As a California resident, you may be required to file Form 8958, also known as the "Allocation of Tax Amounts" form, as part of your tax return. This form is used to allocate tax amounts between California and other states or countries. In this article, we will explore five ways to complete Form 8958 California.

Understanding Form 8958 California

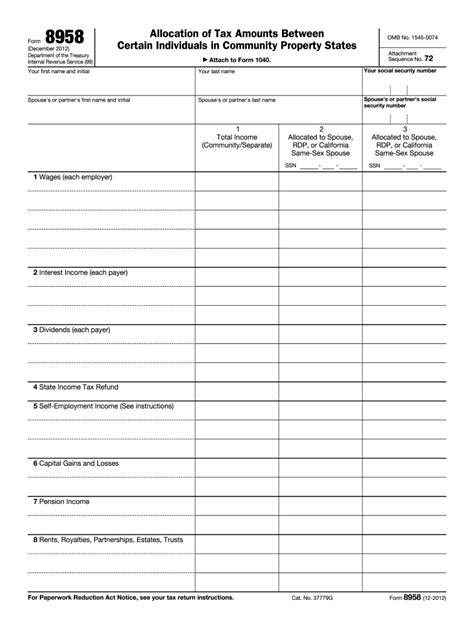

Before we dive into the five ways to complete Form 8958 California, it's essential to understand the purpose of the form. Form 8958 is used to allocate tax amounts between California and other states or countries. This form is typically used by individuals and businesses that have income from multiple sources, such as employment, self-employment, or investments.

Who Needs to File Form 8958 California?

Not everyone needs to file Form 8958 California. You may need to file this form if you:

- Have income from multiple states or countries

- Have self-employment income

- Have investment income

- Have rental income

- Have other types of income that are subject to tax in multiple jurisdictions

5 Ways to Complete Form 8958 California

Method 1: Use the California Franchise Tax Board (FTB) Website

The California Franchise Tax Board (FTB) website provides an online portal where you can file Form 8958 California. To use this method, follow these steps:

- Go to the FTB website and log in to your account

- Click on the "File a Return" tab

- Select "Form 8958" from the drop-down menu

- Fill out the form and attach any required supporting documents

- Submit the form electronically

Method 2: Use Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can help you complete Form 8958 California. To use this method, follow these steps:

- Purchase and install tax preparation software

- Follow the prompts to complete your tax return

- The software will guide you through the process of completing Form 8958 California

- Attach any required supporting documents

- E-file your tax return

Method 3: Hire a Tax Professional

If you are unsure about how to complete Form 8958 California, you may want to consider hiring a tax professional. A tax professional can help you navigate the process and ensure that your form is completed accurately. To use this method, follow these steps:

- Find a qualified tax professional in your area

- Provide the tax professional with all required documents and information

- The tax professional will complete Form 8958 California on your behalf

- Review and sign the form

- Submit the form to the FTB

Method 4: Use a Tax Preparation Service

Tax preparation services, such as Jackson Hewitt or Liberty Tax Service, can help you complete Form 8958 California. To use this method, follow these steps:

- Find a tax preparation service in your area

- Provide the service with all required documents and information

- The service will complete Form 8958 California on your behalf

- Review and sign the form

- Submit the form to the FTB

Method 5: Complete the Form Manually

If you prefer to complete Form 8958 California manually, you can do so by following these steps:

- Download the form from the FTB website

- Fill out the form carefully and accurately

- Attach any required supporting documents

- Sign the form

- Mail the form to the FTB

Conclusion

Completing Form 8958 California can be a complex process, but there are several ways to do it. Whether you choose to use the FTB website, tax preparation software, a tax professional, a tax preparation service, or complete the form manually, it's essential to ensure that your form is completed accurately and submitted on time.

We encourage you to share your experiences and tips for completing Form 8958 California in the comments below. If you have any questions or need further assistance, please don't hesitate to ask.

What is Form 8958 California?

+Form 8958 California is a tax form used to allocate tax amounts between California and other states or countries.

Who needs to file Form 8958 California?

+Individuals and businesses with income from multiple sources, such as employment, self-employment, or investments, may need to file Form 8958 California.

What are the penalties for not filing Form 8958 California?

+The penalties for not filing Form 8958 California can include fines, penalties, and interest on any tax owed.