need to provide additional documentation to verify their ownership.

Method 3: Using a Quitclaim Deed

A quitclaim deed can be used to transfer ownership of real property from a trust to a beneficiary or a new owner. This type of deed transfers the grantor's interest in the property to the grantee, but does not guarantee the grantor's ownership.

Steps to Complete a Quitclaim Deed:

- Prepare the quitclaim deed: The grantor must prepare the quitclaim deed, including the property description and the grantee's name.

- Sign the deed: The grantor must sign the deed.

- Notarize the deed: The grantor's signature must be notarized.

- Record the deed: The deed must be recorded with the county recorder's office.

Method 4: Using a Warranty Deed

A warranty deed can be used to transfer ownership of real property from a trust to a beneficiary or a new owner. This type of deed guarantees the grantor's ownership of the property and transfers it to the grantee.

Steps to Complete a Warranty Deed:

- Prepare the warranty deed: The grantor must prepare the warranty deed, including the property description and the grantee's name.

- Sign the deed: The grantor must sign the deed.

- Notarize the deed: The grantor's signature must be notarized.

- Record the deed: The deed must be recorded with the county recorder's office.

Method 5: Using an Attorney

When completing a trust transfer deed, it is recommended to use an attorney to ensure the process is done correctly. An attorney can help prepare the deed, verify the trust's documents, and ensure the transfer is recorded properly.

Benefits of Using an Attorney:

- Ensures the process is done correctly

- Verifies the trust's documents

- Ensures the transfer is recorded properly

- Provides guidance on the trust transfer process

Final Thoughts

Completing a California trust transfer deed can be a complex process, but by following the methods outlined above, you can ensure a smooth and successful transfer of property. Whether you use a trustee, a quitclaim deed, a warranty deed, or an attorney, it is essential to follow the proper steps to ensure the transfer is valid and recorded correctly.We encourage you to comment below and share your experiences with trust transfer deeds. If you have any questions or need further guidance, please don't hesitate to ask.

What is a California trust transfer deed?

+A California trust transfer deed is a document that transfers ownership of real property from a trust to a beneficiary or a new owner.

What types of trust transfer deeds are available in California?

+There are several types of trust transfer deeds available in California, including trust transfer deeds, quitclaim deeds, and warranty deeds.

Do I need an attorney to complete a trust transfer deed?

+While it is not required to use an attorney to complete a trust transfer deed, it is highly recommended to ensure the process is done correctly.