The Net Investment Income Tax (NIIT) is a complex and often misunderstood tax, and understanding Form 8960, specifically Line 9b, is crucial for taxpayers who need to report this tax. In this article, we will delve into the details of Form 8960, Line 9b, and provide a comprehensive explanation of how to calculate and report the NIIT.

What is the Net Investment Income Tax (NIIT)?

The Net Investment Income Tax (NIIT) is a 3.8% tax on certain types of investment income, including interest, dividends, capital gains, and rental income. The tax was introduced as part of the Affordable Care Act (ACA) in 2010 and applies to individuals, estates, and trusts with modified adjusted gross income (MAGI) above certain thresholds.

Who is subject to the NIIT?

The NIIT applies to:

- Individuals with MAGI above $200,000 (single filers) or $250,000 (joint filers)

- Estates and trusts with undistributed net investment income (UNII)

Understanding Form 8960

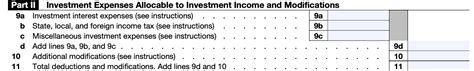

Form 8960 is used to report the Net Investment Income Tax. The form is divided into several sections, and taxpayers must complete the relevant sections based on their specific situation.

Line 9b: Total Net Investment Income

Line 9b on Form 8960 requires taxpayers to report their total net investment income. This includes:

- Interest income (Form 1099-INT)

- Dividend income (Form 1099-DIV)

- Capital gains and losses (Schedule D)

- Rental income (Schedule E)

- Royalty income (Schedule E)

- Income from businesses involved in trading of financial instruments or commodities (Form 1065 or Form 1120)

Taxpayers must calculate their total net investment income by adding up the income from these sources and subtracting any allowable deductions.

Calculating Net Investment Income

To calculate net investment income, taxpayers must follow these steps:

- Identify all investment income sources (interest, dividends, capital gains, etc.)

- Calculate the total income from these sources

- Identify allowable deductions (e.g., investment expenses, tax-exempt interest)

- Subtract the allowable deductions from the total income

- Calculate the net investment income

Example Calculation

John has the following investment income:

- Interest income: $10,000

- Dividend income: $5,000

- Capital gains: $20,000

- Rental income: $15,000

- Allowable deductions: $5,000 (investment expenses)

John's total net investment income is:

$10,000 (interest) + $5,000 (dividends) + $20,000 (capital gains) + $15,000 (rental income) = $50,000 $50,000 - $5,000 (allowable deductions) = $45,000

John's total net investment income is $45,000.

Reporting the NIIT on Form 8960

Once taxpayers have calculated their total net investment income, they must report it on Form 8960, Line 9b. The NIIT is calculated as 3.8% of the lesser of:

- Net investment income

- MAGI above the threshold ($200,000 for single filers or $250,000 for joint filers)

Taxpayers must also complete the rest of Form 8960, including reporting any NIIT liability or credit.

Conclusion: Understanding the NIIT and Form 8960

The Net Investment Income Tax is a complex tax that requires careful calculation and reporting. Understanding Form 8960, specifically Line 9b, is crucial for taxpayers who need to report this tax. By following the steps outlined in this article, taxpayers can ensure they accurately calculate and report their NIIT liability.

We hope this article has provided a comprehensive explanation of the NIIT and Form 8960. If you have any questions or need further clarification, please leave a comment below.

Who is subject to the Net Investment Income Tax?

+The NIIT applies to individuals with modified adjusted gross income (MAGI) above $200,000 (single filers) or $250,000 (joint filers), as well as estates and trusts with undistributed net investment income (UNII).

What is Form 8960 used for?

+Form 8960 is used to report the Net Investment Income Tax (NIIT).

How is net investment income calculated?

+Net investment income is calculated by adding up all investment income sources (interest, dividends, capital gains, etc.) and subtracting allowable deductions.