Filing taxes can be a daunting task for many businesses, especially when it comes to navigating the complexities of employment tax forms. One such form is the Form 944, which is used by small employers to report annual federal income tax withheld and social security and Medicare taxes. In this article, we will break down the Form 944 into manageable steps, making it easier for you to complete and file with confidence.

The importance of accurate and timely filing of Form 944 cannot be overstated. Failure to do so can result in penalties and fines, which can be detrimental to your business's financial health. By following these 7 steps, you'll be able to navigate the form with ease and ensure compliance with the IRS regulations.

Step 1: Determine If You Need to File Form 944

Before diving into the form, it's essential to determine if you need to file Form 944. This form is typically required for small employers who have an annual employment tax liability of $1,000 or less. If your business has a larger employment tax liability, you may need to file Form 941 instead.

To determine which form you need to file, consider the following:

- If you're a new employer, you'll need to file Form 944 unless you expect to owe more than $1,000 in employment taxes for the year.

- If you're an existing employer, you'll need to file Form 944 if your employment tax liability for the previous year was $1,000 or less.

What If You're Not Sure?

If you're unsure about which form to file, you can consult with a tax professional or contact the IRS directly. They can help you determine which form is required based on your specific business needs.

Step 2: Gather Required Information

Once you've determined that you need to file Form 944, it's time to gather the required information. You'll need the following:

- Your business's Employer Identification Number (EIN)

- Your business's name and address

- The total amount of wages paid to employees during the year

- The total amount of federal income tax withheld from employee wages

- The total amount of social security and Medicare taxes withheld from employee wages

- The total amount of federal unemployment tax (FUTA) tax paid

You can find this information on your business's payroll records, W-2 forms, and 1099 forms.

Tips for Gathering Information

- Make sure to keep accurate and detailed payroll records throughout the year.

- Use payroll software to help streamline the process and reduce errors.

- Double-check your calculations to ensure accuracy.

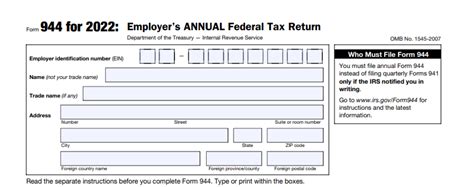

Step 3: Complete the Form 944 Header

The Form 944 header includes your business's identifying information, such as your EIN, name, and address. You'll also need to indicate the tax year for which you're filing.

- Line 1: Enter your EIN

- Line 2: Enter your business name and address

- Line 3: Enter the tax year for which you're filing

Tips for Completing the Header

- Make sure to enter your EIN correctly, as errors can delay processing.

- Use your business's legal name and address.

Step 4: Report Wages and Taxes

This section of the form requires you to report the total amount of wages paid to employees, as well as the total amount of federal income tax, social security, and Medicare taxes withheld.

- Line 4: Enter the total amount of wages paid to employees

- Line 5: Enter the total amount of federal income tax withheld

- Line 6: Enter the total amount of social security tax withheld

- Line 7: Enter the total amount of Medicare tax withheld

Tips for Reporting Wages and Taxes

- Use your payroll records to ensure accuracy.

- Make sure to report all wages paid to employees, including tips and bonuses.

Step 5: Calculate the Total Tax Liability

In this section, you'll need to calculate the total tax liability for your business. This includes the total amount of federal income tax, social security tax, and Medicare tax withheld, as well as any additional taxes owed.

- Line 8: Enter the total tax liability

Tips for Calculating the Total Tax Liability

- Use the IRS's tax tables to ensure accuracy.

- Make sure to include any additional taxes owed, such as FUTA tax.

Step 6: Report Any Payments and Credits

If your business has made any payments or credits towards your tax liability, you'll need to report them in this section.

- Line 9: Enter any payments made towards your tax liability

- Line 10: Enter any credits towards your tax liability

Tips for Reporting Payments and Credits

- Make sure to keep records of all payments and credits.

- Use the IRS's Form 944-V to make payments towards your tax liability.

Step 7: Sign and Date the Form

The final step is to sign and date the form. This confirms that the information provided is accurate and complete.

- Line 11: Sign your name

- Line 12: Enter the date

Tips for Signing and Dating the Form

- Make sure to sign the form in ink.

- Use the current date to ensure timely filing.

By following these 7 steps, you'll be able to complete Form 944 with ease and confidence. Remember to gather all required information, complete the form accurately, and sign and date it correctly. If you're unsure about any part of the process, consider consulting with a tax professional or contacting the IRS directly.

We hope this article has been helpful in guiding you through the process of completing Form 944. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing Form 944?

+The deadline for filing Form 944 is January 31st of each year.

Can I file Form 944 electronically?

+What happens if I miss the deadline for filing Form 944?

+If you miss the deadline for filing Form 944, you may be subject to penalties and fines. You can file Form 944 late, but you'll need to pay any additional taxes owed, plus interest and penalties.